If you have started Googling about “how to invest in an IPO?”, or “what is share market?”, you’re not the only one! With the number of people entering the Nepali share market escalating everyday, it is alright if you feel like you are missing out on something. I did too, and so did many of my friends and relatives! And why wouldn’t we! With every new company promising and delivering at least twice the amount one invests, it’s only normal that we want to chip in some of our money!

When asked why they haven’t started yet, “I don’t know how to!” was the reason repeated most-oft. By the end of this 3-part series, you’ll have an idea about what IPOs are, and how to start investing!

Before we dive into how to start investing in the now-booming-than-ever share market, let’s get familiar with the basics.

When you intend to buy shares of a company, you are actually, quite literally buying a fraction of the said company. For instance, if someone told you that they were allotted 50 units of “NIFRA”, they are a shareholder, and technically, an owner of the company. Wait, does that mean they can make decisions?

No! What you and I own is an iota of the much larger chunk. Let me break it down quickly.

When a large company decides that it wants to expand the services or production, or simply grow, the owners, or the board of directors will list their company in the sharemarket. Of course, there is a certain process in between, but I’ll spare you the jargons.

Once the company is given a green signal by the Securities Board of Nepal (SEBON), the company gets publicly listed at a given date. And in a window of usually 5 days or an extended 15 days, depending on how successful the prospects of the company are, people apply for the allotted number of shares. This “allotted amount of shares” is still a small amount compared to what the owners possess: a significant portion of the company (usually 70-80%).

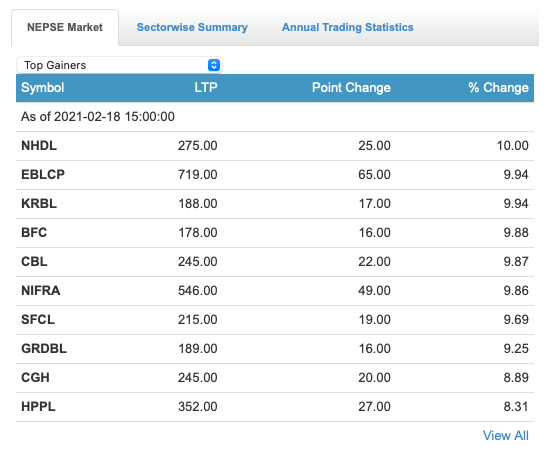

So, the 50 units of NIFRA is actually a smaller portion of the percent of the company that was put into public. While you don’t get to have a say in the company’s decision making, a company works to maximize profit and grow, so that you keep receiving your dividends and profits.

A Brief Rundown:

A company wants to raise capital, it gets publicly listed, you and I, the public buy their shares and help them reach their goals in exchange for multiplied returns.