Nepal Clearing House Ltd. (NCHL) is celebrating it’s 12th year of successful administration this year. We congratulate the family, concerned members, and stakeholders of NCHL on hitting the milestone of the 12th year and for enabling constant and commodious payment, clearing, and settlement services, and advancing digital payment system in Nepal.

History of NCHL (Nepal Clearing House Limited)

Nepal Clearing House is a public limited company under the leadership and guidance of the central bank of Nepal, Nepal Rastra Bank. It was established on 8th Poush 2065 (23rd of December 2008) and since then has been performing its regulatory service. NRB plays the role of a settlement and supervisor bank.

NCHL and its clearing services have been performing its responsibility and abiding by various rules, guidelines ordained by the central bank. NCHL has equity participation i.e. ownership of shares in a company or property, from many commercial banks, development banks, the central bank, finance companies, and Smart Choice Technologies (SCT). NCHL operates and establishes national systems for clearing, settlements, and payments while facilitating the development of secure payment methods in Nepal.

More about NCHL product and services

ConnectIPS:

connectIPS is an extended product of NCHL which was previously introduced to support citizens to the government (C2G), customer to business (C2B), and peer to peer (P2P) payment transactions directly from/ to bank accounts.

connectRTGS:

connect Real Time Gross Settlement (RTGS) which sustains the execution of critical and high-value transactions, is an integral component for integrating banks & financial institution’s internal order with the RTGS system hosted by NRB. This is a gateway to enable the BFIs to initiate and process RTGS transactions. It consists of an inward module to process incoming transactions and an outward module to initiate outgoing transactions and from the RTGS system.

corporatePAY:

corporatePay is a system that acts as a business payment platform that permits the corporate and business customers of the member banks and financial institutions to initiate digital payments from any of the accounts maintained at the member banks was provided and hosted by NCHL for assisting its member banks and Financial Institutions(BFIs).

NCHL-IPS:

A system that gives an efficient and safe means of funds transfer from one account to another account held at any of the participating member BFIs. This supports the procedure of direct credit and direct debit related transactions. ConnectIPS electronic payment system and NCHL-IPS alongside other non-banking institutions are enrolled as indirect or technical members for initiating payment transactions.

NCHL-ECC:

An Electronic Cheque Clearing system that is an image-based, cost-effective MICR check processing and settlement solution. NCHL works with a fully electronic solution using modern digital communications and networking technologies to almost replace the paper-based process of the ECC system.

NPI (National Payments Interface)

National Payments Interface (NPI) is the consolidated Application Programming Interfaces (APIs) of multiple payment systems hosted by NCHL or any other institutions built in an Open API platform concept. It currently provides access to the NCHL-IPS system and connectIPS e-payment as underlying payment systems with the overlaying services built on top of the platform. It primarily supports push transactions with seamless integration to connectIPS for real-time instant payments and to NCHL-IPS for deferred credit payments.

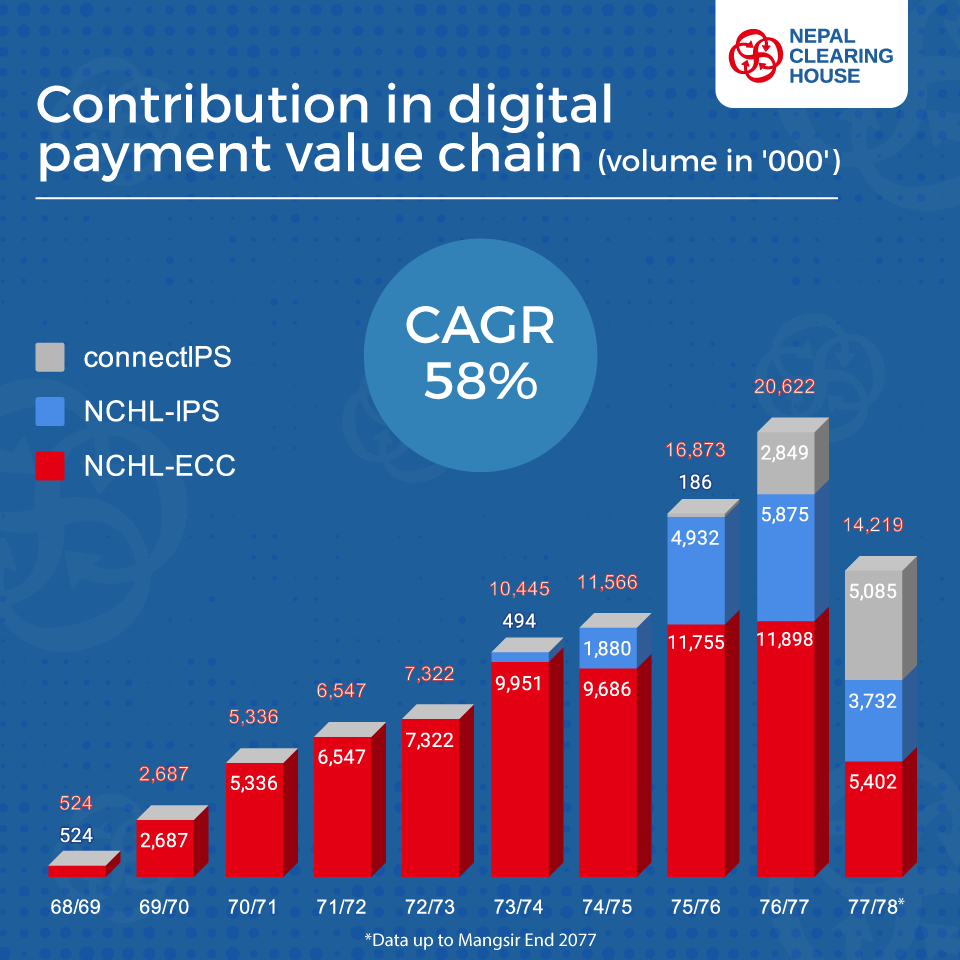

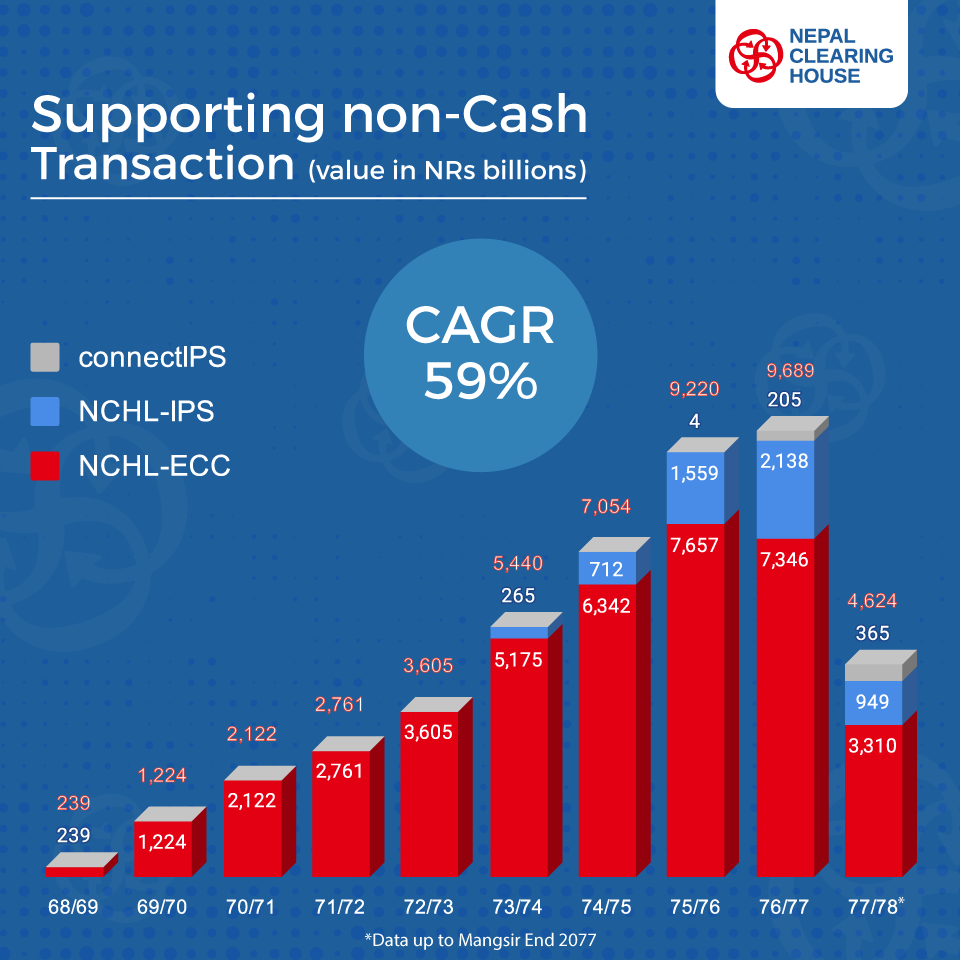

Digital Payment System in Nepal

The integration of financial and banking technology-oriented services in helping banks/financial institutions is probably the reason why NCHL can ensure innovative financial solutions while providing them with various technology-based payment-related assistance without investing heavily into the infrastructure.

The level of commitment and transparency displayed by NCHL towards its shareholders, employees, members, and partners is commendable and goes on to show why NCHL is a reliable company.

The introduction of a system like the Electronic Cheque Clearing system has caused a significant reduction of the time-consuming manual process of cheque clearing both for the banks and for the customers. Comprehending national payment systems, financial opportunities that are convenient and standardized is how NCHL is preparing a roadmap for establishing a national payment gateway and advancing a digital payment system in Nepal.

12 years of NCHL in Nepal: Paving the path for Digital Payment System in Nepal

NCHL has been introducing the latest products and services to facilitate individuals with numerous economic prospects. The approach with which NCHL was initiated was to establish multiple payments, clearing, and settlement systems in Nepal while maintaining explicitness. The long-term vision of instituting a national payment gateway to facilitate electronic payments and financial transactions across the country will surely be accomplished with coordination and proper operation.

Enabling the development of secure and trusted new payment methods and technologies in Nepal while protecting and increasing the shareholder’s values is a mantra with which NCHL has stood for years. Looking at its journey and the resources it has achieved it would be fair to say how NCHL possesses the excellence to be a leading contributor of electronic payment and settlement services.

We congratulate the family, concerned members, and stakeholders of NCHL on hitting the milestone of the 12th year and for enabling constant and commodious payment, clearing, and settlement services.