The use of digital wallets is increasingly being popular in Nepal. While most of the digital wallets are advertising about cash backs while linking the bank accounts, a significant number of the users load digital wallets from credit cards.

While loading the wallets from bank account is free, sometimes you might need to load it from the credit card. At times when you have no balance in the bank or cash in hand, paying through the credit cards might be problematic in Nepal where POS machines are not available.

Additionally, the credit cards come with certain restriction while withdrawing cash. One needs to pay up to 2.75% charge while withdrawing money from ATM machines through the credit cards.

Hence, the only way to make payments is through digital wallets by loading your money through your credit card.

How to load digital wallets from credit cards?

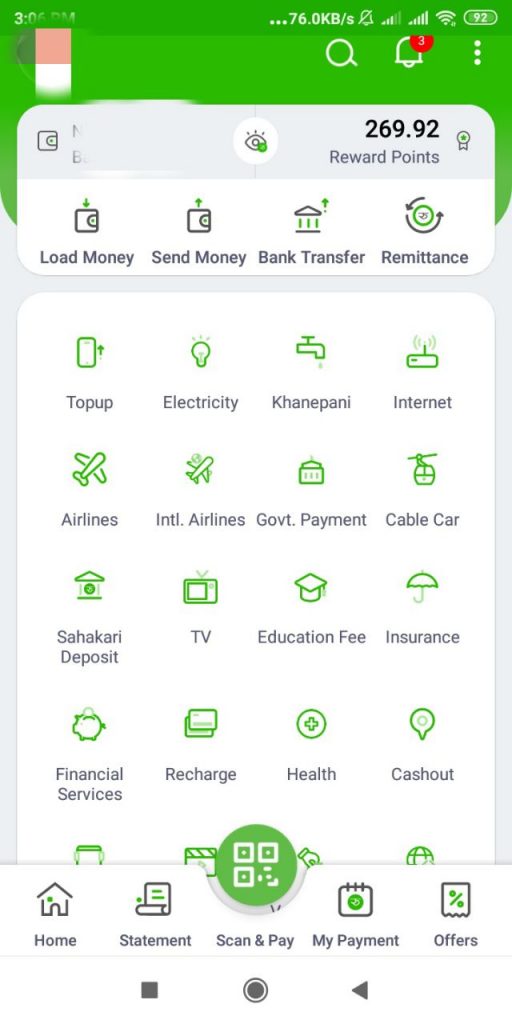

A lot of digital wallets provide various load option which offers you the freedom to choose the way of making payments. Digital wallets like eSewa, Khalti, IME Pay, Prabhu Pay, MyPay, PayWell, Moru etc allow you to load your funds through credit cards.

There are few common steps to load your digital wallets from credit cards. For instance, we have listed out the process of loading your eSewa wallet :

- Log in to your ID in the digital wallet.

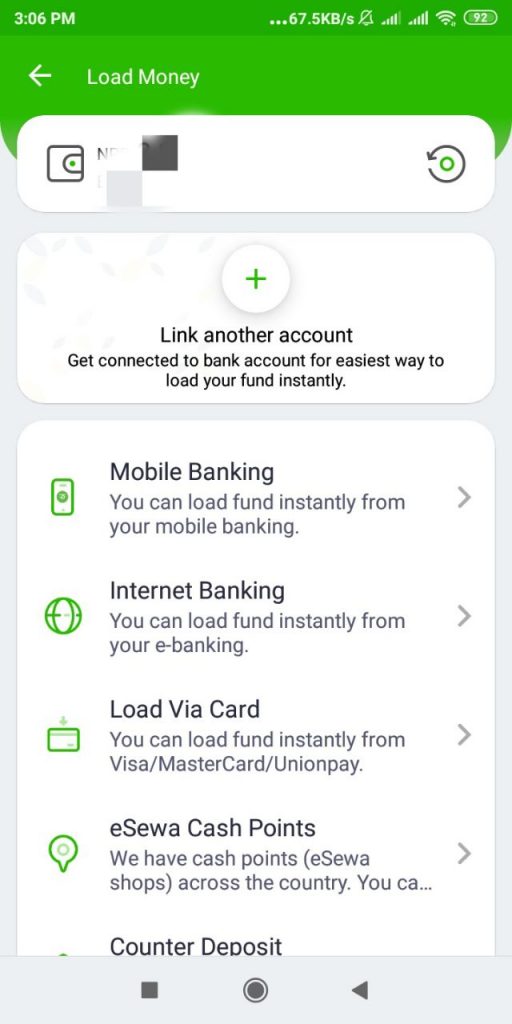

- In the homepage, choose “Load Money” or “Load Fund” option

- Choose the option where you can load from cards

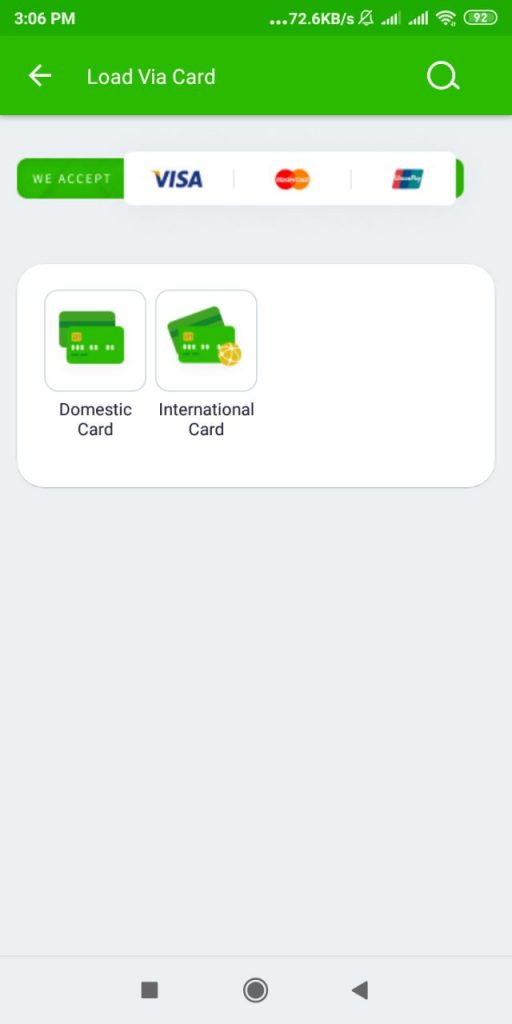

- Select Domestic or International card

- If you use Visa Credit card or any common credit card for Nepal, you can select Domestic card. If you use Master Card or Amex card, select International card option.

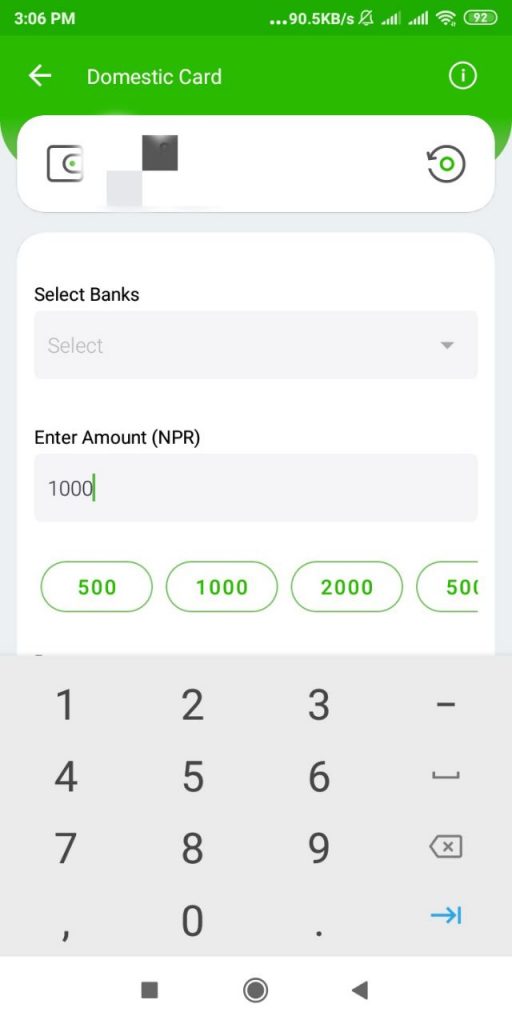

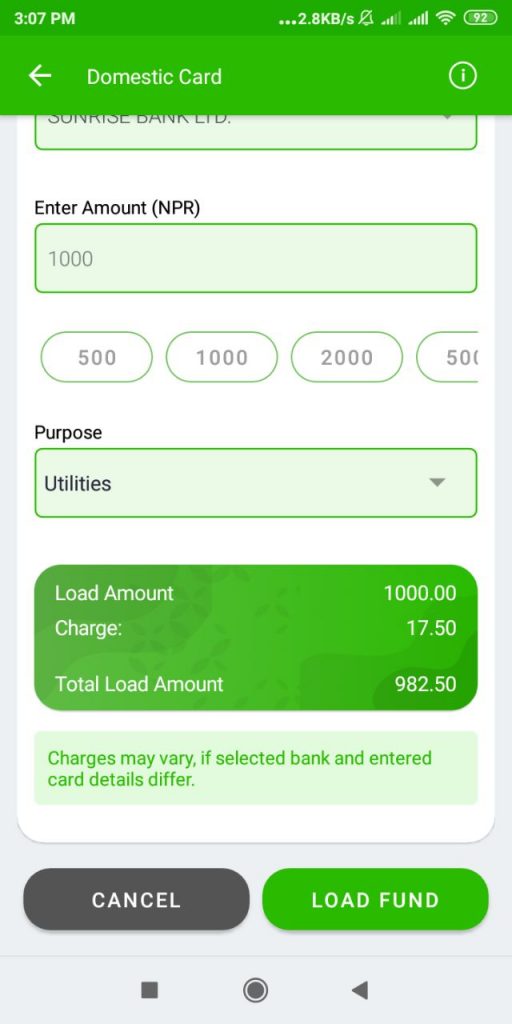

- Then select the bank, and enter the amount to load your wallet.

- Select the purpose and proceed

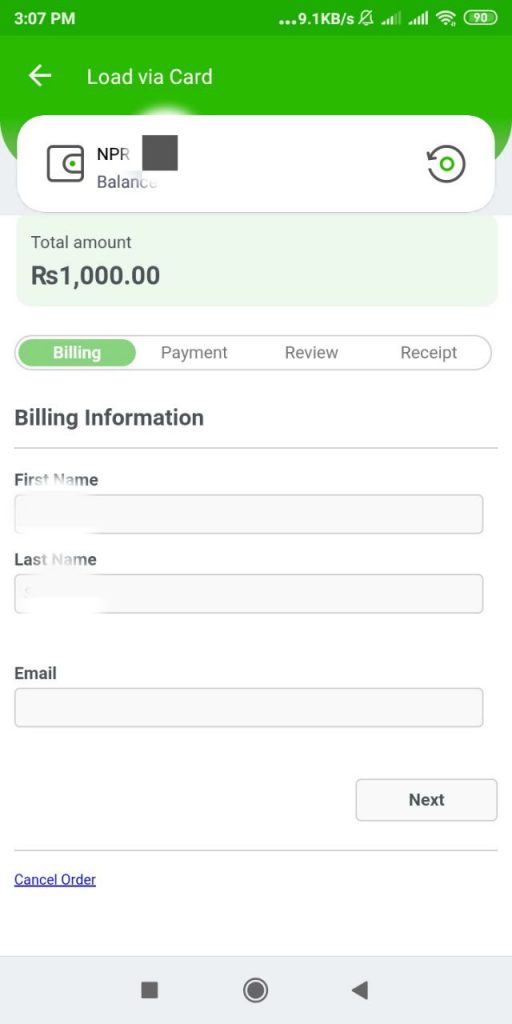

- Then, you have to enter your valid email ID and proceed.

Remember that, you can not make bank transfers through the funds loaded through credit cards. Recently, Nepal Rastra Bank has issued a notice where the users can make only digital payments through that loaded amount.

Know about the charges to load digital wallets from credit cards

It incurs a certain charge to load your digital wallets from credit cards. The charges vary as per the digital wallets. We have created a list of charges to be applied while loading digital wallets from credit cards:

| S.N. | Digital Wallet | Load Amount | Charge (in % of the load amount) via Visa/ Master Card | Charge (in % of the load amount) via SCT |

| 1 | eSewa | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 1.75% | 1.75% |

| 2 | Khalti | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 1.75% | For loading funds amounting to less than 4000, a service charge of 1% after the first three transactions |

| 3 | IME Pay | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 2.5% | NA |

| 4 | Prabhu Pay | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 3% | NA |

| 5 | Moru | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 2.15% | 2.15% |

| 6 | MyPay | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 2% | 2% |

| 7 | QPay | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 1.5% | NA |

| 8 | iCash | Up to Rs 10,000 per transaction Rs 25,000 per day Rs 50,000 per month | 1.5% | NA |

Unfortunately, these other wallets do not have load option from credit cards:

- PayWell

- Sajilo Pay

- CellPay

- CG Pay

You can load these wallets through your mobile banking or internet banking, or connectIPS.

If you want to find more easy way to make payments through cards using digital wallet, you can try Moco Digital Wallet

The reason? Because Moco digital wallet is the only digital wallet that allows you to pay through the QR by linking your cards., without the need to load your wallet.

For the first time in Nepal, you can link your Visa cards directly to Moco and make payments through a QR code tp the merchants.

Right now, you can pay by scanning NEPAL QR through Moco digital wallet. As of now, only the Visa card holders can directly pay through their card using this Moco app.

You can download the Moco app from Google Play Store for Android devices and from the App Store for iOS devices.

One major advantage of using MOCO is that you can pay through it by simply linking your cards- without paying for the charges.

Like other digital wallets and PSPs allow you to pay through the linked bank accounts, Moco digital wallet allows you to pay directly through the linked Visa cards. In this way, you can skip to load digital wallets from credit cards.

Also read: Prepaid Dollar Card- Necessity or a Luxury for Nepali?