A secured, trusted and convenient payment service provider, connectIPS has its own grandeur in the fintech industry of Nepal, where it is more preferred over available digital wallets for making payments to financial institutions. While some digital wallets lack integration and options to make financial payments like hire purchase or capital market payments, credit card payment (some of them have very limited options), this system is way more convenient for this particular purpose.

About ConnectIPS

ConnectIPS is a single payment platform developed by Nepal Clearing House Limited (NCHL) to render easy, secure and faster digital payment and fund transfer options for various transactions. Unlike digital wallets, loading amount is not required here since the bank account of the user is directly linked and one can make payments directly through their linked bank account. It is an extended product of Nepal Clearing House to support citizen-to-government (C2G), customer-to-business (C2B) and peer-to-peer (P2P) payment transactions directly from/to bank accounts.

Also read: https://techsathi.com/getting-started-with-connectips

With its multilayer authentication requirements and more options for payments, connectIPS has provided the option to link multiple bank accounts to its system which gives hasslefree experience in making payments or funds transfer. And its wide acceptance in both government and business entities has made it easier to use. It has been providing a series of services as:

- Payment options for governmental bodies, financial institutions and third party payments

- Fund transfer services

- Biller payments

- Utility payments

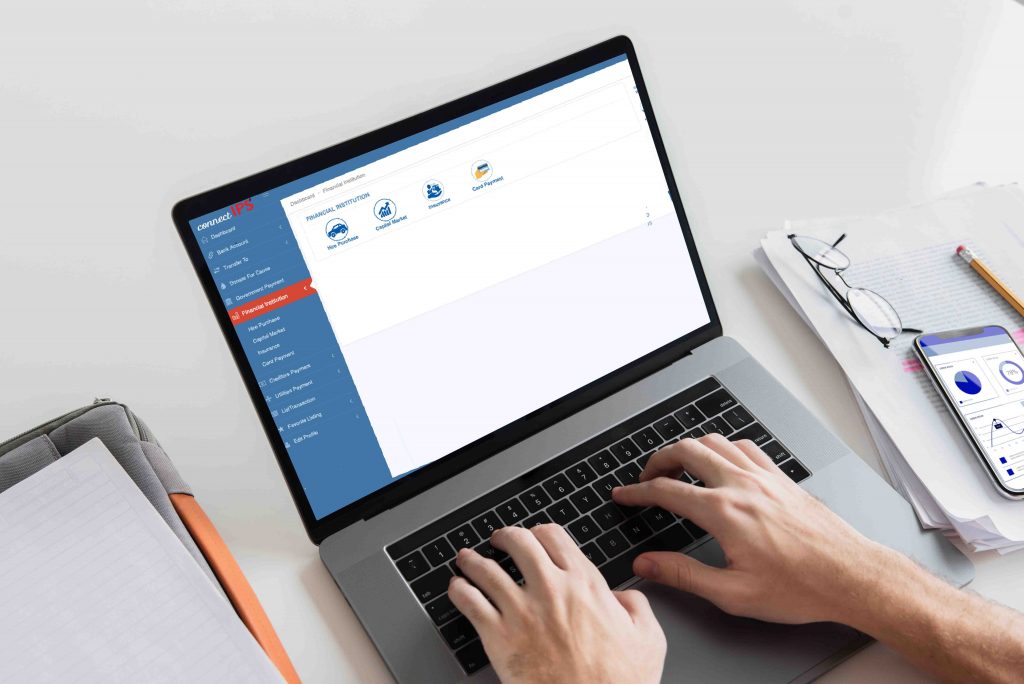

Among all, it is more popular for the option of payment to financial institutions. There are four major payment services available for financial institutions:

- Hire Purchase

- Capital Market

- Insurance

- Credit Card Payment

Making payments for Hire Purchase

If you have purchased or hired vehicles or equipment in credit or hired them, you need to pay for the interest and/or other fees on a regular basis as per the contract. This option in connectIPS enables you to pay for the hire/purchase services that you enjoyed from the listed financing companies/ dealers or suppliers.

You just need to follow these steps to make payments for hire/ purchase:

- Login to your connectIPS ID

- Click on “Financial Institution” option

- Go to “Hire Purchase

- Select your payment receiving party among the listed ones

- Then fill up personal and payment details

- Finally click on transfer, you’ll have to enter your transaction pin to finish the payment

Making payments for the Capital Markets

Well, if you are a stock investor, you might be quite familiar with this option. Stock investors are certainly making money, but they are not free from fees incurred on a cyclical or regular basis. Either for renewing their demat account or for making payment for the purchase of shares, or to pay for the bonus taxes, one must make payments to their depository participants (DPs) or brokers. connectIPS has made it easier by providing a one stop solution for overall capital market payments like Meroshare fee, brokers payment and bonus tax payment.

If you’re using the Trading Management System (TMS) of Nepse, the amount obtained from your sold stocks is directly deposited to your bank account via connectIPS. Isn’t it easier and hasslefree?

Actually, the fact is that many of the stock market analysts claim that the development of easier payment services like connectIPS have somehow contributed to the increasing daily turnover volume in the capital market of Nepal.

The available options under Capital market payments are:

- Brokers Payment- To make payment for the securities you purchase in the capital market

- MeroShare Fee- To make payment for renewal of meroshare to your DP

- DMAT Fee- To make payment for DMAT account renewal

- Bonus Tax- To make payment for the tax on bonus shares or cash dividend if mentioned by the associated company listed on NEPSE

Insurance Payments

Whether you have purchased a life insurance policy or owned assets like vehicles, buildings, livestocks and so on, paying for insurance premium is a must. There are options to make payment for both life and non-life insurance companies in the “Insurance Payment” option.

Currently, there are 10 life insurance companies and 13 non-life insurance companies available for payment in the system. You can choose the insurance company as per your insurance contract and make payments by filling up your details.

Credit Card Payment

Another option among financial payments is making credit card payments. You need to enter your card details and select the bank on the “Card type” option. Then you can click on the transfer button to make payment of your credit card.

Few information on the transaction amount

- The daily transaction limit for payment or fund transfer is upto NPR 1,00,000 via mobile app and NPR 10,00,000 via web application.

- ConnectIPS charges a certain amount on transactions carried through its system. For example, it charges you some amount around Rs 2-15 on every payment you make in purchasing the stocks, depending upon the transaction amount slab. However, most of the biller payments are free here.

No doubt, connectIPS has stood on its distinct position among its corporate peers like eSewa, Khalti, IME Pay and others. It has a wider option for making payments to the financial institutions online. NCHL has been upgrading its systems and providing convenience to the government entities, corporate bodies, merchants and general users via its five major systems- ECC, ConnectIPS, NCHL-IPS, connect RTGS, and NPI. Among them, connectIPS is the most popular among the general individuals who use this system for their regular financial transactions or payments. Further going deeper, connectIPS’s option for making payments to the financial institutions stands out among other payment systems available in the digital spectrum of Nepal.

How often do you use connectIPS for making payments to financial institutions? Do you find it convenient in comparison to others?

Please drop down your comments.