Digital age has introduced many new innovations. One of those innovations is Omnichannel banking: an interactive approach towards providing innovative experience to customers. NMB Bank is about to come with the Omnichannel Digital Banking service to provide their customers with ideal interactive experience. This approach started by a bank in Nepal is an advance milestone in Nepali banking community. Streamlining customer interaction within a single platform, optimizing the digital banking experience, fostering the customer centric culture, integrating them with connection to provide satisfying user experience is what Omnichannel digital banking service is all about.

NMB bank previously initiated its own Mobile Banking Service, which is the bank’s official mobile banking app for customers to enjoy banking from the ease and comfort of their homes.

Customers are able to open their NMB Bank accounts via Facebook Messenger and via Viber by directly having chat with the Bank’s Facebook and Viber account. After this innovative service the bank starting Omnichannel banking service is definitely a milestone in Nepali banking community.

NMB Bank Viber Banking

NMB Bank

What is OmniChannel Banking?

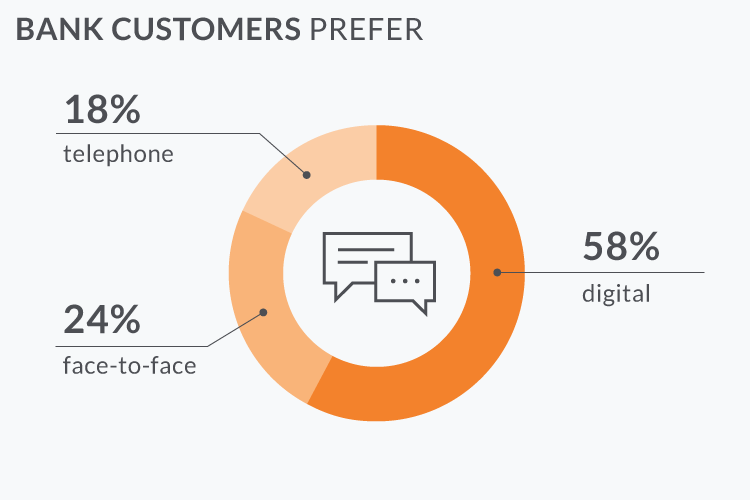

As time is evolving customers are evolving too .Today customers choose to do their banking when, where and how it suits them. Customers are in need of an ideal, personalized, interactive customer experience provider which is stable with unified experience serving quality. People want to connect with their bank in their own terms, and their terms can be fulfilled by services like Omnichannel banking.

The approach about integrating channels with each other in order to provide a smooth customer experience with every channel being able to integrate and relate to one another so that the customers are able to switch effortlessly between channels is something customers will entrust. Omnichannel being able to foster customer centric culture is an introduction towards automated fashion. This experience provides customers with satisfaction as it regulates customer interaction while focusing on customer policy.

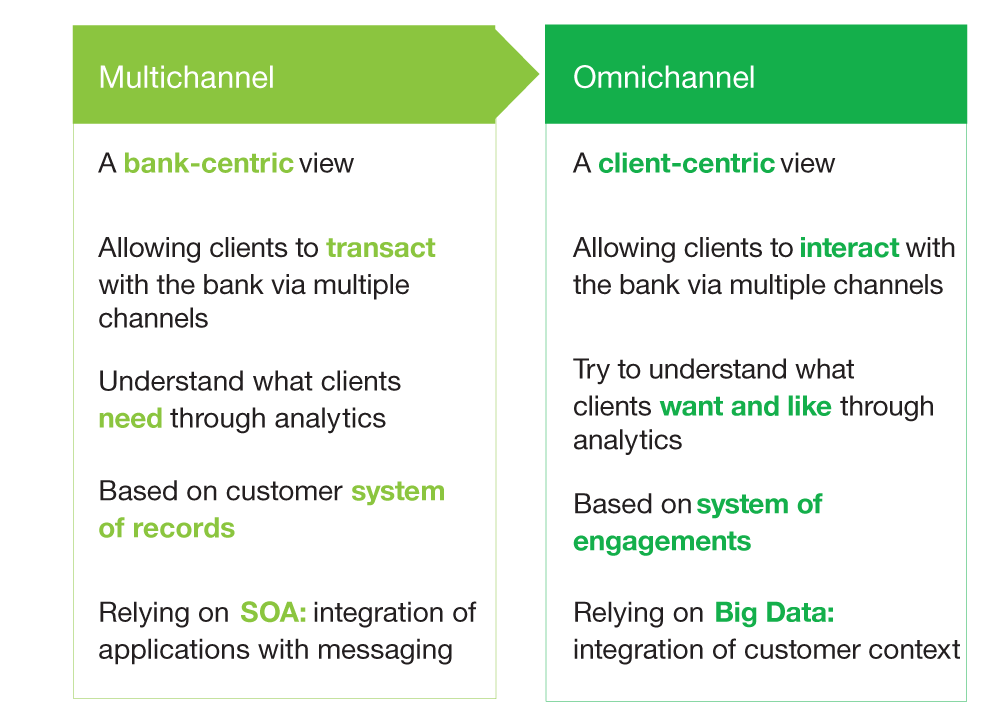

OmniChannel Banking vs Multichannel Banking

The digital transformation NMB bank is trying to introduce to their banking system can be said as a shift from product centric to customer centric model by providing ideal personalized experience for customers. NMB bank has raised its bars to meet customer expectations as customers want service which is reliable and reciprocal. Safeguarding the interests of customers while delivering new levels of consistency through Omnichannel digital banking service is probably the goal of NMB Bank for the goodwill of their bank and customers .

This exciting turn of event in digital banking service in Nepal by increasing customer satisfaction, customer interaction, better communication and enabling customers with the choice of banking in their way, at their choice of time is a tempting thing for customers .In the future dominated by digital platforms adding such Omnichannel digital touch in their services NMB bank is trying to make its way in the direction of innovation .

1 Comment

Pingback: NMB Bank Advancing With New OmniChannel Digital Banking Service - Amrit Sparsha