Srilanka is entering into an economic crisis as it is experiencing various economic problems ranging from higher inflation to rising public debt. Not only in the time of pandemic but also the economy was gradually running slow before the pandemic. The Srilankan Government was piling up huge debt amounts since 2014.

According to Al Jazeera, the debt-to-GDP ratio was 101% in 2020. Moreover, the rising prices have added fuel to the fire. With the running inflation of 11.1% (as of November 2021) and rising public debts, the country is having an economic downturn.

On July 2021, it had just $4 billion foreign currency reserves in the central bank enough to pay for the imports for 3 months. The Srilankan Government has the highest amount of countrywide debt with China. Despite having the highest Human Development Index (HDI) among the SAARC nations many times, Srilanka is now on the brink of economic crisis.

Is the Pandemic to Blame for the Economic Crisis in Srilanka?

The scary situation is continuously rising amid the pandemic. Though this started before the pandemic, the economic downturn got worse during the Covid-19 crisis. According to the World Bank, more than 500,000 people in Srilanka have fallen back under the poverty line during the pandemic. Despite the efforts of Srilanka in reducing poverty for five years, the poverty rate is more likely to increase due to an increase in prices. Even the price of basic goods has increased.

The pandemic took a toll on the tourism sector which had about a 10% contribution to the GDP. More than 200,000 people lost their jobs in the tourism and hospitality sector due to the pandemic.

President Gotabya Rajapakshya had declared that Srilanka is going under an economic emergency. Hence, the military was given the power to supply essential food items to the people including rice and sugar at government prices. However, it was not enough to lessen the effects of this crisis. It has high debt obligations towards other countries and global agencies like The World Bank, Asian Development Bank, and Japan International Cooperation Agency (JICA).

What Worsened the Situation to Deepen this Economic Crisis in Srilanka?

To control the currency reserves, the government had also banned the import of fertilizers in May 2021. However, this couldn’t help at all. The situation got worse as the agricultural production got affected. The farmers across Srilanka protested against this step by the government. However, since the economy had been relying upon imports from the foreign market, banning the import of fertilizers just made things worse, increasing the price of agro products.

Hence both the reduction in food production and imports have pushed Srilankan Economy to a rough patch.

According to The Guardian,

Sri Lanka will need to repay an estimated $7.3 billion in domestic and foreign loans over the next 12 months, including a $500 million international sovereign bond repayment in January. However, accessible foreign currency reserves were only $1.6 billion in November.

Srilanka printed 213 billion (USD 1005 million) money on July 26, 2021, to repay its debt. This further decreased the currency reserves. Apart from that, the increase in money supply didn’t go through the banks. This increased the inflation as that money was not spent for production purposes.

As this economic crisis deepens, various economists claim that Srilanka may go bankrupt in 2022. Inflation has reached a record high. Food prices have skyrocketed and government reserves are going empty.

Economic Crisis in Srilanka: What Can Nepal Learn From It?

Indeed, an economy can not sustain with imports alone. Nepal also has a huge import from various countries, India being the prominent one. The import-export ratio was 9.2% in September 2021 which meant we spent $9.2 for every dollar exported. Since we are dependent upon India for most of the basic needs (mostly food supplies and oil), an import-led economy is similar to a double-edged sword.

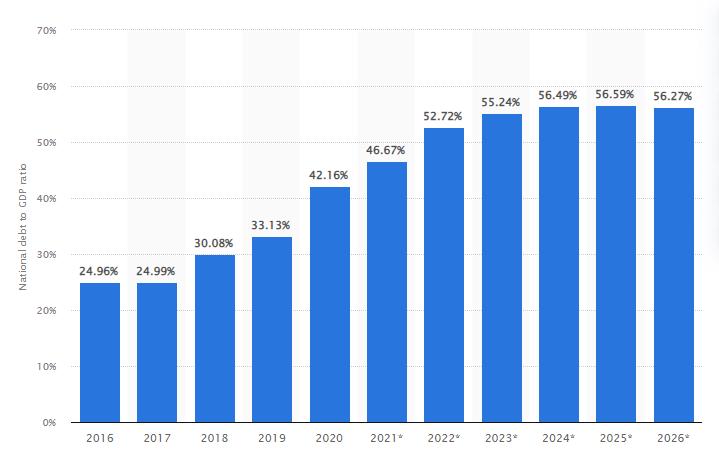

Talking about debt, the debt-to-GDP ratio of Nepal was 42.16% in 2020, according to Statistica.com. It has been forecasted that the figure may rise up to 56.27% by 2026.

Getting debt is not scary until the economy has a perfect plan to repay it through productive activities. Moreover, investment in skills and production could save the economy from the debt crisis. All the debt collected could generate further income if it is invested in productive sectors. Nepal is getting a lot of public debt and grants from foreign and donor agencies. It was about $2 billion in the last year. The ongoing liquidity crisis in the country is giving warnings for the potential economic slowdown in Nepal.

Let’s hope Nepal would learn it soon from the economic crisis in srilanka and plan for better financial and economic stability.