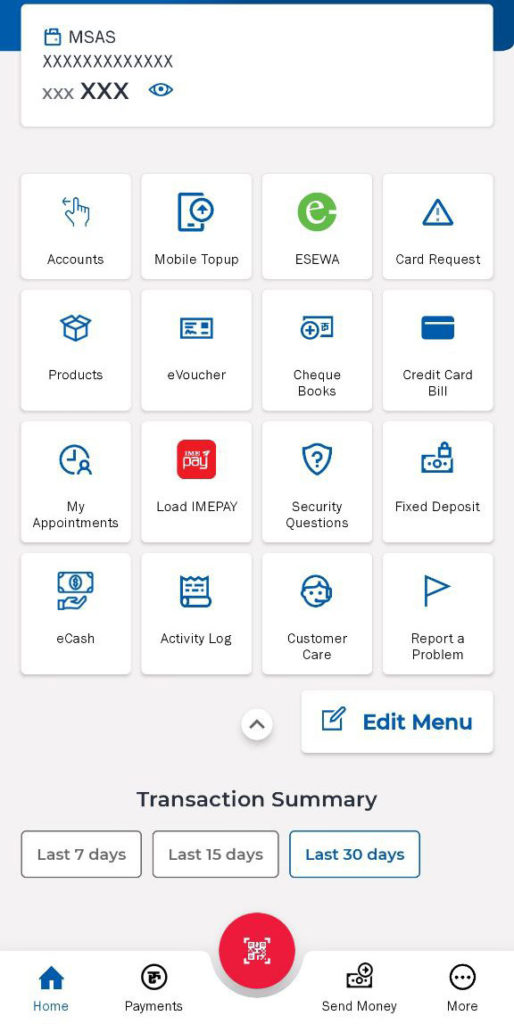

Mega Bank has updated its mobile banking app to make it easier for customers to use. The app will include features like mVoucher, mCash, appointment booking, and card requests, as well as better security and access. Customers can access a dashboard that provides a 360-degree financial overview of all expenses.

Mega Smart Banking is the latest edition of the bank’s mobile banking app. It is now available for download in the Google Play Store (version 6.3.13) and App Store (version 6.3.6). Customers will be able to enjoy their Mega Bank Digital Banking Experience even more with the updated version.

Mega Bank includes new features in the mobile banking system that deliver the banking services in the palm of the user’s hand, improving the entire customer experience. The upgraded version is a digital platform provides a complete and uniform Digital Banking Experience to customers via self-service and assisted customer touch points.

Mega Bank enters into Omni-channel System to promote Digital Banking

Mega Bank has entered into the Omni-channel system that connects with potential customers, converts them into end users. And then it persuades them to buy products and services through targeted promotions and cross-selling.

An omni-channel approach means there’s integration between distribution, promotion and communication channels on the back end. It means your details are already in the system which you do not require to verify time and again.

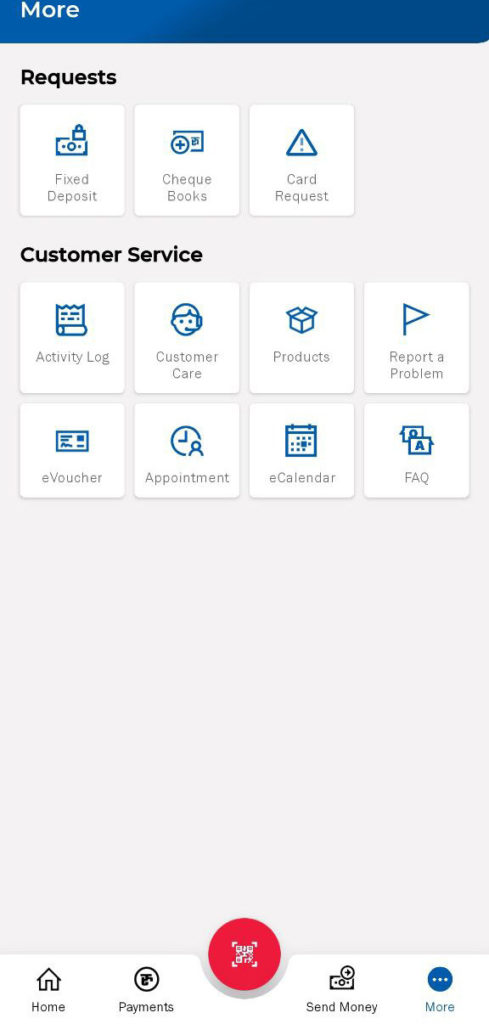

These are the new features in Mega Smart Banking App

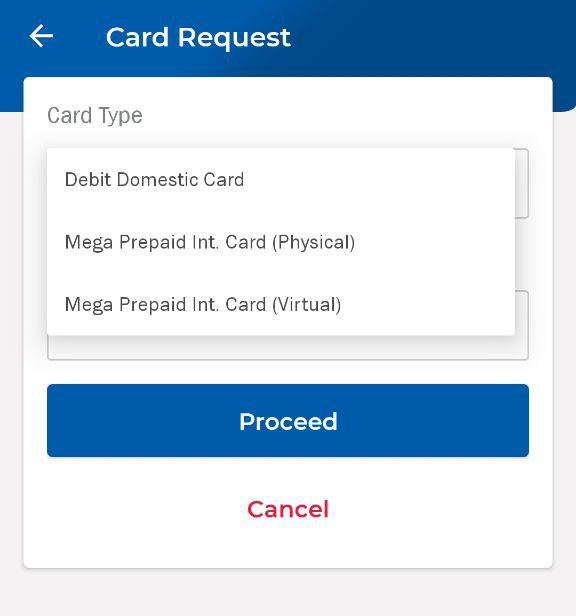

Card Request from Mega Smart Banking App

You can request for cards directly through the Mega mobile banking app and the website. You can request for:

- Debit Domestic Card

- Mega Prepaid Int. Card (Physical)

- Mega Prepaid Int. Card (Virtual)

mVoucher (Digital Deposit Vouchers)

To make a deposit at any of Bank’s locations, a customer previously had to fill out a paper voucher and then wait in line until his or her token number appears on the teller’s display.

Mega Smart intends to digitize this procedure by allowing users to fill out digital vouchers from the app/web. Users will get a code after completing the process, which they can give to the teller at the branch along with the cash. The teller types the code into the Mega Smart admin module, which sends the transaction to the Core Banking System.

mCash

This function allows registered Mega Smart customers to receive a code that they can use to encash at any of the Bank’s branches, similar to receiving remittance. The function would primarily assist non-account holders in registering and using the service. Likewise, Mega Smart users can receive from the Bank the mCash code supplied by other Mobile Banking customers. Hence, this supports for interoperability in the digital banking system.

To get the money, the receiver must go to a branch and provide the teller the code. The teller enters the code into the Mega Smart Admin Module, which validates it and sends a verification code to the recipient’s phone number. The receiver then gives the teller the verification code, following which the teller enters the transactions into the CBS.

Schedule Appointments

Mega Smart users can set up meetings with certain Bank personnel for a variety of reasons. The mobile app or a web browser also allows to book appointments. In addition to that, appointment requests display on the customer service dashboard. Then, the bank can assign them to specific staff based on their function.

Additionally, the customers receive a notification with a specific date, time, and the details of the staff who will be attending to the call once after the confirmation by the bank. As a result, the consumers know with whom they should meet in the bank. The bank, on the other hand, has prior information about the customer and the goal of the visit, allowing it to give a more tailored service experience to the customer.

Pay through digital wallets like eSewa and IMEPay

With the new upgraded version of Mega Mobile Banking app, you can pay through the digital wallets like eSewa and IMEPay too. The icons of these payment options are displayed in the dashboard where you can select which of the digital wallets to pay through. Through them, you can link your Mega Bank account and pay directly without loading the funds. If you have loaded the funds too, you can pay through the digital wallets.

Also Read: Premier Insurance Becomes the first Non-Life Insurance to Join NPI

Expenses Tracking

The Mega Smart engine is able to segregate a user’s digital expenditures. It assists for easier QR payments, card payments, and online payments. Additionally, it has different categories to display a summarized graphical representation of the expenses over a specified time-frame. Furthermore, users can use this information for budgeting and tracking their expenses. In this way, the customers of Mega bank can become smart banking users.