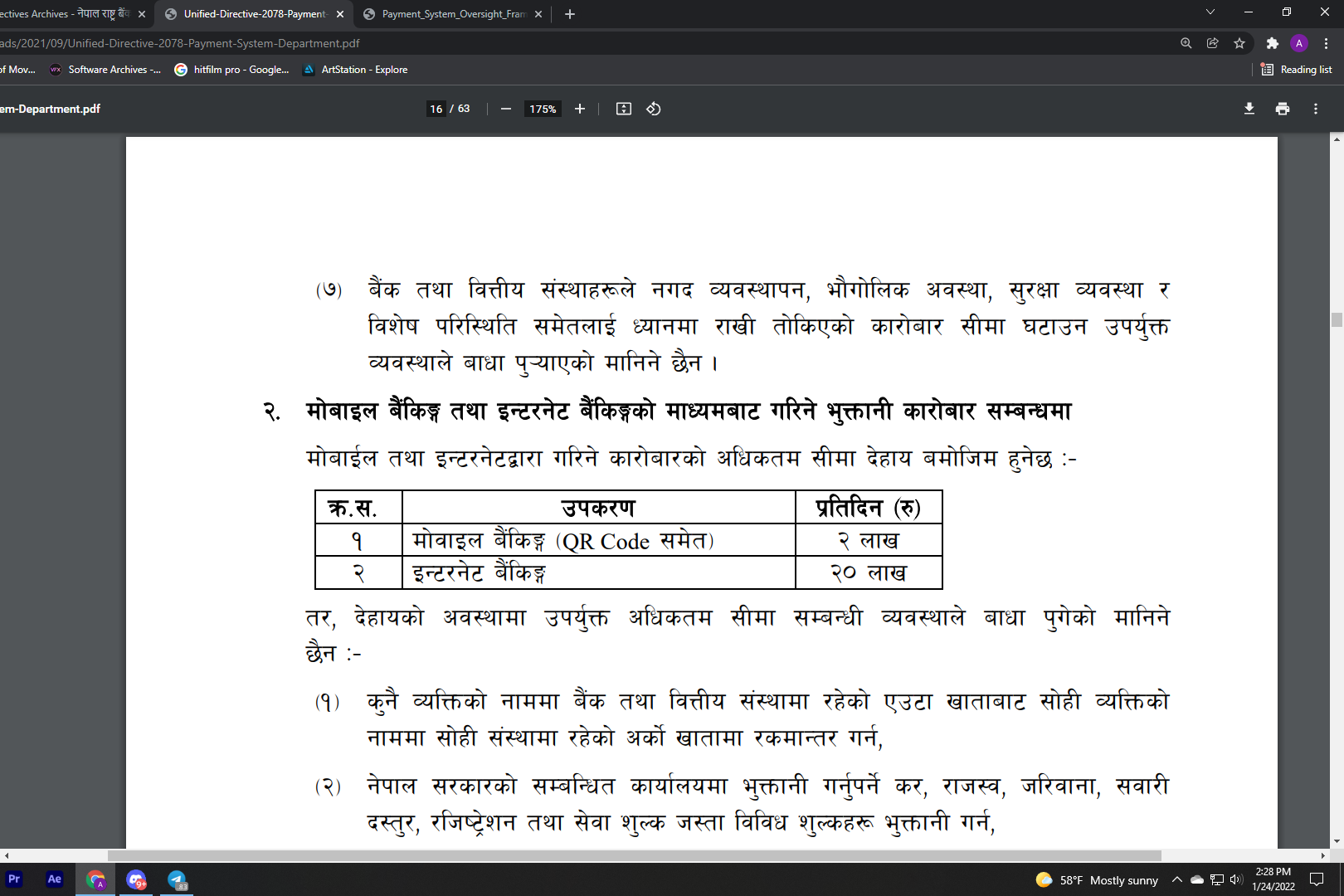

Nepal Rastra Bank has set the transaction limit for mobile banking and other payment systems in the Unified Directives through the Payment Systems Department. The maximum transaction limit per day from mobile banking channels is NRs. 200,000. On the other hand, you can transfer funds up to NRs. 20 lakhs in a day from internet banking.

The mobile banking system is popular among individual banking customers while internet banking is mainly for corporates.

This transaction limit applies to all mobile banking systems as well as including connectIPS

connectIPS too has updated its transaction limits as per the limit prescribed by the Unified Directives of Nepal Rastra Bank.

However, we were surprised by how the transaction limit on the mobile banking system remained unchanged after we made a fund transfer through that.

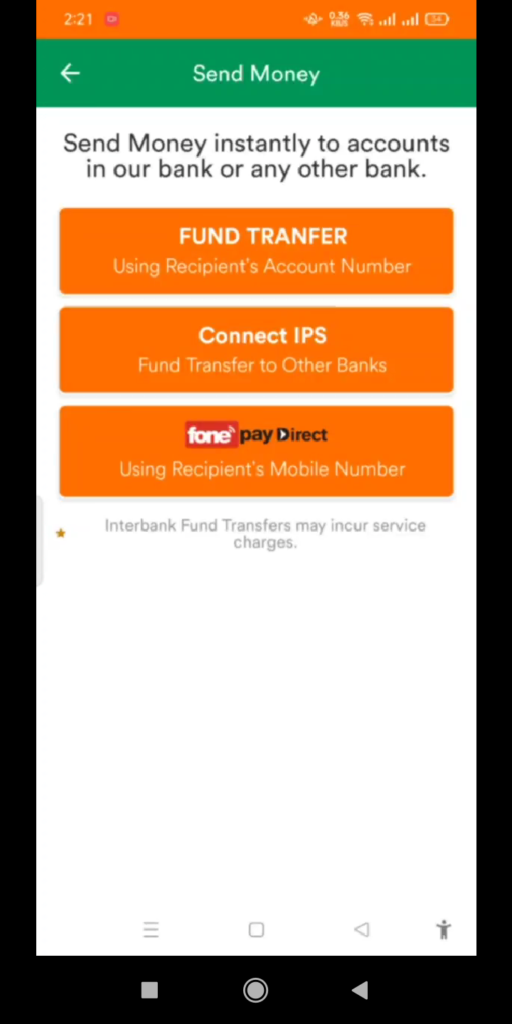

At present, you can transfer funds from your mobile banking app in two ways:

- Transferring funds through recipient’s mobile number using FonePay Direct

- Funds transfer through recipient’s account number (either entering manually or scanning the QR code)

- Bank transfer through the connectIPS portal in your mobile banking app

Nepal Rastra Bank has clearly stated that the maximum mobile banking transaction limit per day is NRs. 200,000. Even if you use the mobile app of connectIPS, you can not transfer the amount more than that per day from your mobile app. In addition to that, you can avail of not more than 10 transactions through the mobile banking system.

To our surprise, we could transfer NRs. 300,000 from the mobile banking system while the maximum limit is only NRs. 200,000. How’s this possible?

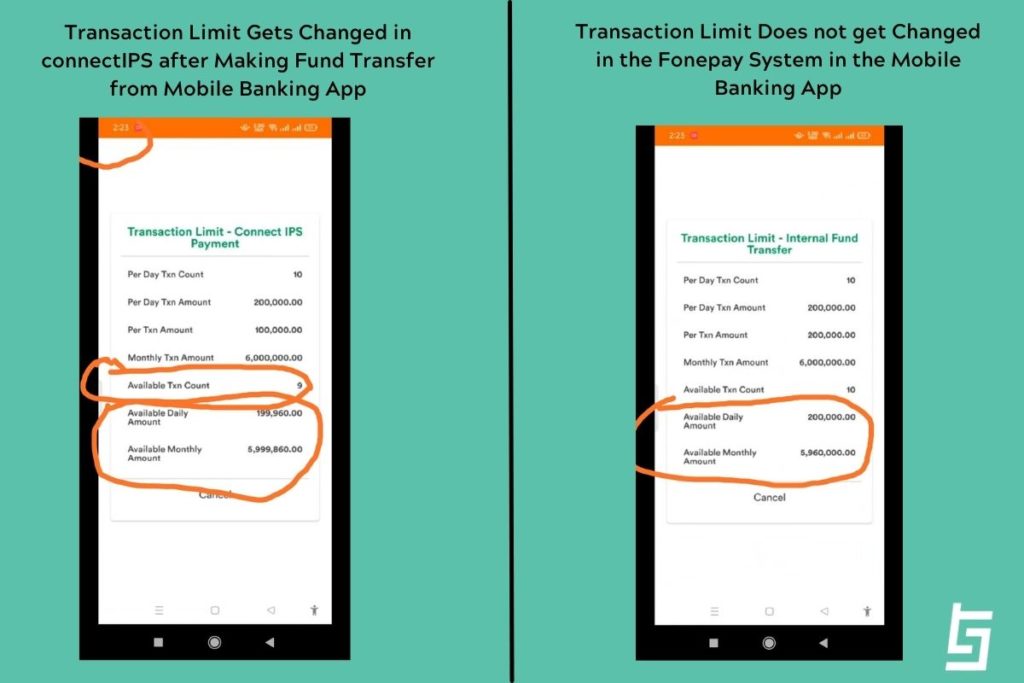

Normally, if you have noticed it before, your transaction limit gets deducted once you make a bank transfer from your mobile banking system. For example, if you transfer funds of NRs. 100 to any other bank account using a mobile banking system, it deducts the maximum per day limit. The limit then must be NRs. 200,000- NRs. 100= NRs. 199,900.

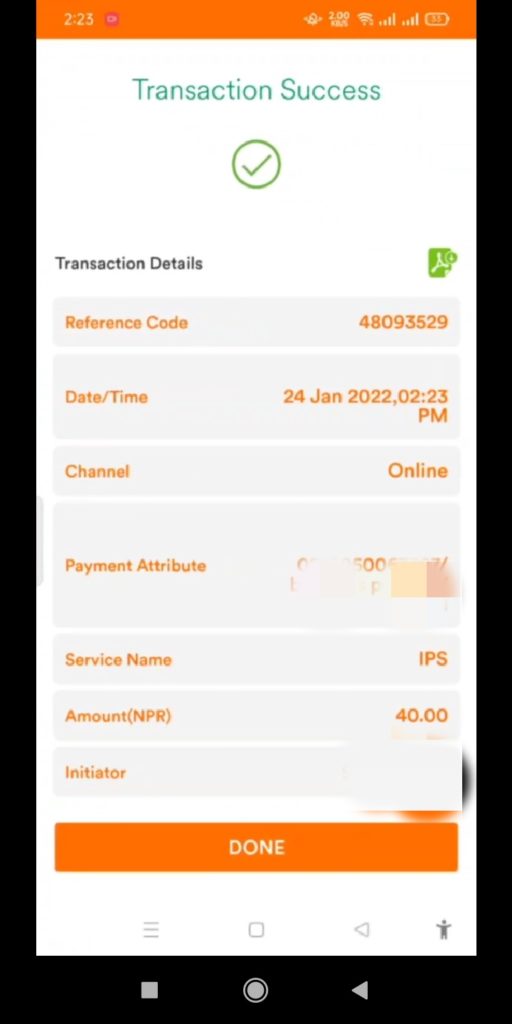

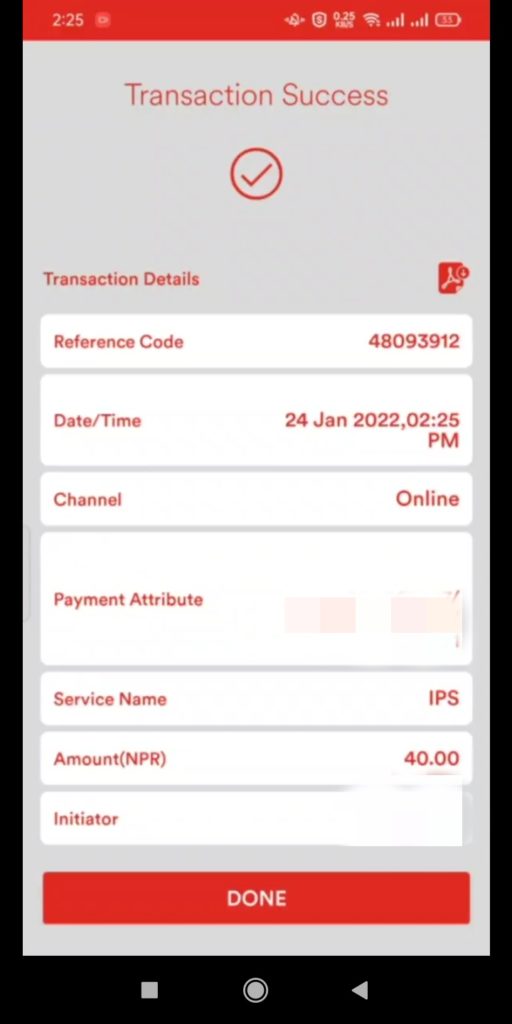

For instance, we tried with a test where we transferred NRs. 40 to Mega Bank from Century Bank Limited. What we did was:

- Open the mobile banking app and log in

- Go to send money option

- Then, choose any option among the three. We chose connectIPS option for making fund transfers. We entered the necessary details and transferred NRs. 40 to another bank account at Mega Bank Limited.

Then we checked the transaction limit simultaneously in the connectIPS system and Fonepay’s system in our mobile banking app.

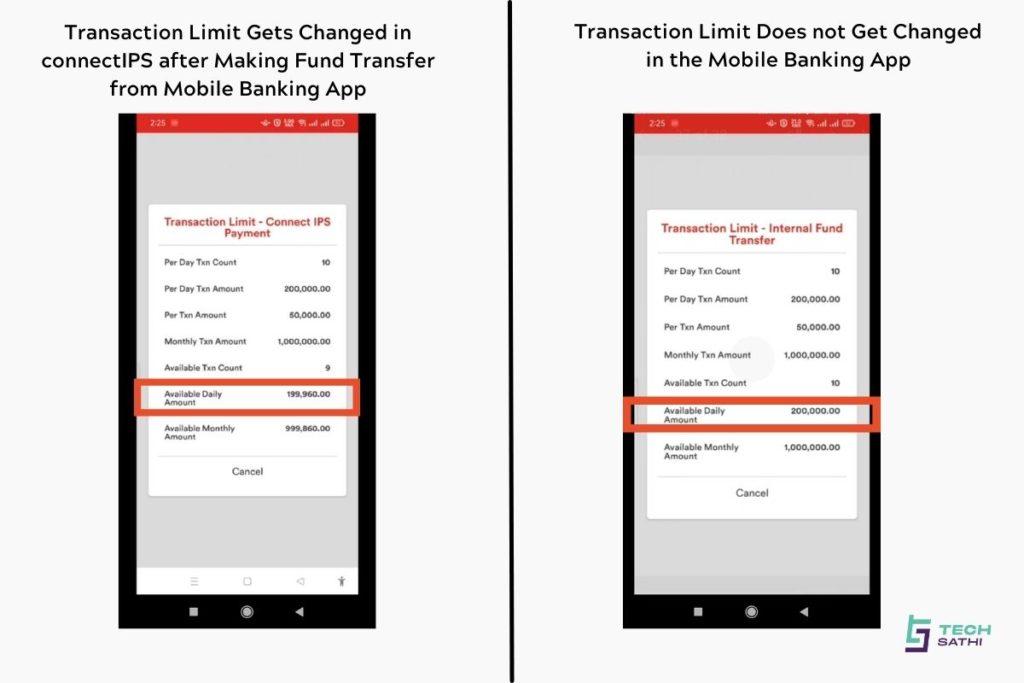

For your information, we did the transaction at 2:23 PM. When we checked the remaining transaction limit, the connectIPS transaction limit was changed while Fonepay’s transaction limit remained unchanged.

As you can see, the transaction limit in the connectIPS account has decreased to NRs. 199,960 while it is still the same i.e. NRs. 200,000 in the internal mobile banking system. Isn’t it surprising that mobile banking is allowing you the per-day transaction limit of more than the maximum limit of NRs. 200,000?

For further confirmation, we checked through NIC Asia Bank too and found out the similar issue

We also transferred NRs. 40 from NIC Asia to Prabhu Bank and found a similar issue. While transferring funds from connectIPS through the mobile banking app of NIC Asia Bank, our transaction limit got deducted. Even the transaction count per day dropped from 10 to 9.

But when we checked in the mobile banking system after making a fund transfer, the limit was still NRs. 200,000. it means, the transaction from connectIPS in mobile banking didn’t reduce our overall transaction limit of NRs 2 lakhs and this is something serious to think about.

If this is possible, what’s the use of transaction limit by Nepal Rastra Bank? Is Nepal Rastra Bank unknown about this issue?

While any transaction made from the mobile banking system can not exceed NRs 200,000, we can clearly see that one can easily make a total of NRs 4 lakhs of transactions from the mobile banking app using these separate methods.

While there are exceptions where this limit might not be applicable:

- When a person transfers the amount from one bank account to another bank account maintained in the same bank

- While paying for the taxes in government offices

- Electricity bills, telephone bills, water charges, insurance premium, Social Security Contribution oayments

- Payment for the bills of educational institutions, hopitals, flights, transortations, hotels and corporate payments

- Payment to broker for the purchase of securities

- Or any other payments allowed by Nepal Rastra Bank

Other than these exemptions, one can not make fund transfers more than the limit.

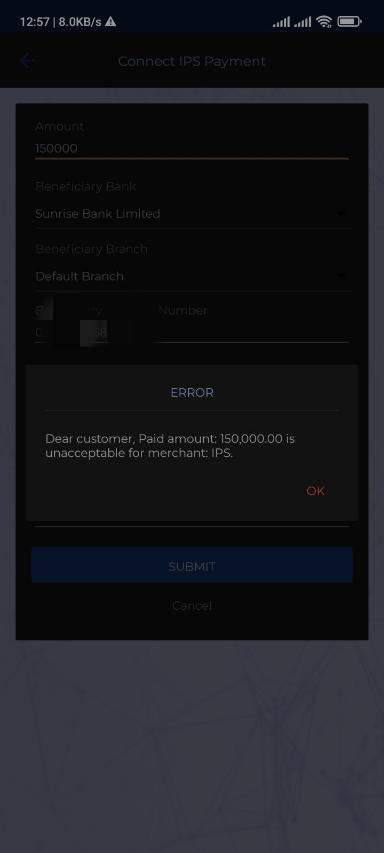

However, the banks are allowed to maintain their own internal limit for the transactions of mobile and internet banking without exceeding the maximum limit of NRs. 2 lakhs and NRs. 10 lakhs respectively.

For instance, when one of my friends tried to send me NRs. 150,000 from Global IME Bank Limited, it was denied by the mobile banking system. What do you think about this restriction by the banks in the limit while the Nepal Rastra Bank has allowed per transaction limit of NRs. 200,000?

Coming back to the issue, we are unknown if this has come under the eyes of Nepal Rastra Bank. While the regulatory body is restricting us from making bank transfers more than NRs 2 lakhs per day from the mobile banking channel, why is it still possible to make bank transfers more than the limit? What is your view on this? Is this a violation of regulation or has Nepal Rastra Bank itself allowed the banks for this? We would like to draw the concern of all the mobile banking users, banks, and the regulatory authority- Nepal Rastra Bank too.

Also read: Now You Can Pay Insurance Premium of 30+ Companies Using connectIPS and Get Real-Time Settlement