Gone are the days of having hassle to make payments to the government units and offices by the beneficiaries. The Government of Nepal is adopting digital payments in a wider range now, making both payout and revenue collection easier than before.

Government of Nepal has taken an initiative to expand the implementation of digital payments through an integrated and automated e-payment of the transactions related to payouts and revenue collection. With the successful rollout of the payout (G2B and G2C) transactions, the GoN has also adopted e-payment for revenue collection.

For that, it has been bolstering the development of payment systems so as to ease the individuals, business units, and government bodies under the payment eco-system.

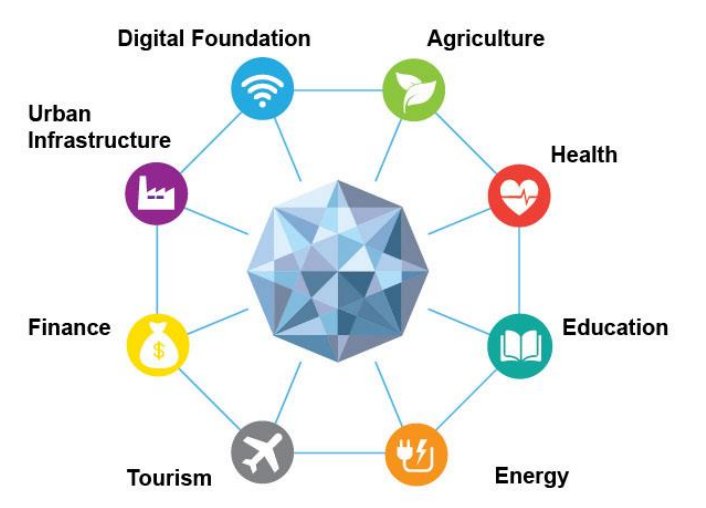

Supporting the essence of Digital Nepal Framework, the Government of Nepal is promoting digital payments

As per the goal of Digital Nepal Framework 2019 to allow Nepal to unlock its growth potential to become a middle-income nation by 2030, digital payments is also an essential part of the process. The Government of Nepal has undertaken some digital initiatives on the following grounds:

- Digital Foundation

- Agriculture

- Health

- Education

- Energy

- Tourism

- Finance

- Urban Infrastructure

Under the Finance category, the government has been targeting the unbanked population to bring them in banking channel. By leveraging digital technology and telecom infrasructure it is buliding strong linkages between financial inclusion and economic prosperity.

Nepal is poised to benefit from the use of fintech, broadening access to financial services to nearly 55% of the country’s unbanked population.

Adopting NEPALPAY QR, digitalilizing both government payouts and revenue collection

The customers will now be able to enter all the revenue details of the governmnet from integrated web portal and application of the revenue collecting division of the GoN. Once they are ready to pay, they can select connectIPS as payment option and pay directly from the linked bank account. Likewise, they can make government payments initated from any among connectIPS mobile App, Web application, CORPORATEPAY, mobile banking or wallet integrated with National Payment Switch.

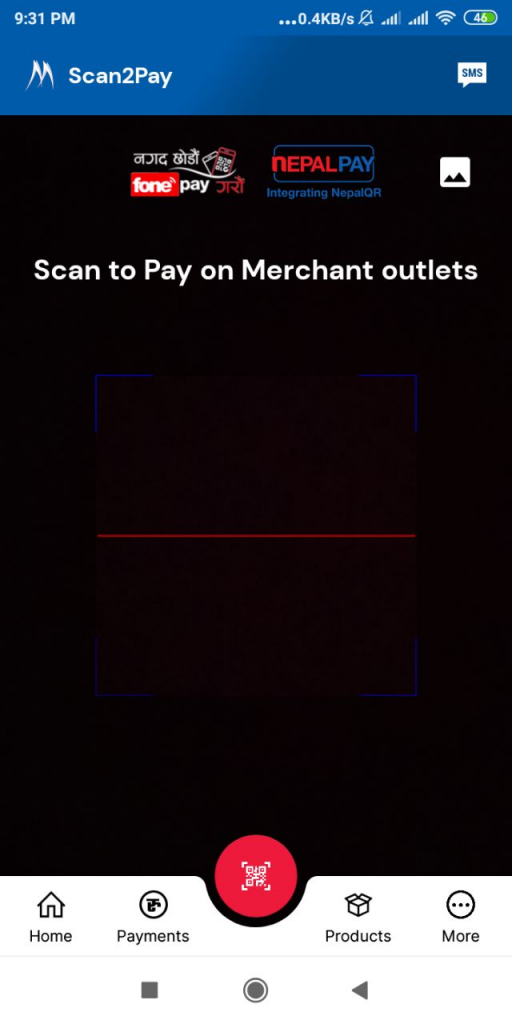

Additionally, it has been much easy these days with the introduction of NEPALPAY QR for making government payments. While paying taxes and other payments, the custmers can simply scan QR codes through the NEPALPAY QR in the connectIPS payment gateway. The dynamic QR can be scanned byany among connectIPS app, mobile banking and wallets that are enabled for NEPALPAY QR.

NEPALPAY QR is currently available from

- Himalayan Bank Ltd (HI-MB)

- Sanima Bank Ltd. (Sajilo e-banking)

- Samriddhi Finance Ltd.(mBanking)

- Focusone Payment Service Ltd. (MOCO)

- connectIPS mobile app

- Mega Bank

- Machhapuchhre Bank

Nepal Clearing House Limited is onboarding more mobile banking systems, BFIs and wallets of PSPs to add this facility and expand the usage of NEPALPAY QR. As the use of QR payments in increasing due to its ease and instant settlement process, NEPALPAY QR is expected to gain its traction really soon in the market.

According to the Oversight Report by the Payment Systems Department of Nepal Rastra Bank, more than Rs 20.28 billion of QR payments took place in Nepal between the period of Mid-July 2020 to Mid-July 2021.

This number is exected to rise even more by the end of the fiscal year 2078/79.

Also read: NEPALPAY QR Announced as an Implementing Infrastructure of NepalQR

How to make payments to Government of Nepal with NEPALPAY QR?

- Go to the GoN portal where you want to proceed payments and then fill all the revenue details. For example, if you are paying for the driving license, visit the respective portal of the Department of Transportation Management (www.dotm.gov.np) for making payments.

- You may also use the generic portal of FCGO for initiating the payment

- Generate EBP No. (voucher number) from the portal

- Click on “Proceed to Payment” and select connectIPS, which will display a dynamic NEPALPAY QR along with regular payment gateway credentials

- Scan the available QR from any of the mobile app enalbed with NEPALPAY QR

- Verify the payment details and confirm to pay

Also know about the transaction limit for QR based payment in NEPALPAY QR

QR based transaction limit has been set by the Payment Systems Department of Nepal Rastra Bank. QR based payment is limited to the maximum amount of Rs 200,000 per transaction per day. However, the limit may vary per the bank not exceeding the maximum limit.

However, you can make payments from multiple payment channels for GoN revenue payments with varying transaction limits.

Click here to know more about the transaction limits.

You can acccess connectIPS from the payment gateways like the connectIPS app itself, website, mobile banking apps, PSP/ Wallets. Then, you can select NEPALPAY QR option on the mid-bottom.

NEPALPAY QR is a QR facility introduced by Nepal Clearing House Limited (NCHL) to facilitate QR based payments in an instant through mobile phones. By initiating payments through NEPALPAY QR, the customers can opt for instant payments and settlements through their bank accounts in connectIPS.

Also read: Now You Can Renew Your Health Insurance Policy from connectIPS Online