Nepal budget 2079/80 has provisioned for the compulsory requirement of e-billing for specific companies Shrawan 1, 2079.

The companies that have an annual turnover above Rs 10 crores are required to issue computer-generated e-bills. Otherwise, they would be charged a hefty fine of up to Rs 5 lakhs. If your business is running with an annual turnover above Rs 10 crores, this article is for you.

The new rule has something to do with digital Nepal and growing the ICT sector on a larger scale.

Confused about the e-billing system?

e-billing system is the method of receiving and paying bills electronically rather than through a paper billing process.

It enables the customers to receive bills online via e-mail in a supplier portal. Also, the seller or company can get automated data records of the sales or services they offer.

For example, if you pay your electricity bills through e-sewa, you will get a bill on your mobile and you can also download the receipt.

E-billing provides a lot of benefits as:

- Reduces the cost of paper costs

- Is more transparent than paper bills

- Faster payment and delivery of payment status

- Option for automatic payments

- Can be stored for future reference

- Easier for bookkeeping and accounting for businesses

What are the requirements for e-billing as per the Government of Nepal?

The Government of Nepal had already set the requirements for the compulsory e-billing for these companies on the 29th of Falgun 2075:

- Hotels, Restaurants, Cafes, and Internet Service Providers (PSPs) with an annual turnover of more than Rs 5 crores in sectors like

- Department stores, marts, flooring and furnishing companies with annual turnover above Rs 10 crores

- Cinema Halls under Box office system operating inside Kathmandu valley

On the budget announcement for the fiscal year 2079/80, Finance Minster Janardhan Sharma announced that the companies with annual turnover above Rs 10 crores will need to issue e-bills through electronic systems from Shrawan 1, 2079.

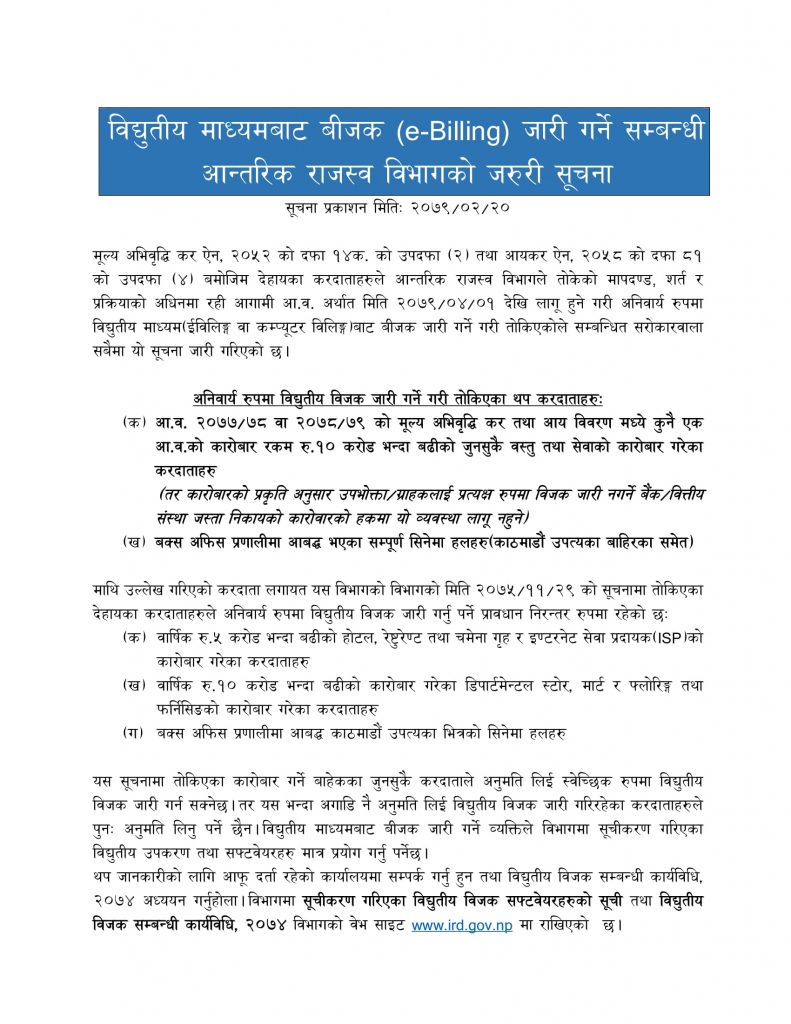

The Inland Revenue Department released a notice about e-billing on 20th Jestha, 2079.

The government has required these additional companies to enter into the e-billing process from the beginning of the next fiscal year:

- Any company having more than Rs 10 crores turnover as per the value-added tax or income statement of 2077/78 or 2078/79

- All the cinema halls in the box office system (all of them inside and outside of Kathmandu Valley)

How to apply an e-billing system for your business?

All the taxpayers other than those listed here also can voluntarily issue e-bills and invoices after getting permission from IRD.

And IRD has required all the taxpayers under the criteria of e-billing to use the systems listed by Inland Revenue Department itself.

According to the head of the Inland Revenue Department Mukti Acharya, there is a list of more than 450 software for electronic billing. The companies can download the system according to the nature of their business.

To get that, you have to fill up the form requesting e-billing. Along with that, you have to submit the following in pen drive:

- Authorized set-up file of the software

- 20 samples of the bills

- Specifications of the app

- Data recovery and backup system

- User manual for app and software

- Materialized report of testing in CBMS test server

- Agreement with software server

After submitting all these, the department will check them and allow them to get the e-billing system.

The Government will levy fines up to Rs 5 lakhs to companies with an annual turnover over Rs 10 crores if they are found not issuing the e-bills as per the requirement. A similar rule is for the companies that use the e-billing system without permission from the Inland Revenue Department.

How can software businesses benefit from this new rule on e-billing systems?

Following the amended rule on e-billing systems, many IT companies, and accounting-related businesses are seeking opportunities. Well, my news feed is flooded with all the advertisements for these types of companies.

The IT companies that are building software on ERP or any accounting systems can find a perfect time to reap their fortunes now. They have a chance to pitch the companies that require e-billing systems and then offer various other services to their clients like:

- Tax invoicing, e-billing, CBMS

- Automated Finance, accounts, procurement, inventory management

- Management Information System (MIS)

Businesses also can find it easier to keep their day-to-day records or even while ging for auditing and paying the taxes with the e-billing system. This is obviously, one step closer to making Nepal digital. Enabling tech like e-billing systems in business has no loss, rather it could streamline the business processes and increase efficiency by cutting many costs.