CellPay, a payment service provider under Cellcom Private Limited has yet again announced a brand new offer. To celebrate the auspicious occasion of Rakshya Bandhan, it is offering its customers a cashback of up to Rs 500 on CellPay Kart. The customers making any purchase of a minimum of Rs 5,000 with CellPay Kart can get to enjoy this cashback offer. This offer has already started today and will end on the 22nd of August 2021, on the day of Rakshya Bandhan. Well, you might have already known that one must be a KYC verified customer to enjoy this offer.…

Author: Radha Sapkota

With the increase in population in urban areas, managed settlements are difficult to find here. Moreover, open lands are disappearing day by day with the settlement areas inside Kathmandu valley. Mostly, there are only apartments available as housing options inside the ring road. Housings and colonies are available outside the distance of 4-5 KM from ring road. In this case, Urban Space is providing a housing facility inside the valley, within 200 meters from the ring road in Satdobato. The concept put forward by Urban Space is the first one of its kind in Nepal. Apart from that, it is…

Governor Maha Prasad Adhikari unveiled the monetary policy for FY 2078/79 today afternoon. Many anticipations and expectations were raised from the public and concerned authorities regarding this monetary policy. Moreover, the announcement was being postponed time and again as NRB failed to publish it on the predetermined date i.e. Shrawan 1st due to leadership changes in the government. However, today afternoon Governor Maha Prasad Adhikari presented the monetary policy on the behalf of NRB. Lets Look from the View of Economics First It is a better way to start this topic through the lens of Economics. Monetary policy certainly affects…

Have you ever thought of an e-commerce platform with its own payment gateway? Well, now it exists in our country too. Ambe group has launched a new e-commerce app- Lenden with its own integrated payment gateway called Lenden Pay. Normally, we choose among the various payment gateway options in e-commerce platforms like Daraz, UG Bazaar, Hamrobazaar etc. We can either pay through digital wallets or through cards for online purchase. For paying through cards, most of them use third party payment procedures. However, none of them have their own integrated payment system. The other digital wallets are integrated to their…

Rastriya Banijya Bank has finally launched its own credit card service. The bank launched this service for the first time, after 56 years of its establishment. Though it appeared late, the bank is providing a huge credit limit of Rs 20 thousand to Rs 5 lakhs. Similarly, it is charging a 1.5% monthly interest rate which makes up the annual interest rate of 18% on this credit card service. The card has following features for the convenience of the card holders. Credit limit from Rs 20,000 to Rs 500,000Acceptable in Nepal, India and Bhutan Competitive interest rateCustomers can pay from…

Entrepreneurship in Nepal is not just growing in the concepts, but also is mushrooming with new ideas that benefits the society. Ideas with a digital backup are gaining momentum in Nepal as well. Entrepreneurs are bringing up new products and services in the market with added values. Moreover, we are getting many native products built in the country that can compete with international products too. In this regard, a new learning platform has emerged in the market named as Hivelaya. Hivelaya is a digital skills marketplace that connects aspiring learners and passionate skills providers named as “Knowledge Gurus”. Know more…

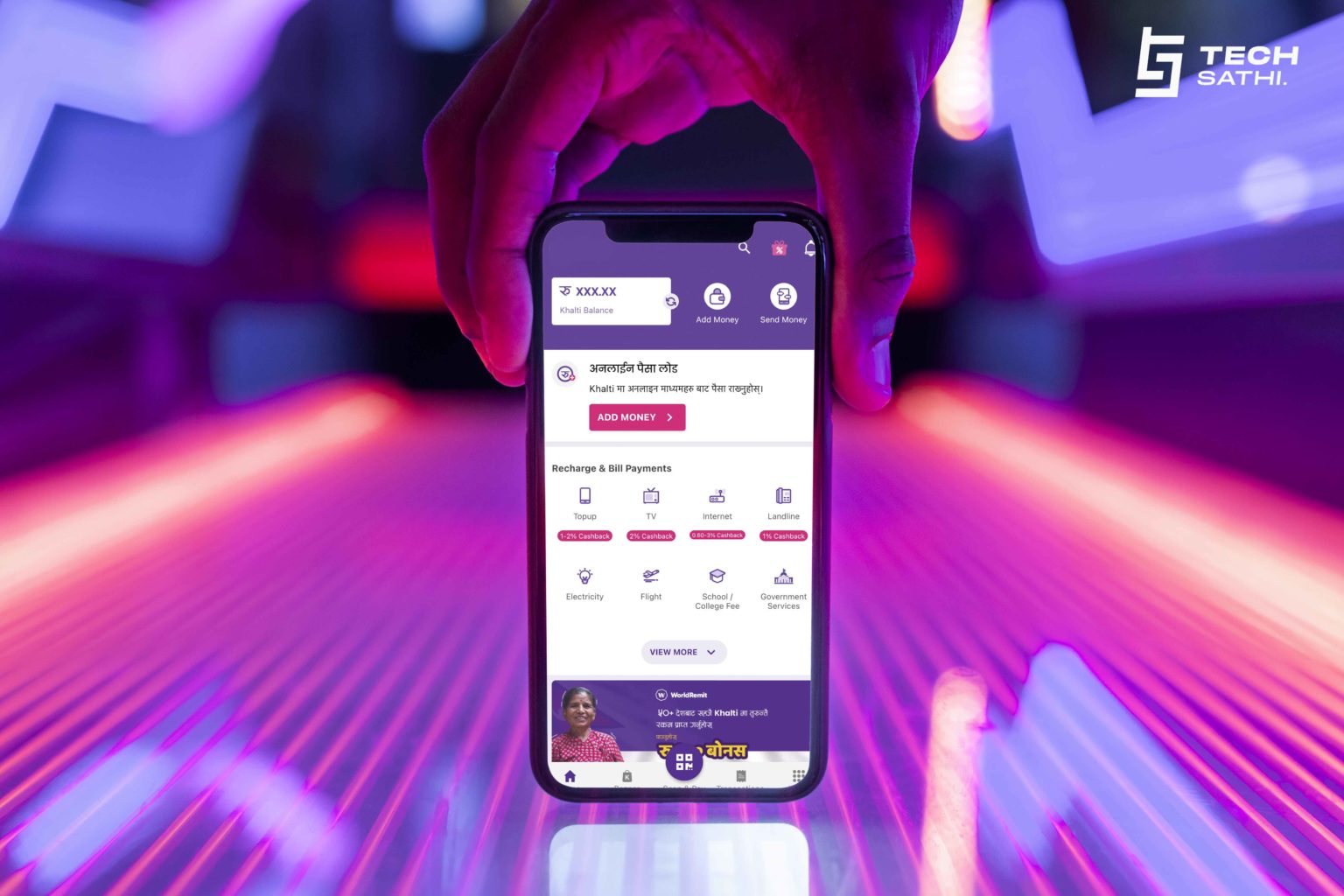

Khalti digital wallet is now available in its new version 3.0. It has upgraded its app system from version 2.69 to version 3.0 with some additional features on August 1, 2021. The update is available for both Android and iOS users. What’s new in Khalti 3.0 Version? As Khalti releases its new version, it is now available with: New User Interface (UI) Added FeaturesNew version 3.0 completely built in Flutter Yes, Khalti digital wallet is now fully developed using Flutter, a Software Development Kit by Google. What’s interesting is that, Flutter gives the similar UI on both Android and iOS.…

CellPay Nepal is celebrating its second anniversary today with its valued customers. It is the first PSP to provide both banking transactions and wallet services. A product of Cellcom P. Ltd, it is a young yet, growing payment service provider in Nepal with some distinct features and services. As it turns 2 today, it is celebrating this anniversary with exciting offers and cashbacks with its customers. Remember it’s ongoing offer where you could win Samsung Galaxy F22! On 25th of July, it had announced its anniversary offer where the 7 lucky customers could win a brand new Samsung Galaxy F22…

Nepal Clearing House Limited (NCHL) is a payment institution promoted by Nepal Rastra Bank and other BFIs. It is a central clearing house that provides major six payment systems namely, connectIPS NCHL IPS corporatePay NCHL ECC NCHL RTGS National Payment Interface (NPI) These all payment methods are either electronic or digital in nature which are introduced to upgrade from the paper-based transactions. NCHL has enabled the government, BFIs, corporates and the public to receive and make payments online. Non-Cash Retail Payments in NCHL Crosses the Country’s GDP by 3 Times Among the products by NCHL, transactions across connectIPS, NCHL IPS…

One of the most approved way to secure your cards is by changing your PIN time and again. Since hackers mostly aim at ATM machines and cards, the users need to stay alert while using their cards. Changing the PIN is a crucial act of securing your cards, be it an ATM card or debit/credit cards. In Nepal, most of the commercial banks have already allowed their users to change their PIN by themselves through their mobile banking app or via ATM booths. Some banks even require the users to contact the branches to regenerate the PIN. However, Green PIN…