Imagine using a digital wallet to transfer the funds without the Internet. If you think it’s not possible, you might be wrong. Nepal Digital Payments Company Limited (NDPC) has unveiled the most awaited Fintech product- Namaste Pay digital wallet today.

You can transfer funds just with a USSD code

Namaste Pay has already started USSD services today. You can get offline services by Namaste Pay on your own mobile phone. For that, you should dial *500# on your NTC SIM and then proceed with the registration process. After that, you will get a code in your mobile number with log-in details and then you can log in to the Namaste Pay app which has been released on a beta version. According to the NTA, the test has been completed and it would be released tomorrow in the full version for everyone.

Namaste Pay digital wallet is already available in the beta version for Android. You can test the beta version of this app on Google PlayStore. You can also give your review on this.

It is the first of its kind to provide both online and offline mobile wallet service in the Nepalese market

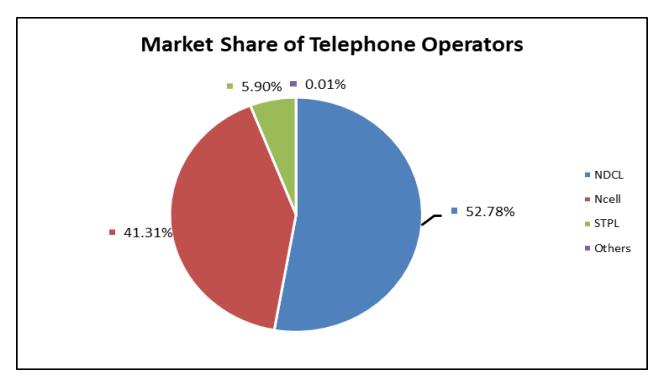

Yes, this is the first time in Nepal where a digital wallet can run offline too for fund transfer facilities. Since Nepal Telecom has the highest market coverage in both fixed broadband and mobile subscribers, Namaste Pay is going to be the biggest mobile wallet in Nepal. The users can transfer funds through both smartphone and feature phones anytime and anywhere.

If you are wondering how it could happen, let us make it clear. The wallet is identified by the mobile number of the user. And it uses Unstructured Supplementary Service Data (USSD) service which allows the users to transfer funds even without the Internet. A code will be sent by the company which you could use to transfer funds. It is as simple as how you buy data packs or transfer your mobile balance!

NamastePay is like no other digital wallets because…..

With new digital wallets emerging these days, there are more than 27 non-banking PSPs and 10 PSOs at present. Moreover, all the commercial banks have their own mobile banking apps that offer payment services. However, all of them are based online, which means you can only perform the transactions or even log in through the Internet connection.

Namaste Pay is the first ever digital wallet in Nepal that uses USSD system for fund transfers. This would support for the digital inclusion because even the feature phone users can easily enjoy digital wallet services.

It would utilize the increasing mobile penetration which has already reached 128.08% by the end of Jestha 2078. As of the MIS report prepared by Nepal Telecommunications Authority on Ashadh 2078, the market share of Nepal Telecom as a telephone operator is 52.78%. All the subscribers of this network can enjoy the use of NamastePay to a greater extent.

This is the great initiation of two big governmental companies

NasmatePay is the long-awaited digital wallet developed by the government body. The founders of this product are two companies having a long history in Nepal. One of them is Nepal Telecommunications Authority (NTA) while the other is Rastriya Banijya Bank (RBB).

The main objective to develop this product is to expand digital payment services in the rural areas of Nepal as well.

The concept of NamastePay was prepared a few years ago. Mr. Kiran Kumar Shrestha, CEO of Rastriya Banijya Bank made it public on November 28, 2020, during a panel discussion on the Fonepay Digital Nepal Conclave-2021. There, he had informed that NTA and Rastriya Banjiya Bank would establish a digital company on their joint collaboration to leverage the wide customers base of both companies. As a result, they formed Nepal Digital Payments Company (NDPC) for this particular purpose. And finally, we are have got the most awaited digital wallet- NamastePay.

In addition to that, there are more than 3.5 million customers of Rastriya Banijya Bank.

Similarly, people without a bank account can also use this service because it uses your mobile number for funds transfer. Unlike other digital wallets, you can perform transactions without remembering your bank accounts or linking them. However, it is providing a load option where the users can load their account at the nearby Namaste Pay agents.

What does it offer?

As a novel digital wallet in Nepal with wide coverage, NamastePay would offer the facilities like the following after its full development:

- Credit card payment

- Mobile top up

- DTH payments

- Attractive reward points on transactions

- Financial Payments

- Merchant payments

- Ticket booking

- Utility bill payments

- Easy fund trasnfer even without the Internet

- QR code payment through smartphone

- Wallet load and fund transfer option

However, only a few features are available in this initial phase. As of now, the users can perform mobile top-up, link their banks, pay for electricity and water bills, load the wallet and transfer the funds. According to NTA, other features will be added very soon.

Also read: NamastePay to use NCHL’s National Payments Interface (NPI)

Will NamastePay become the game changer in digital wallet ecosystem?

With more and more digital wallets entering the market, their effort in trying to stand out amongst the rivals is still competitive. In this scenario, NamastePay has a huge advantage as it can drive the wide customer base of both NTA and RBB into its system. Moreover, there is no need for a smartphone or internet connection for funds transfer as a simple code can transfer the funds. It means you do not need to go through multiple tabs for fund transfer like in other digital wallets.

Furthermore, it is a government-owned digital wallet with a huge customer base. Hence, we could expect more government payment options in NamastePay which can help us go cashless ahead of time.

17 Comments

Please give me information for referral code

नमस्ते पे सञ्चालनमा त आयो तर यसको apps चल्न सकेको छैन । कहिले fix होला त?

Pingback: ICT Award 2021 Selection Process Begins With Over 350 Nominations in 11 Categories - TechSathi

Pingback: How to get started with Namaste Pay? Know about the transaction limits as well - TechSathi

Pingback: NRB Releases Unified Directives 2078 with Updated Transaction Limits for PSOs, PSPs - TechSathi

I’m really excited to see Namaste Pay finally launch! The features highlighted in the post sound promising, and I can’t wait to try it out. Digital wallets are the future, and this one seems to bring some unique advantages to the table. Looking forward to seeing how it performs in real-world usage!

I’m really excited to see Namaste Pay finally launched! The features you mentioned sound promising, especially the focus on security and ease of use. Can’t wait to download it and give it a try. Thank you for the detailed insight!

I’m really excited to see the launch of Namaste Pay! The features mentioned in the post sound promising, and I can’t wait to give it a try. Digital wallets are the future, and it seems like Namaste Pay is stepping up to offer a great experience. Looking forward to seeing how it performs in real-world use!

I’m really excited to see Namaste Pay go live! The features mentioned sound promising, especially the focus on security and ease of use. Can’t wait to download the app and give it a try. Thanks for sharing this update!

I’m really excited to see the launch of Namaste Pay! The features mentioned in the post sound promising, and it’s great to have another option for digital transactions. Can’t wait to try it out and see how it compares to other wallets. Thanks for sharing the news!

Exciting news! I’ve been eagerly waiting for Namaste Pay to launch. Can’t wait to try it out and see how it compares to other digital wallets. Thanks for sharing the details!

I’m really excited to see Namaste Pay finally launched! The features you mentioned sound promising, especially the seamless transactions. Can’t wait to give it a try and potentially ditch my old wallet. Thanks for the update!

I’m really excited about Namaste Pay finally launching! I’ve been waiting for a reliable digital wallet, and it sounds like this could be a game-changer. Can’t wait to try it out and see how it stacks up against other options. Thanks for the update, TechSathi!

Exciting news about Namaste Pay! I’ve been eagerly waiting for a user-friendly digital wallet, and it sounds like this could be the answer. Can’t wait to try it out and see how it compares to other options available. Thanks for sharing the details!

I’m excited to see Namaste Pay finally launched! The features you highlighted sound promising, especially the emphasis on security and user-friendliness. I can’t wait to download it and give it a try! Thanks for the detailed overview, TechSathi!

This is exciting news! I’ve been waiting for Namaste Pay to launch, and I can’t wait to try it out. The digital wallet space has so much potential, and I’m looking forward to seeing how it stacks up against the competition. Thanks for the update!

I’m excited to see the launch of Namaste Pay! It’s great to have a new digital wallet option in the market, especially one that caters to our local needs. Looking forward to exploring its features and benefits!