ConnectIPS allows you to pay your life and non-life insurance premiums directly from your personal account at any member bank or financial institution. Such payments can be made in real time using connectIPS (web and mobile app) or the different insurance providers’ websites (using connectIPS gateway).

You can pay the insurance premium of 30+ insurance companies including life and non-life insurance companies from connectIPS. Moreover, it allows real time settlement which makes the transaction fast and easier.

How to pay insurance premium using connectIPS?

You can pay your insurance premium from using connectIPS in three different ways.

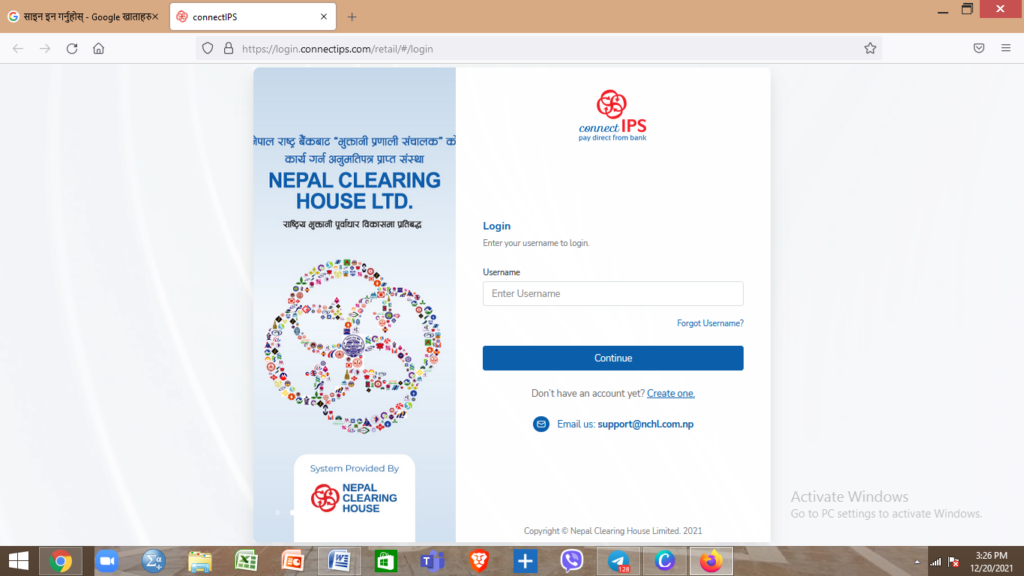

- From the official website of connectIPS

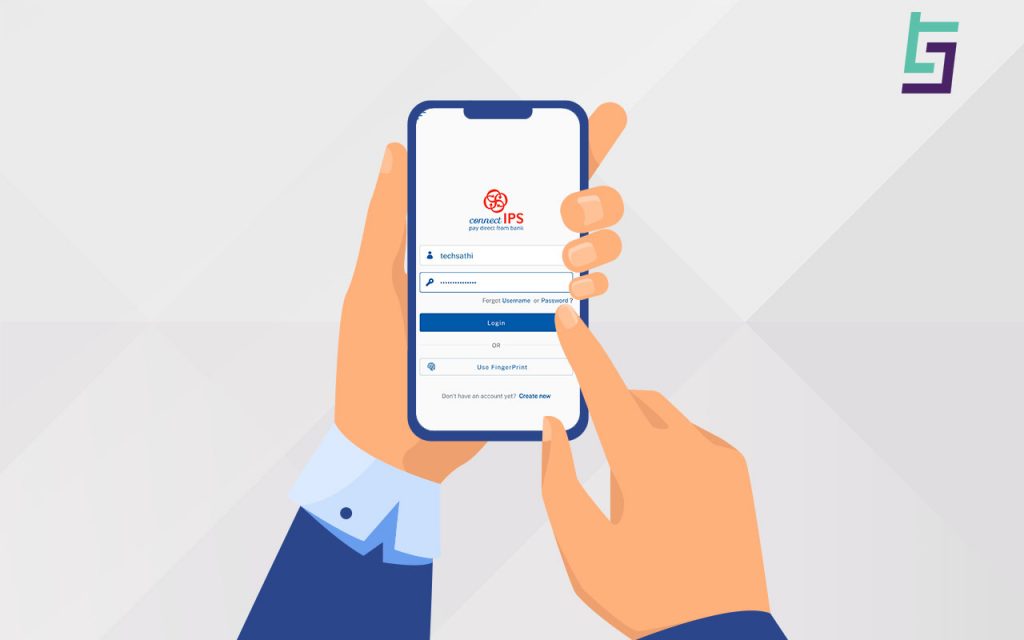

2. From the mobile app of connectIPS

3. From connectIPS payment processor (gateway) integrated in insurance company’s website

How to pay insurance premium using the website or mobile app of connectIPS?

- If you are proceeding through the website, go to www.connectips.com . IF you are processing through mobile app, open your connectIPS mobile app and login.

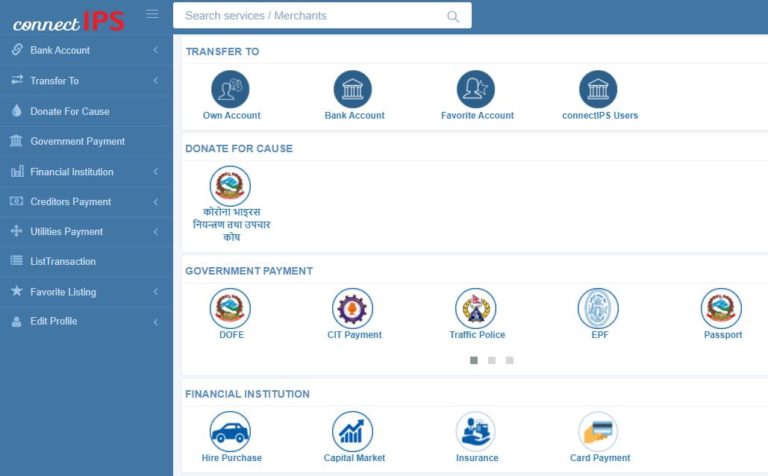

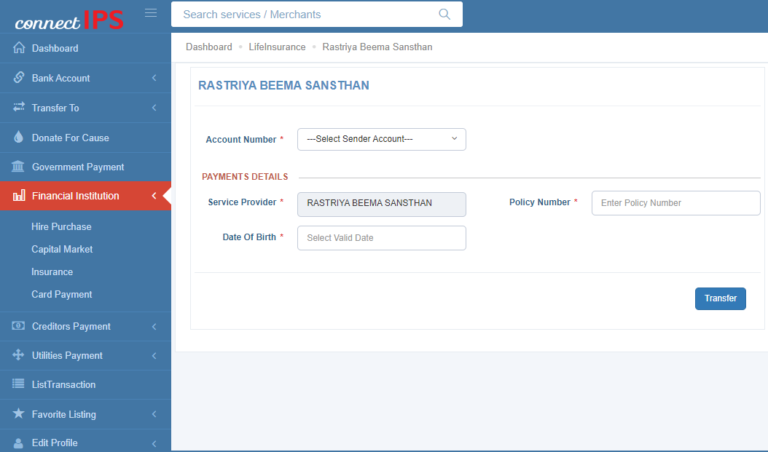

- In the website, go to the Dashboard, click on Financial Institutions, click on Insurance then click on Life Insurance or Non-Life Insurance and then click on your insurance company

- If you are using mobile app, then on the Homepage click on Creditors, click on Financial Institutions, click on Insurance, click on Life Insurance or Non-Life Insurance Payment, and then click on your insurance company

- Select your Account for making payment and fill the required details for insurance premium payment

- Recheck the details and use your Transaction Password and/or OTP received in registered mobile number and e-mail

- Click on Submit to complete the transaction

How to pay insurance premium from from connectIPS payment processor (gateway) integrated in insurance company’s website?

- Log in to your insurance company’s online portal.

- Select on the renewal payment option available in the portal.

- Fill in the required details and select connectIPS as the payment option

- Enter valid Username and Password and login to connectIPS

- Select your bank account and enter your Transaction Password and OTP received in registered mobile number and e-mail

- Click on Submit to complete the transaction

You can pay the premium of 31 Insurance Companies in Nepal from connectIPS including 17 Life Insurance Companies and 14 Non-Life Insurance Companies

| S.N. | Life Insurance Company | Non-life Insurance |

| 1 | American Life Insurance Company-Nepal (Metlife) | Ajod Insurance Co. Ltd. |

| 2 | Asian Life Insurance Co. Ltd. | Everest Insurance Co. Ltd. |

| 3 | Citizens Life insurance Co. Ltd. | General Insurance Co. Nepal Ltd. |

| 4 | IME Life Insurance Co. Ltd. | Himalayan General Insurance Co. Ltd. |

| 5 | Jyoti Life Insurance Co. Ltd. | IME General Insurance Ltd. |

| 6 | Life Insurance Corporation (Nepal) Ltd | Lumbini General Insurance Co Ltd. |

| 7 | Mahalaxmi Life Insurance Ltd | Neco Insurance Ltd. |

| 8 | National Life Insurance Co. Ltd. | Nepal Insurance Co. Ltd. |

| 9 | Nepal Life Insurance Co. Ltd. | NLG Insurance Co. Ltd. |

| 10 | Prabhu Life Insurance Ltd. | Premier Insurance Co. (Nepal) Ltd. |

| 11 | Prime Life Insurance Co. Ltd. | Prudential Insurance Co. Ltd. |

| 12 | Reliable Nepal Life Insurance Ltd. | Sagarmatha Insurance Co. Ltd. |

| 13 | Reliance Life Insurance Ltd. | Shikhar Insurance Co. Ltd. |

| 14 | Sanima Life Insurance Ltd. | United Insurance Co. (Nepal) Ltd. |

| 15 | Surya Life Insurance Co. Ltd. | |

| 16 | Union Life Insurance Co. Ltd. | |

| 17 | Rastriya Beema Sansthan |

Know about the transaction limit in Insurance Premium Payment through connectIPS

The limit of payment of insurance premium is available as per the directive by Nepal Rastra Bank. Nepal Rastra Bank has limited daily payment from mobile channel to NRs. 200,000. Similarly, you can send it through mobile channel up to NRs. 20,00,000. However, the limit may vary as per the bank’s policy, not exceeding the maximum limit as per the NRB directive.

| Web Channel | Mobile Channel | |

| Maximum amount per transaction (per user per bank) | NRs. 20,00,000 | NRs. 2,00,000 |

| Transaction Per Day Count | 100 | 100 |

| Maximum transaction amount per day | NRs. 20,00,000 | NRs. 2,00,000 |

Also Read: Now You Can Easily Load Fund in Your PrabhuPay Mobile Wallet Using the Kiosk Machine

With this, it will now be easier to pay your insurance premiums through connectIPS and settle in real-time. Once you pay through your linked bank account from the connectIPS, your account gets debited in an instant and the money also reaches to the concerned recipient. Isn’t it an easier method of making payments? You neither need to contact your insurance agent or stay on long lines in the bank for making payments and getting the voucher. connectIPS has made it easier for not only insurance payments but also for other payments like bank transfer, tax payment, broker payments, MeroShare renewal, vendor payments and so on.