Receiving business payments might be a hassle for the accountants when you are receiving it from multiple sources and in multiple accounts. For this, it would help if a single payment gateway could handle all the receipts such that it would help you with documentation. And there comes NCHL which allows you to receive business payments through connectIPS directly to your company’s account.

I have been into many cases where I find it difficult to maintain the accounts of my business because the clients sometimes send the payments in my personal account, and sometimes in cash. As an online business, getting cash-on-delivery (COD) payments from your customers is a commonplace.

And the backend work takes a long time to maintain accounts in the book of company. Sometimes, it also gives burnouts. To manage this, I found a way which could converge all my receipts through a single payment gateway i.e. connectIPS.

You can list as a creditor and receive business payments through connectIPS directly to your company’s Account

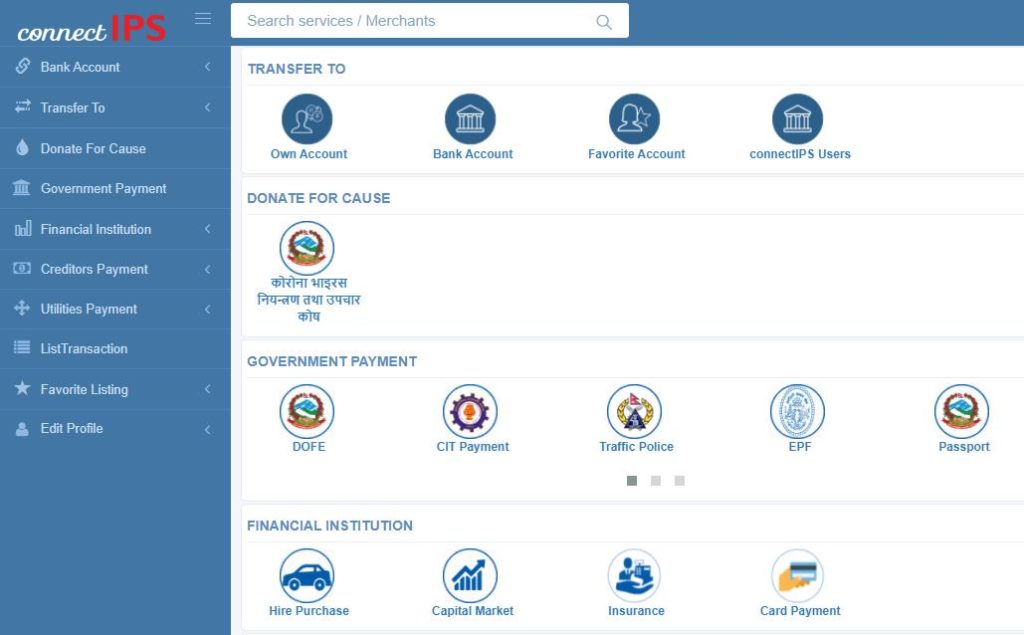

connectIPS is a payment service operator under NCHL licensed by Nepal Rastra Bank. It is a popular digital payment system that has been serving individuals, businesses, government and merchants for making payments and receipts.

You can register as a creditor in connectIPS for receiving payments and get CORPORATEPAY to make payments.

The beneficiary’s bank account information can be entered into the connectIPS system as a creditor, and they will appear in the connectIPS web portal and mobile app for payment collection directly into their specified bank account.

Service providers/merchants can also integrate their web portal with the connectIPS payment processor (gateway), for which NCHL will supply the required payment processor APIs so that payment collection can be initiated directly from the web portal against the service given.

For creditor listing in the connectIPS system, service providers/merchants/creditors should consult their bank. The bank provides you with a form and you can fill up that form to for listing a a creditor in connectIPS.

You can also reach out to them at [email protected] for more information.

Who can list as creditors and receive business payments through connectIPS?

- Insurance Companies

- E-commerce Portals

- Schools

- Colleges

- Utility providers

- Government offices

- Semi-government Offices

- Airlines

- Event Organizers

How to make business payments through connectIPS?

In Nepal, businesses often make payments through cheques. For this, NCHL has introduced Electronic Cheque Clearing Service long before which handles the payments and settlements of the cheques of different accounts and banks.

With the increasing popularity of digital payments in Nepal, companies are also getting into making digital payments. Making digital payments is not only faster and easier but is also transparent.

In a larger company having a large number of employees and clients, it is difficult to manage the accounts for manual payments. In such case, CORPORATEPAY can be a useful tool in making digital payments directly through the bank account to client’s account or making administrative payments like salaries, rent etc.

The businesses can register themselves in CORPORATEPAY by contacting their bank. The bank provides you with a form to fill up for CORPORATEPAY and will activate your account through mail.

In this way, you can get rid of the hassle of visiting the bank every time you need to clear or deposit the cheque. Also, you can reduce the cost of your business as you should not hire somebody to go to your clients and pay checks or collect from them.

In this way connectIPS allows businesses for both payments and receipts digitally. You can download the connectIPS app for Android devices from Google Play Store and for iOS devices from App Store.

Also read: Get 15% Cash Back in IME Pay While Paying for Foodmandu