The investors and traders of Nepal Stock Exchange are pretty aware of the requirement to load collateral while buying securities through the online portal of NEPSE TMS. Each time you buy securities through the trading management system (TMS) of Nepal Stock Exchange (NEPSE), you must load collateral in NEPSE TMS.

Among the 50 stock brokers in Nepal, each one have their own TMS portal through which you can digitally trade securities listed in NEPSE, without visiting the broker office. While buying the securities like stocks, mutual funds and debentures in NEPSE, you must load the collateral amount which is paid to the broker’s account at the time of settlement.

For that, you must deposit collateral in NEPSE TMS beforehand, so that you can load collateral in NEPSE TMS each time you buy the securities.

Previously, depositing collateral was available either manually or digitally through connectIPS. In manual deposit, the beneficiaries used to provide a signed cheque to their brokers by filling up a form. In that form, they would enter the required collateral limit.

What is a collateral limit? Why should you deposit and load collateral in NEPSE TMS?

A collateral limit is the yardstick for your investment and trading volume which you can carry through your TMS account. Every investors should open a TMS account to buy or sell securities through this digital system developed by Nepal Stock Exchange.

Previously, if an investor had to buy or sell any stock, they had to visit the broker office and had to fill up buy/sell slip. The selling slip is called Debit Instruction Slip (DIS), which is now updated into electronic form in the Mero Share system as EDIS.

Similarly, they would fill up the selling instruction slip to the broker and when it is sold, pay to the broker through cheque or connectIPS.

Now that the TMS system has been widely adapted by the investors, broker companies need some security as collateral such that your bank account would compensate if you fail to pay the amount for your stock purchased.

Hence, you will need to take a collateral limit from the brokers. This limit, allows you to trade stocks, mostly during buying them. And for that, you must deposit collateral amount.

This collateral deposit does not debit your bank account right away but you must load collateral to the broker’s account when you buy the stocks. Only after that, the amount will be deducted from your bank account. Normally, the broker companies allow up to 4 times of the collateral limit to trade the securities.

For instance, if you have a collateral limit of Rs 500,000, you can buy stocks up to Rs 2,000,000 from your TMS account at a time. However, the provision of collateral limit may vary per the broker. Also, it depends upon the volume of transaction you have carries out as a trader or investor through that broker. The brokers tend to provide higher collateral limits to regular and high-volume traders.

How to load collateral in NEPSE TMS? You can now do it from digital wallets too

Now that you have known that you should load collateral to buy stocks through it, there are few ways how you can load collateral in NEPSE TMS.

It is different from depositing collateral amount. While depositing the collateral amount, it only allows you to load that amount later each time you buy securities through the TMS system.

In the other hand, you can load your collateral at the time buying securities through the TMS.

There are few identical steps to deposit and/or load your collateral amount in TMS:

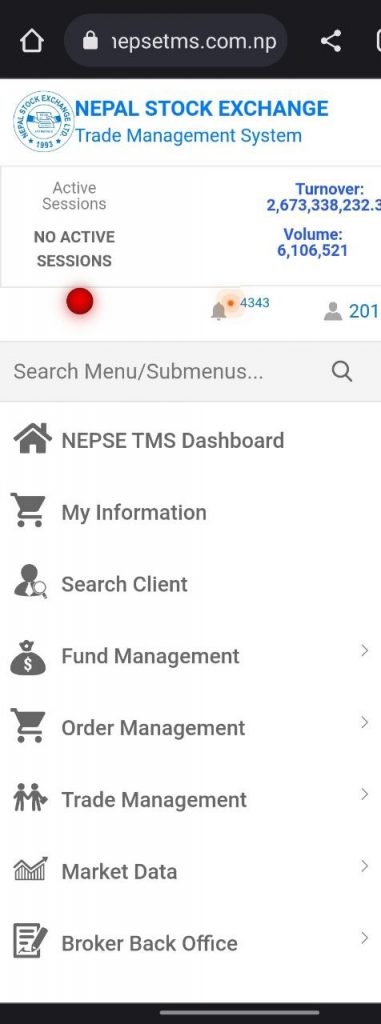

- Log in to your TMS account

- Scroll down the dashboard or click on the three lines at the top-right corner of your phone. Then, go to Fund Management

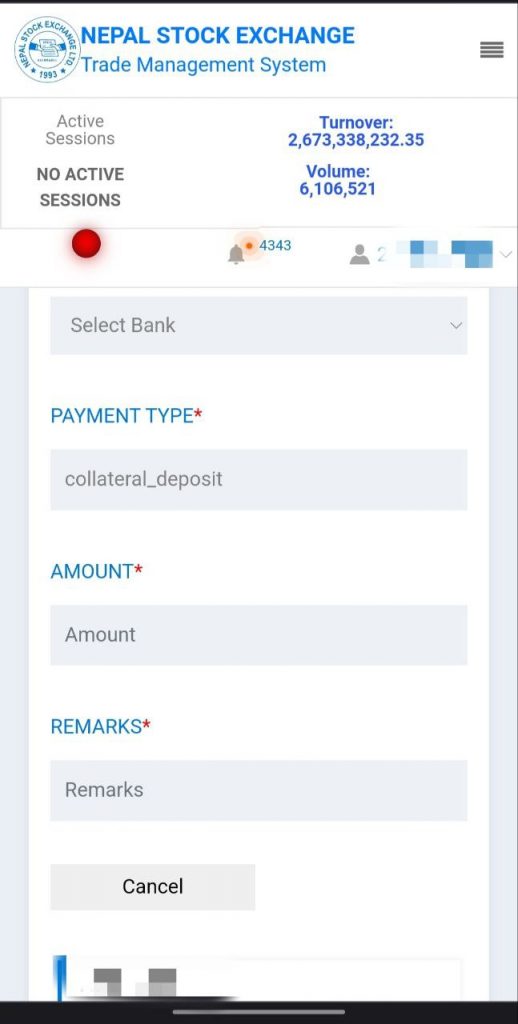

- Click on Collateral Management and select Load Collateral

- In the given options, select the payment option, payment type,

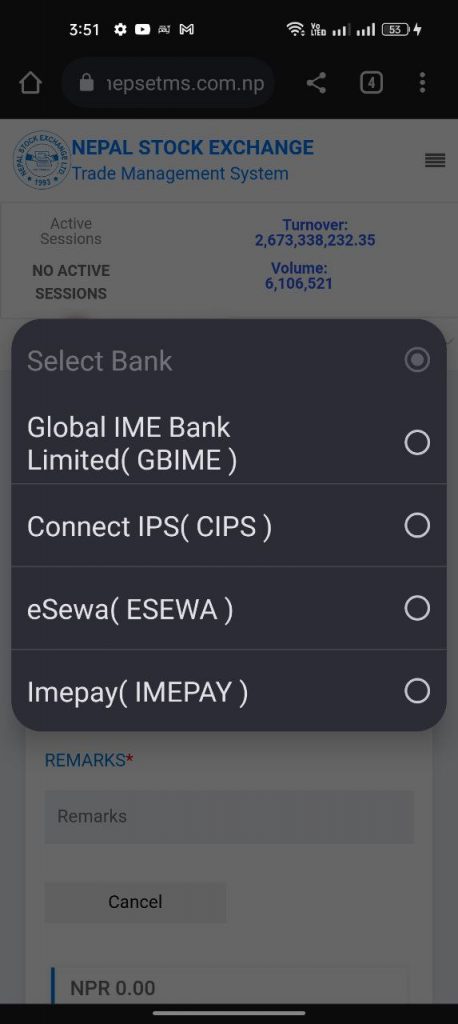

- There you will need to enter the amount and remarks. Then, select the payment options from “Select Bank” option.

- Among the given options, you can directly load the amount from your bank account if it is in Global IME Bank Limited. If you select this option, it directs you to the mobile banking system of Global IME Bank.

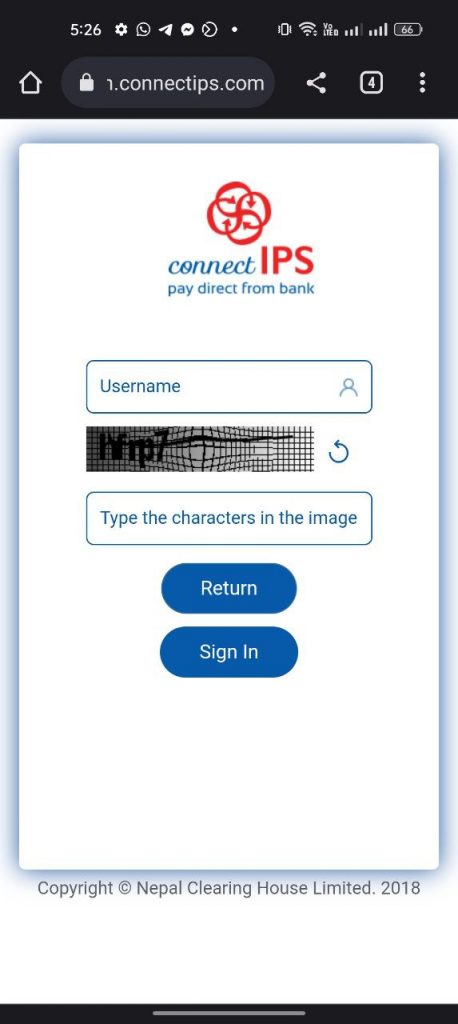

- If you select connectIPS, this directs you to the dashboard of connectIPS where you can pay through your any linked bank account.

Apart from that, other two new options are also added now: eSewa and IME Pay. These digital wallets also now allow you to deposit or load the collateral amount to your TMS account.

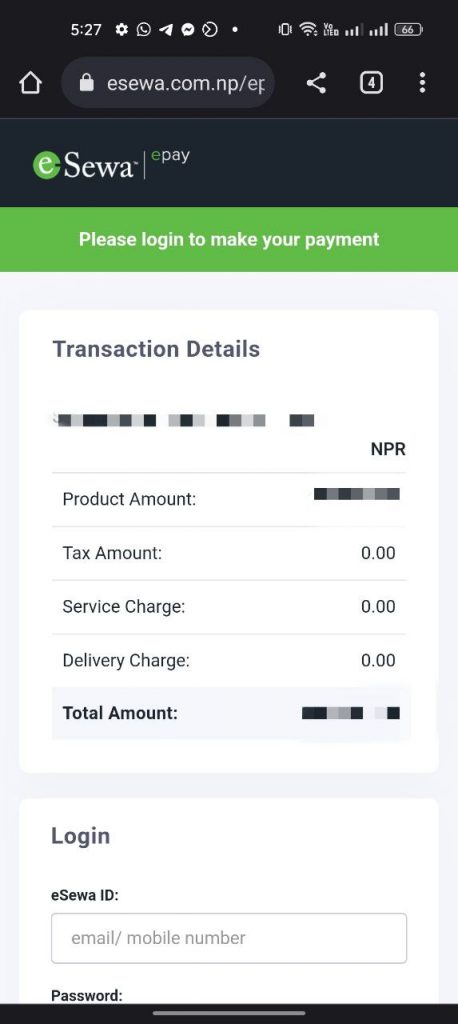

3. If you select eSewa option, it will redirect you to the portal of eSewa. You can login there and make payment.

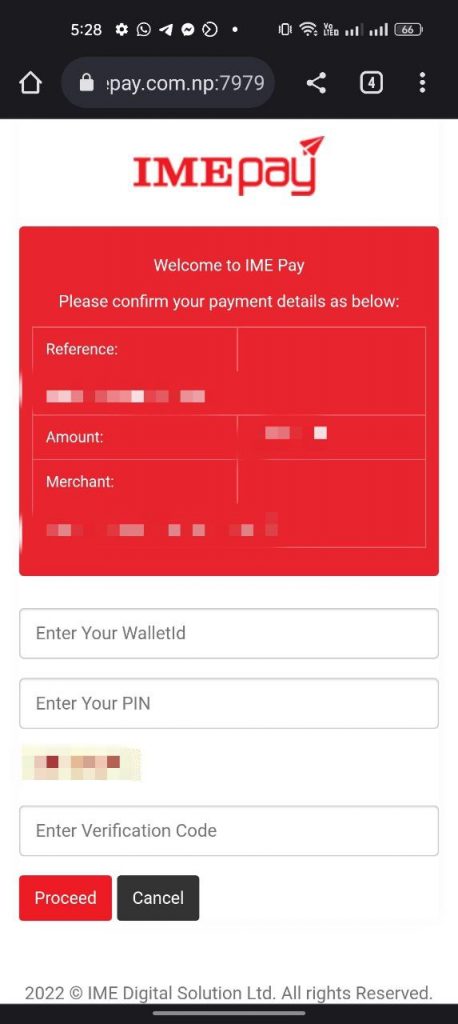

4. If you select IME Pay option, you can pay for your collateral deposit or load through IME Pay digital wallet.

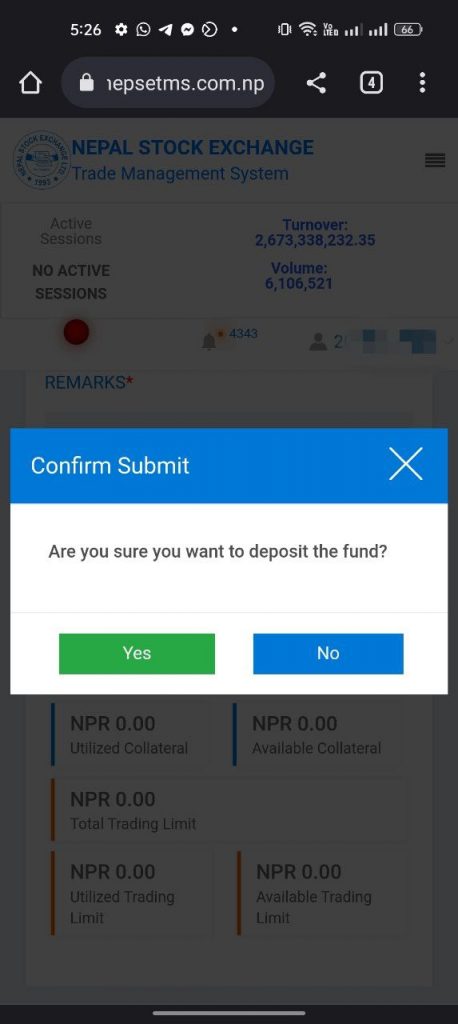

- After selecting the payment option, entering the amount and remarks, click on Submit.

- Then, select “Yes” option to confirm the submission.

- After that, it will redirect you to the payment portal that you have selected. You will need to log in to that portal and confirm the payment. Then, it will send you an OTP to proceed the collateral deposit or load.

- Then, enter that OTP to the TMS system and complete your collateral deposit or load.

In this way, you can easily deposit or load collateral in NEPSE TMS and begin your online trading of securities in Nepal Stock Exchange. Trading through NEPSE TMS has widespread during the time of Covid-19 pandemic, where the trading room in broker houses were restricted. In such case, the market was still open. This gave a rise in digital payments like connectIPS, mobile banking and digital wallets for trading in NEPSE. Since you can now deposit the collateral or load it from digital wallets like eSewa and IME Pay too, it has increased the use cases of these digital wallets.

Also read: Out of Your Bank Balance? Know How to Load Digital Wallets from Credit Cards Now

2 thoughts on “You Can Now Load Collateral in NEPSE TMS From Digital Wallets”