Stock Market, it’s a new passion among the youngsters today. While Covid-19 is wreaking havoc in people’s lives, Stock Market has seen an influx of new investors in Nepal. Everyone is talking about opening a Demat account and many have even started online stock trading. What about you? Haven’t started trading yet? Don’t worry, we have got you covered. In this post, we elaborate on the complete online stock trading process during Lockdown at your home.

1. Opening a Demat Account

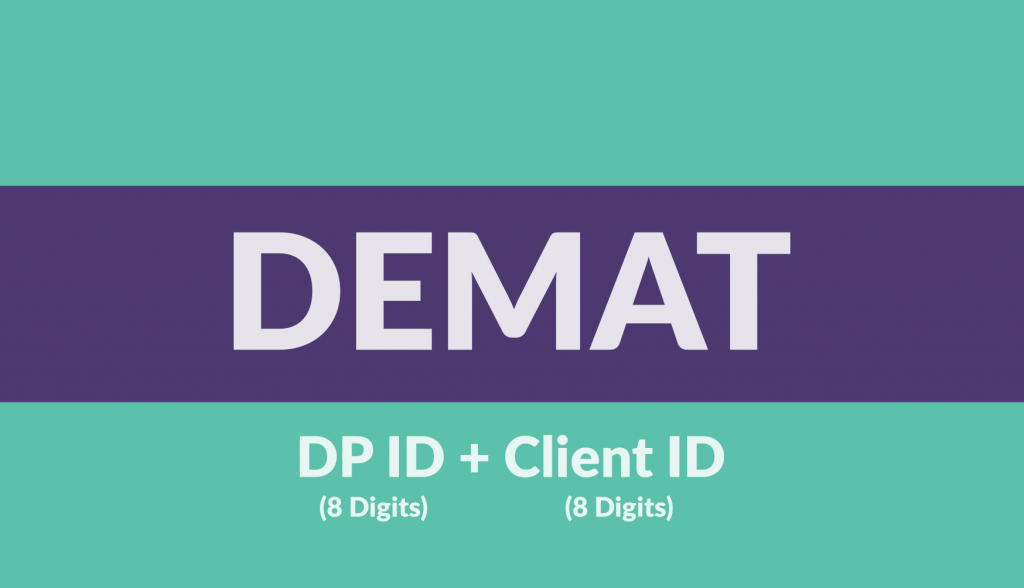

Demat Account is an electronic account opened by a beneficiary through the depository participants (DP) with the central depository company. This account is similar to a bank account but holds the shares in electronic form instead of money. Every beneficiary gets a unique account number where he or she deposits the securities. A Demat number provided by CDSC is 16-digits in numbers.

As one cannot conduct any share transactions without Demat, the first step for new investors is to open a Demat account. You can open a Demat account at depository banks, merchant banks, and broker companies. The complete steps for opening a Demat account in Nepal are:

- Step 1: The investors should submit the required documents and form to a chosen depository participant (DP).

- Step 2: The DP enters information about the investor into the system of CDSC after the beneficiary submits the necessary documents.

- Step 3: CDSC verifies the entry from DP and provides the verification letter to the beneficiary.

- Step 4: After verifying the details, CDSC opens the Demat account of the beneficiary.

- Step 5: When the account is opened, the DP provides the beneficiary with a 16-digit Demat account number.

In light of lockdown, several financial institutions like Global IME Bank, NIC Asia Bank, and many more have been providing online DP service for new investors. Currently, it costs Rs 50 to open an account and Rs 100 operating charge of account annually.

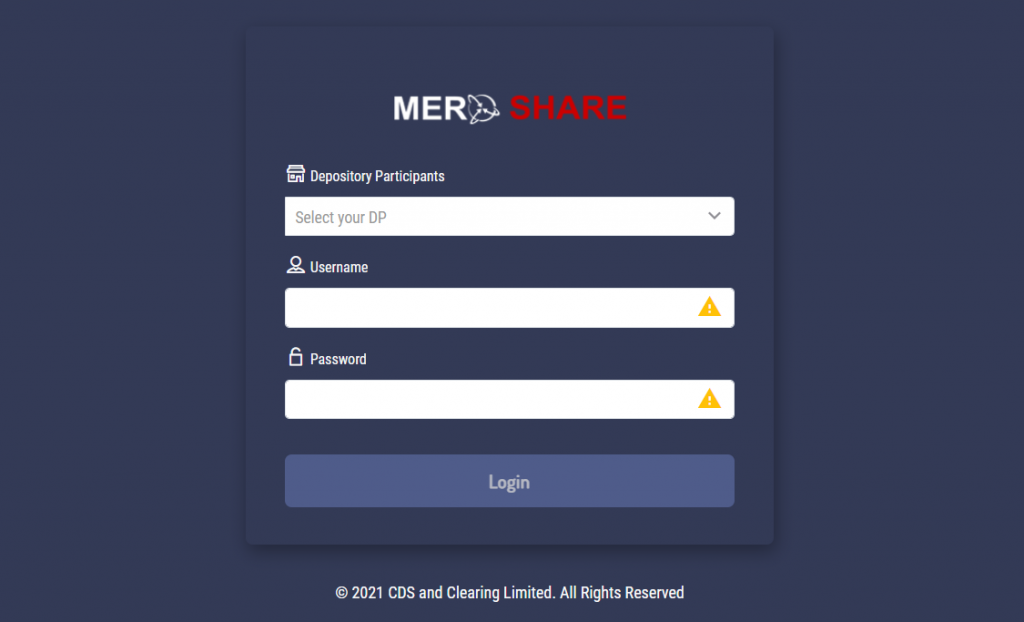

2. Opening MeroShare Account

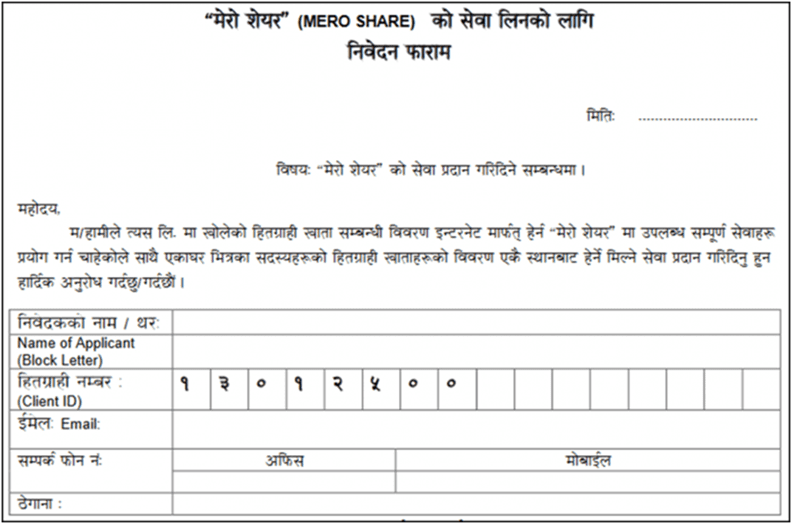

After you get your Demat account, make sure you also get a MeroShare account. MeroShare account can be used to fill different IPOs (Initial Public Offerings) and electronic direct transfer of shares (EDIS). Although it comes with additional Rs 50 charge, it sure is worth it. One can get MeroShare login details by following these steps:

- Step 1: After you get your Demat Number, you have to get CRN Number (C-ASBA Registration Number). For this, you will have to visit the same DP where you got your Demat Number and fill a form for CRN.

- Step 2: Fill in a Mero Share login details request form available at your depository participant. You will need your fill in your email id, phone number, DPID, and Client ID.

- Step 3: The DP will send you Mero Share login details through email within a few days.

- Step 4: Login into the Mero Share web portal HERE.

Various banks and financial institutions like Prabhu Bank, NIC Asia, and so on are providing online MeroShare account opening these days. After getting your Mero Share login details, you can start applying for various IPOs and FPOs immediately.

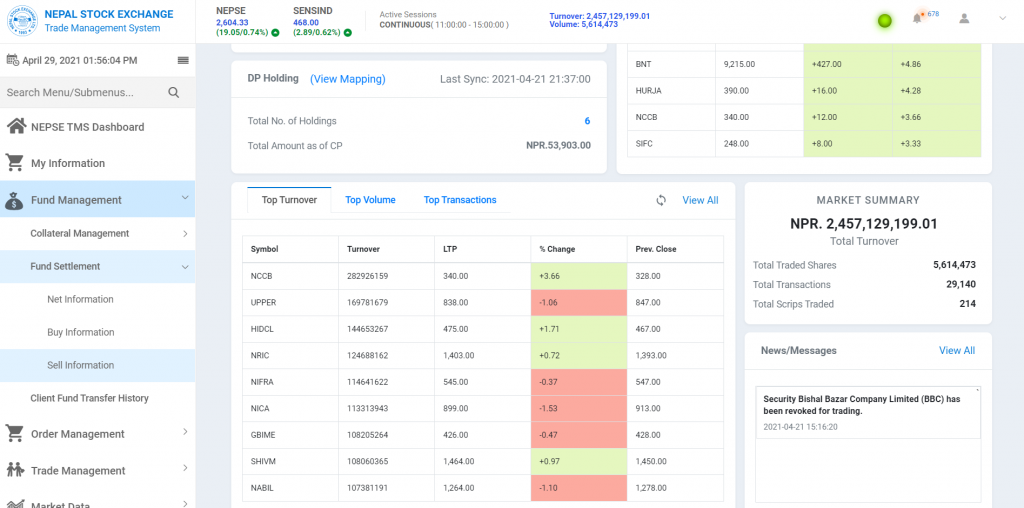

3. Getting Nepse Online TMS

Now, if you want to start trading on the secondary market, you have to open a trading account at any broker house. Using the Nepse TMS system, not only investors can watch live stock prices but also place buy or sell orders online. As shares prices are fluctuating every second on Nepse, one can easily benefit from Nepse Online TMS to buy and sell at the right time. Similarly, users can also check the market depth and settle their funds using this system.

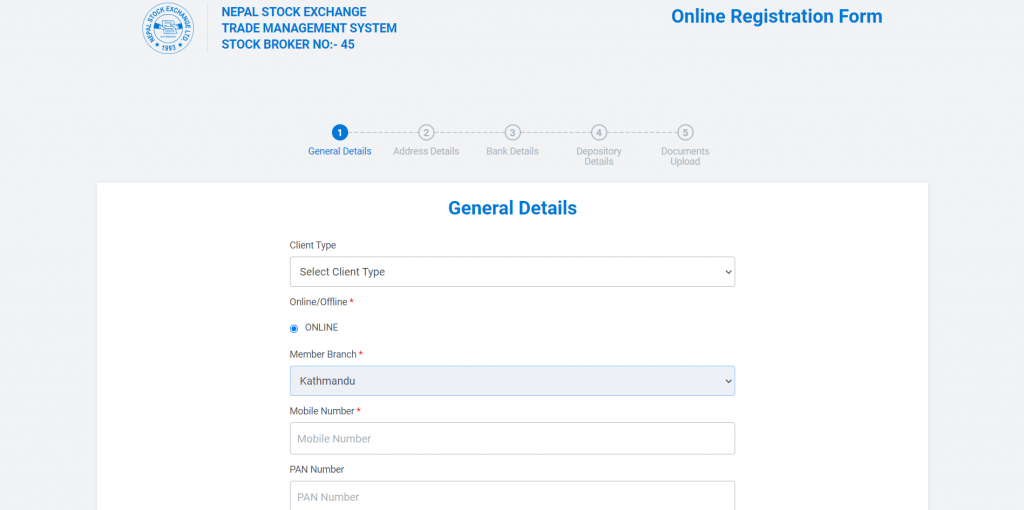

Opening a TMS account online is easy now. An application can be submitted by selecting the broker directly from the Nepse website. Due to the Covid-19 epidemic, such an arrangement has done to maintaining social distance and making it possible to trade in the secondary market. Now investors don’t need to visit the broker office. The process to open an online TMS account are:

- Step 1: Choose a broker that suits you the best. Make sure you choose the broker that is available near to your home.

- Step 2: Go to the link provided by Nepse for your chosen broker to register TMS service. The complete list of brokers and their registration links can be obtained HERE.

- Step 3: Fill in the necessary details while filling the forms which include general details, address details, bank details, depository details, and so on.

- Step 4: Upload the required documents for opening an account. Generally, the document required includes a KYC form, Citizenship certificate, ID card, and online trading agreement form.

- Step 5: Submit the application and after a few days you will receive TMS login details in your email.

- Step 6: Login into the Nepse TMS system according to your respective broker.

Top Brokers That Provide Online TMS Registration Service

| Broker Name | Broker Number | Location | Online Registration Link |

| Naasa Securities Co. Ltd. | 58 | Naxal | tms58.nepsetms.com.np |

| Online Securities Pvt. Ltd | 49 | Bagbazar | tms49.nepsetms.com.np |

| Midas Stock Broking Co. Pvt. Ltd | 21 | Putalisadak | tms21.nepsetms.com.np |

| Sani Securities Company Ltd. | 42 | Jamal | tms42.nepsetms.com.np |

| Imperial Securities Co. Pvt. Limited | 45 | Anamnagar | tms45.nepsetms.com.np |

| Araya Tara Investment And Securities Pvt. Ltd. | 57 | Anamnagar | tms57.nepsetms.com.np |

| Shree Krishna Securities Limited | 28 | Dharmapath | tms28.nepsetms.com.np |

| Dipshika Dhitopatra Karobar Co. Pvt. Ltd. | 38 | Anamnagar | tms38.nepsetms.com.np |

| Vision Securities Pvt.Limited | 34 | Laxmi Plaza | tms34.nepsetms.com.np |

| Malla & Malla Stock Broking Co. Pvt. Ltd. | 11 | Dillibazar | tms11.nepsetms.com.np |

Final Words

Stock Trading is not as easy as it seems. If you are not careful, you may lose a substantial amount of your investments. You can follow these steps to get a heads up about online stock trading. But make sure you do enough study and research before setting your foot in Stock Trading. Happy Investing!

Also Read: 5 Best Stock Market Apps to Keep You Updated: Be Informed about IPOs and Stock Market

5 Comments

Great insights! This guide really simplifies the complexities of online stock trading, especially during such uncertain times. I appreciate the practical tips and resources shared. Looking forward to applying these strategies!

This is a fantastic guide! I found the tips on managing risk especially helpful. With so many people turning to online trading during lockdown, having clear strategies to navigate the market is crucial. Thanks for sharing such valuable insights!

This guide is incredibly helpful! The detailed steps and strategies for online stock trading during the lockdown make it much clearer for beginners like me. I especially appreciated the tips on managing risk and staying informed. Thanks for sharing this valuable information!

This guide is incredibly helpful! I appreciate the detailed tips on navigating online stock trading during such uncertain times. The strategies you provided are not only informative but also gave me a sense of direction. Thanks for sharing your insights!

This guide was super helpful! I appreciate the detailed insights on online stock trading during such uncertain times. The tips on managing risk and choosing the right platforms were particularly useful. Thanks for sharing!