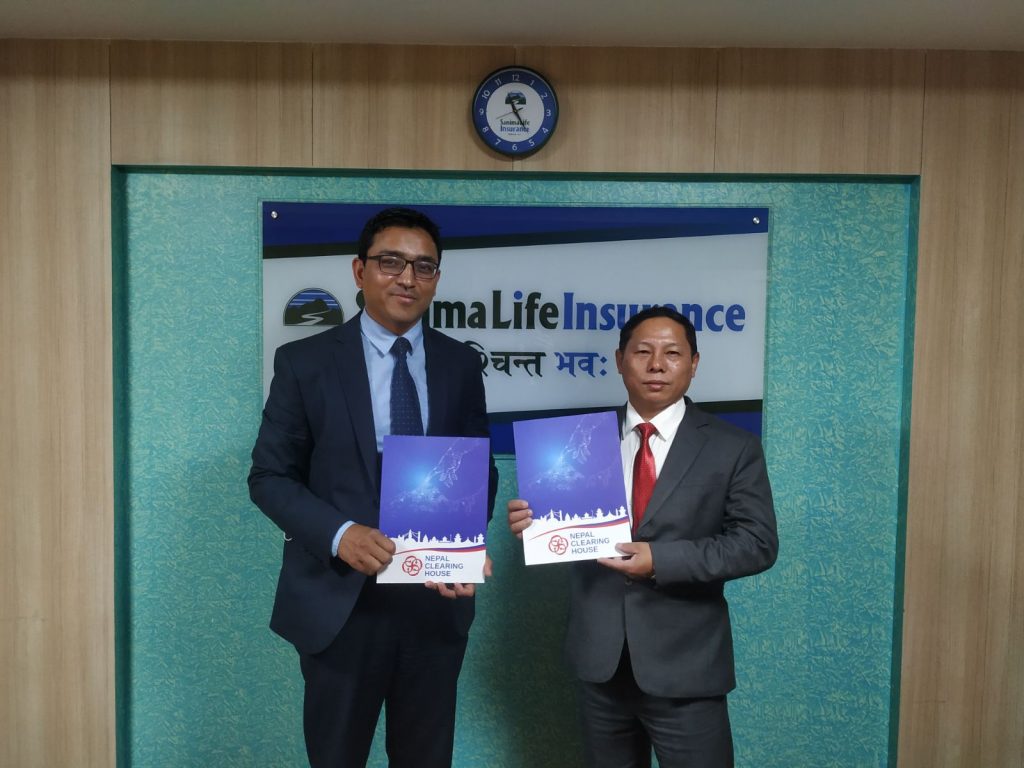

Sanima Life Insurance Ltd. has signed an agreement with Nepal Clearing House Ltd. (NCHL) for automating its various payments-related processes, including disbursements and collections, through the National Payments Interface (NPI) of NCHL. The agreement was signed by Mr. Agam Mukhiya, CEO of Sanima Life Insurance Ltd., and Mr. Neelesh Man Singh Pradhan, CEO of NCHL.

With this, Sanima Life will directly integrate its system(s) with NPI and its banks such that all the payments will be processed through the underlying payment systems of connectIPS e-Payment and NCHL-IPS systems enabling the insurance company to process the disbursements, like claim proceeds, agent commission, salary payment, vendor payments and investment placements. All such transactions will be processed directly through the bank accounts of the insurance company and the beneficiaries/ customers.

The premium collection from the policy holders of Sanima Life from any of the channels of connectIPS including mobile app, connectips.com and any of the bank branches was already in operations.

Sanima Life lnsurance Ltd. was established in B.S. 2074 and promoted by Sanima Bank and Non Residents Nepalese (NRN). Sanima Life Insurance is a trusted name in the life insurance sector of Nepal and it believes that this partnership with NCHL will help extend its presence in the insurance products delivered through various digital channels.

Also Read: corporatePAY: NCHL’s Corporate Platform for Business Transactions and Payments!

NCHL is promoted by Nepal Rastra Bank and banks and financial institutions (BFIs) to establish multiple national payment systems in Nepal. Its NCHL-ECC, NCHL-IPS, connectIPS e-Payment, connectRTGS, NPI and CORPROATEPAY systems are currently in operations with participation of almost all the BFIs.