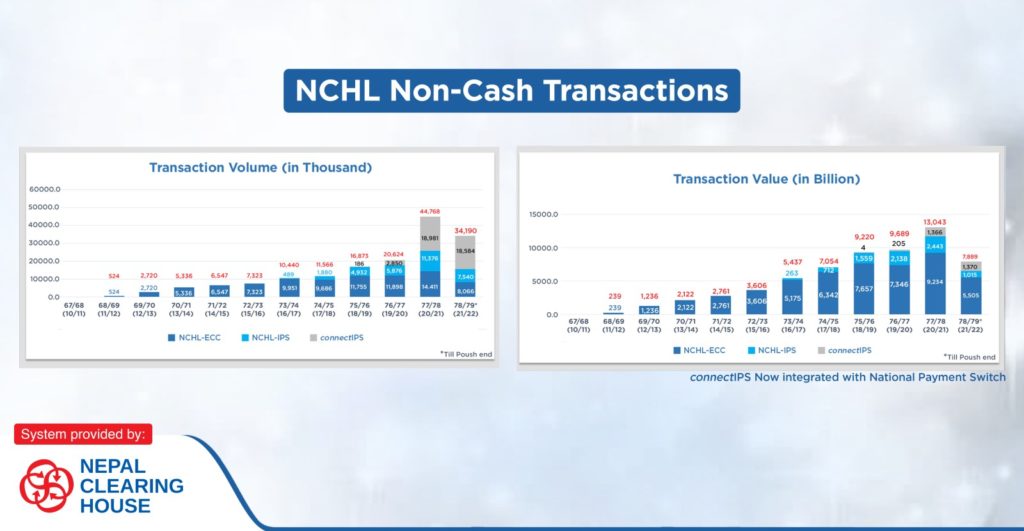

Nepal Clearing House Limited (NCHL) has made a new record in its non-cash transactions. By the first 6 months of 2078/79, the non-cash transactions in NCHL channels have crossed NRs. 7 trillion in value.

It has reached NRs. 7.88 trillion in transactions across the three channels : NCHL ECC, NCHL-IPS, and connectIPS.

Through NCHL-ECC alone, the non-cash transactions have crossed NRs. 5.3 trillions. Similarly, transactions over NCHL-IPS have crossed NRs. 1.01 trillion. In the same way, connectIPS transactions have crossed NRs. 1.36 trillions.

The transaction amount in connectIPS for the first 6 months have exceeded the annual transaction of last fiscal year. The whole yearly transaction of the year 2077/78 was NRs. 1,365 billions while it is already NRs. 1,369 billion in till the end of this Poush 2078/79.

You can check the transaction statistics of NCHL through here.

Increasing Non-Cash Transactions Reveals that NCHL is driving Digital Payments in Nepal through its major 6 channels

It has already been 13 years of the operation of NCHL in Nepal as the NRB licensed payment system operator. It is providing various digital payment and clearing services through 6 major channels:

Through electronic cheque clearing system NCHL-ECC, NCHL-IPS for interbank electronic payment, connect RTGS for high-value payment, National Payment Interface (NPI), and corporate Pay for business transactions, it assists the financial market, government, and corporations in their day-to-day activities.

Moreover, it is operating National Payment Switch that is integrating major payment platforms including wallets, mobile bankings and card systems.

In addition to that, NCHL’s non-cash transactions in the last fiscal year 2078/79 have exceeded Nepal’s GDP by 3 times. It had crossed NRs. 13.04 trillion transactions in the end of 2078/79 which was 304% of the GDP of Nepal that year.

The Increase in Non-cash Transactions Made NCHL Profitable by 38% in the year 2077/78

It is mostly due to an increase of almost 117% in transactions handled through NCHL, as well as the normalization of transaction fees following Covid-19, which was made free for nearly four months in the previous fiscal year. connectIPS charges at most Rs 8 for the transactions which is the cheapest rate among all the digital payments in Nepal.

As a result, the AGM held on 12th January 2022 ( 28th Poush 2078) concluded that the company is issuing 38% bonus shares for its shareholders.

As of Ashadh end 2078, NCHL’s network included 60 banks and financial institutions as direct members, with access to over 5,728 bank branches and 62 non-bank institutions as indirect/technical members. Similarly, it has 22 PSPs/ PSOs linked with its system.

With the Operation of National Payment Switch, NCHL is leading the Overall Digital Economy

National Payment Switch one of the major projects under Digital Nepal Framework. Payment gateways facilitate the exchange of funds between banks and digital payment vendors.

As the prime infrastructure for retail payment, the switch offers both real-time and non-real-time services, as well as open banking APIs that allow banks, financial institutions, and non-banking institutions to share financial information.

Using the national payment switch, accounts will be settled centrally and all electronic transactions made through banks, financial institutions and digital payment service providers will be tracked centrally.

The rising use of digital payments including digital wallets, QR codes, mobile banking, connectIPS and other payment systems have posed a need for an integrated payment system. National Payment Switch is about to fill up this void by integrating major payment systems in a single platform. For example, direct funds transfer from one digital wallet to another one will be easily possible after this. Similarly, you can integrate cards with your digital wallet or mobile banking systems as well.

A total of 18 commercial banks, 5 development banks and 6 finance companies have already entered into the NPS Phase 1 rollout agreement with NCHL. As more and more institutions will join the system, it will facilitate easy and interoperable payment system by contributing to the goal of digital economy in Nepal.

With these innovations record breaking transactions time and again, NCHL has bagged Digital Services ICT Award 2021 on the 2nd of Poush.

Also read: Customs office implements Online Payment System to accept customs tax