Do you have your bank account in NIC Asia bank? If yes, this article is definitely for you.

NIC Asia bank has started to provide Video KYC (V-KYC) services to its customers where they can update their KYC details through a video call with the bank.

Every banking customer needs to update their Know-Your-Customer (KYC) details. The customer fills up the KYC form right at the time of opening an account at the bank. KYC details contain your name, bank account number, address, citizenship, and other identity documents, and most importantly, your mobile number.

If you have changed your mobile number, you must inform your bank to change the registered mobile number so as to enjoy mobile banking services.

Before video KYC, customers had to visit the bank on their own and submit the details on a paper form. Now after the introduction of video KYC, they can submit and update their KYC details from anywhere comfortable.

In accordance with its long-term strategy of becoming a ‘Digital First Bank‘, NIC Asia Bank has also started making it possible to update the KYC details of customer dignitaries through Video KYC (V-KYC).

How to update KYC details through video at NIC Asia Bank?

To use this new facility to update the KYC details of your account from home or office, you can simply follow these few steps:

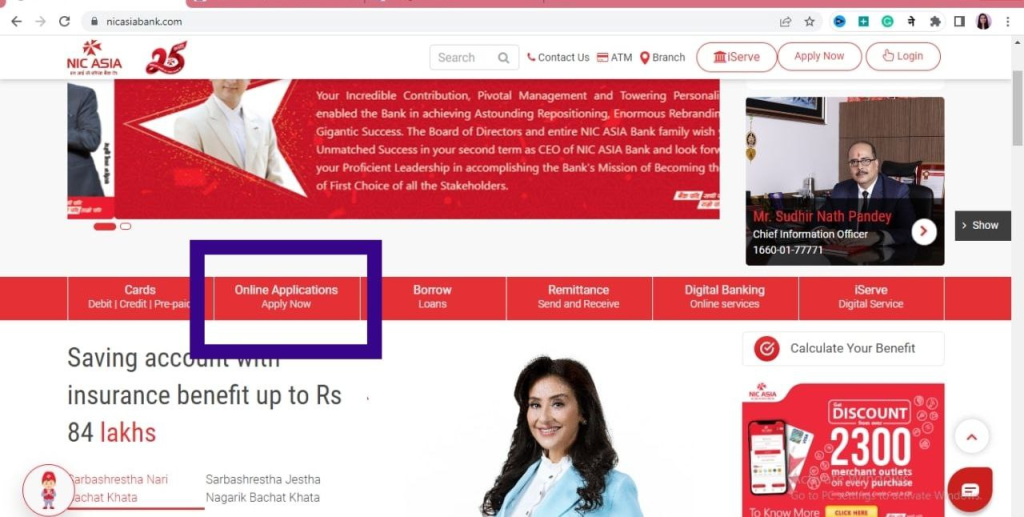

- Go to the Online Application tab on the bank’s website www.nicasiabank.com

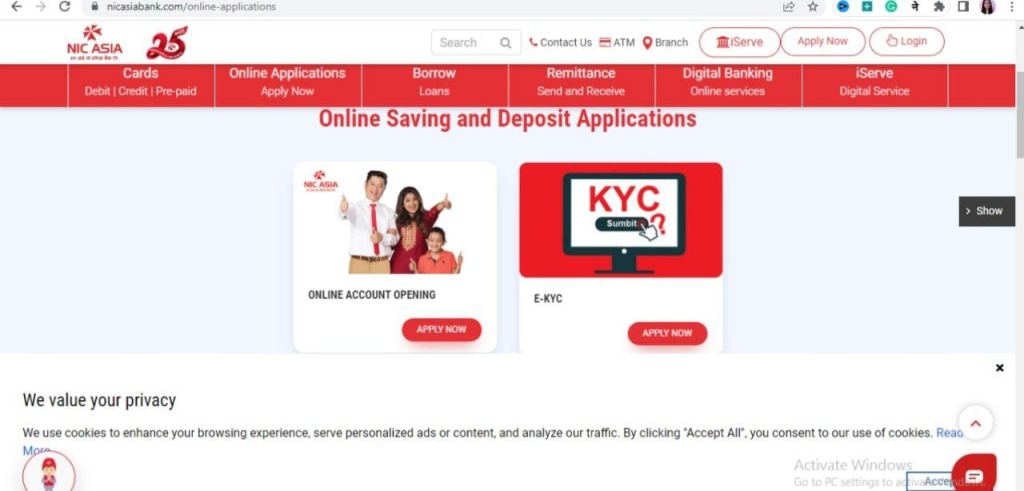

- Select e-KYC, mention your account number and the reason for the KYC update

- Select receive an OTP via SMS or email. Or you have to choose both options and submit.

- After that, fill in your personal details and provide the KYC details to the bank through Video Call at a convenient time or book an appointment for the Video Call during banking hours

The bank has already started the Video KYC service where the details can be updated online for customers who have opened an account online.

When customers call for V-KYC, they should keep any identity card (citizenship/passport/driving license/voter ID card) and white paper, and a pen with black/blue ink with them. The bank staff will ask for showing your thumbnail and then scan that for the biometric record.

Also Read: Now You Also Can Scan Smart QR through NIC Asia MoBank

Thus, after updating the KYC details through V-KYC, the customers can fully operate their bank accounts. The bank believes that since the details related to customer identification can be updated easily through video calls, the customers staying both inside the country or abroad will get rid of the hassle of having to physically attend the branch office of the bank to receive the service.

About NIC Asia Bank

NIC Asia Bank is the fastest-growing bank in Nepal having expanded its banking network the most in the country. It has already expanded with 359 branch offices, 473 ATMs, 103 extended counters, and 81 branchless branch networks across the country.

Out of the total population of the country, this bank has succeeded in serving about 25 percent of the economically active population of the age group 20 to 50 years. Practicing responsible banking to support the economic development and high economic growth of the country since its inception, NIC Asia bank has been successful in establishing itself as the highest tax-filing bank among all commercial banks by paying more than 19.92 billion in revenue to the government so far.

In the last fiscal year, it paid more than Rs. 3.41 billion in revenue to the Nepal Government, which is the sixth largest contribution compared to other companies in the country as a whole.

For financial inclusion, branches are being expanded and operated even in remote districts such as Mugu, Kalikot, Bajhang, Rukum, Jumla, and Salyan. The bank has established 72% of its branch offices in rural and small urban areas where more than 80% of the total population of the country resides.

Also Read: NIC Asia MoBank Upgrades to Omnichannel App: Moving Towards The Super Banking App