The Buy Now Pay Later scheme is not a new concept in the world. Many banks, credit, and payment companies have been providing the Buy Now Pay Later plans to their customers since long.

The global payment giants like PayPal, Klarna, etc have provided Buy Now Pay Later plans long before. And they have hit a larger number of customer base globally. PayPal alone has 400 million active users under BNPL plans.

TrueLayer had predicted that the alternative payment methods like BNPL is expected to grow by 70% over the next four years in Europe.

However, with the fears of the world going towards recession, major markets like cryptocurrency, stock market, etc are dropping at present. While the USD is rising in its value, making the historical high, the listed payment companies in the world are losing their valuation recently.

Buy Now, Pay Later Bubble is Bursting in the World

On July 12 2022, The Sydney Morning Herald made one headline- “The Buy Now Pay Later Bubble is Bursting Before Our Very Eyes“. This was not only an article, rather a testimony of a real-life happening in the world right now.

Buy Now Pay Later was popular in the entire global market till the last year. However, with the rising interest rates and regulations over these products, there is just a slight chance of survival of the businesses that are providing this service.

The popular payment company providing BNPL services- Klarna lost more than 85% in its valuation while dropping from $US 45 billion to $US 6.7 billion in one year. Hence, it raised an additional capital of $800 million the investors on Monday. Klarna has more than 15 million UK customers.

It was hyped once, for it had introduced buy now, pay later plan which attracted a large number of customers. And at the present, the rising risk of defaults on this plan has left this company in the verge of losing its valuation by more than 80%.

Why is “Buy Now, Pay Later” collapsing? Is it real?

The international media is going with the wildfire- Buy Now, Pay Later is Collapsing. But how did it start?

Let us know how the international BNPL plans have been working lately. The payment giant PayPal also introduced Buy Now Pay Later plans which did not charge late fees. The customers could pay in 4 installments. The brands like Walmart, Nike, Samsonite, Champion, etc gave their participation as a merchant in PayPal’s BNPL plans.

However, with the rising inflation in the world, default rates on Buy Now Pay Later have been increasing lately.

And it is surprising that Buy Now Pay Later (BNPL) products, which allow the customers to delay or spread the cost of their purchases, are not regulated in the UK.

Due to this, these companies haphazardly provided BNPL services to all types of customers, this too, being interest free. The rising competition among the players in the BNPL market led many customers to fall for these lucrative plans.

As soon as the inflation and rising interest rate hit the global market, the default rates also increased in case of these BNPL plans. The soaring price of groceries, gasoline and other products along with the rising interest rates has made credit products costly. This led to increase in default risks of these products and the companies providing BNPL plans are on the brink of loss.

The Reserve Bank of India (RBI) is Regulating the BNPL Sector with New Rules

India also experienced a whopping rise in private companies providing BNPL services which were interest free, and late charges free. Reportedly, the BNPL segment of India is expected to reach $43 billion mark by the end of 2025.

However, the Reserve Bank of India is regulating the BNPL sector in India to curb the rising default rates. It is scrutinizing on how the credit is being lent through BNPL plans.

Customers who availed these products last year are waking up to the costs behind the scenes, and lack of full transparency while marketing these products is not going unnoticed by the RBI.

How Feasible is the Buy Now Pay Later Plan in Nepal? Is it Worth Growing Amid this Liquidity Crisis?

The ongoing liquidity crisis in Nepal is crippling the economy since a year. Nepal Rastra Bank is also getting strict upon the banks and financial institutions (BFIs) upon maintaining the CD ratio below 90%.

The banks lent hugely to the customers during the Covid-19 crisis and now, they are suffering from a liquidity crisis where they are not in the capacity to disburse credits anymore. To tackle this problem, they have been advertising high rate of interest. Some banks are even providing lucrative schemes like loan on fixed deposit.

As the rate of interest is rising, there is a high risk of defaults in the banking sector. During the lenient banking loan disbursal, many borrowers took loans and invested in the stock market. This caused a boom in Nepal’s stock market- NEPSE.

Now that the market has plunged from the highest high of 3180 points (15 August 2021) to the line of 1900 at present, the investors are also mourning over their loss in the stock market which they invested from the borrowed money.

More than that, the banking sector is now bleeding over the increasing liquidity crisis. To some extent, the problem of liquidity is slightly improving.

According to Nepal Rastra Bank’s Current Macro- Economic and Financial Situation Report, (Based on 11 months Data Ending Mid-June 2022), the deposit in banking sector had increased by 5.7% during the period. Similarly, the credit lending to the private sector has also increased by 13.5%.

While these things might console the public and concerned people for a while, some of the top managers of the Commercial banks of Nepal even fear that the default in loans will surely threaten the liquidity status of the banks.

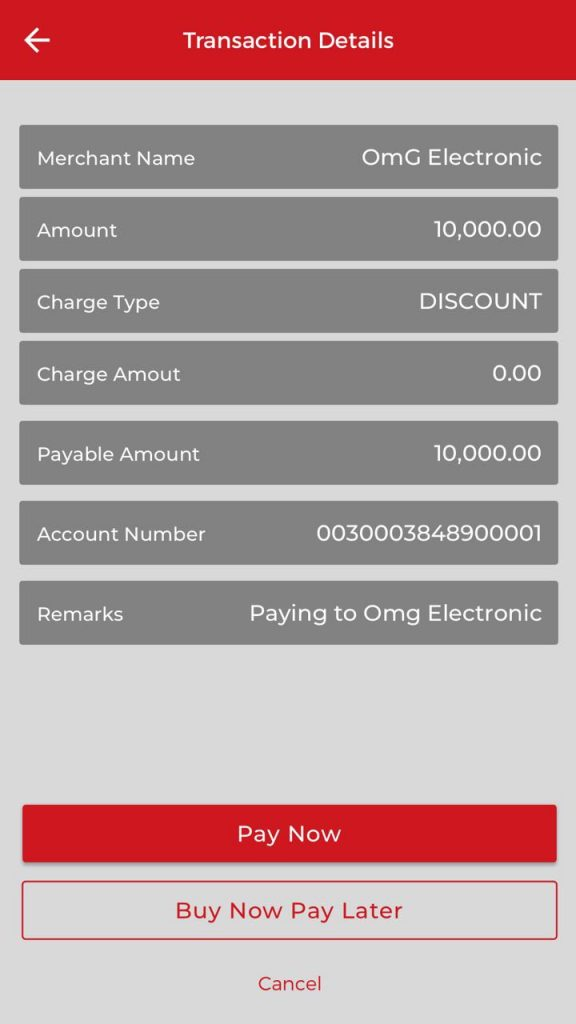

In the time when the banks are being strict on lending loans, just 6 months before, Buy Now Pay Later was introduced by a private company – F1 Soft International. F1 Soft International’s credit lending product Foneloan has been providing Buy Now Pay Later plans through which you can pay for the purchases on credit from your mobile banking app.

A digitized version of EMI plans with additional benefits and features- BNPL by FonePay is available in more than 7 banks of Nepal.

Right now, this service can be enjoyed by the salary account holders in these banks:

- Kumari Bank

- Mega Bank

- Prabhu Bank

- Nabil Bank

- Citizens Bank International

- Laxmi Bank

- Machhapuchhre Bank

Currently there are 17,953,837 mobile banking users in Nepal. FonePay is the prime mobile banking system operator for most of the banks, serving more than 16 million users. Having this huge base, it has taken the first mover advantage of introducing BNPL plans through mobile banking apps. The eligible customers can just scan QR codes and pay in EMI through Fone Loan.

The Foneloan’s BNPL plan has served the customers of more than 7 commercial banks. One of the respondents of FonePay revealed that they are onboarding other banks too from the next fiscal year. According to them, this credit product is performing well in the market.

Indeed, the default rates might not exist as of now since, Foneloan is only accessible to the salary account holders. It means, you need a regular stream of income to avail of this service. This way, Buy Now Pay Later product could thrive for a time.

However, if it reaches to any banking customers, it might invite a massive default cases amid this inflation and rising interest rates. Hence, F1 Soft also has taken a smarter move to avoid the risk of default by allowing BNPL services to only salary account holders as of now.

The digital lending market is still in the nascent phase in Nepal. However, we can not underestimate its growth prospect that can take off like digital payments including the use of mobile wallet, QR codes. Let us hope that Nepal would not experience the downfall in the Buy Now Pay Later market as it is prevalent now in the international market.