Well, I know. You might have been tired of hearing all the bombarding news from the media regarding the ongoing Srilankan Economic Crisis and various solicited/unsolicited comparisons between Nepal and Srilanka.

The burning issue in the South Asian region is revolving around the Srilankan Economic Crisis. As we know, Srilanka is going through a rough patch with rising inflation of more than 13%.

With the effect of Covid-19 and the ongoing Russia-Ukraine war, the whole world is under the turmoil of oil supply shock and rising inflation. Oil prices are at a record high- crossing $100 per barrel in the international market, which has directly affected the general price level ranging from essential goods to luxury items.

Know what’s going on in the Srilankan Economy

According to Trading Economics, the annual inflation in Srilanka has crossed 18.7% by the end of March 2022, which is the highest ever in the history of the Srilankan Economy after 2008. Also, the shortages in food supply and fuels have raised a huge concern about the possibility of hunger there.

To curb the fuel shortage, the Srilankan Government has implied power cuts and curfews in the country, expecting it would reduce the fuel shortage. Worsening the situation, it resulted in a large protest of civilians in the streets outside the PM’s residence, President’s Residence, and Parliament.

Moreover, the Srilankan Government defaulted on $51 billion in external debt as it is running out of foreign reserves to even cover its imports. This alarming condition has woken up the whole world giving a message that even a country can go bankrupt.

The Prime Minister of Srilanka Mahindra Rajapaksha stated that the country’s cost of living is worsening as a result of price increases in vital food products such as medicine, milk powder, rice, sugar, wheat flour, and commodities such as gas, diesel, kerosene oil, and fuel. To control the riot amidst food and fuel shortage, even militaries are deployed in Srilanka, which indicates it is going under both economic and humanitarian crisis.

Should I tell you again the reason behind the ongoing Srilankan economic crisis?

Let us remind them again as it might be a lesson for Nepal too. The major reasons are crystal clear:

- The newly elected government comprising the Rajapakshya family in the ruling party implied hefty tx rebates on VAT by reducing the rate from 15% to 8% which reduced the government revenue

- Also, the devastating Easter Bombings in April 2019 in 3 churches and 3 luxury hotels deterred the tourism industry thereby declining the income from tourism by 15% within a year.

- Moreover, the Covid-19 pandemic hit the tourism industry of Srilanka badly which used to contribute about 10% to the GDP of Srilanka

- In May 2021, the government banned the import of chemical fertilizers to support its vow to promote Srilanka as a fully organic economy. However, this move backfired on the economy by declining production in the prime exportable product i.e. tea and other food items.

- The lockdown imposed during Covid-19 was followed by the bad weather, affecting more than 2 million farmers and up to 70% of its population. More than 13,000 hectares (0.19% of the total area of Srilanka) of the vegetable and food crops farms were affected by the bad weather and fertilizer shortage

Due to the decline in food production, Srilanka had to heavily depend upon food imports from other countries like India and the USA, China, Thailand, and Ukraine. The government led by President Gotabya Rajapaksha amended the ban on the import of chemical fertilizers in November 2021 after the food shortage worsened in the country leading to an increase in prices of essential food products like rice, sugar, milk powder, tea, etc.

After the decline in income from tourism and agricultural exports, Srilanka depended heavily on the imports that reduced its foreign reserves. It was only left with $2.36 billion in January. Now, the foreign reserve there has plunged to $1.93 billion in the month of March 2022.

Srilanka has due external debts amounting $6 billion for the year 2022, including the soveriegn bond of $1 billion maturing on July, 2022.

Is Srilanka the first economy to go through this crisis? Definitely not.

Srilanka is not alone in this crisis. Countries like India, East Asian countries, and South East Asian countries have gone through the economic crises time and again which has shocked these economies and the surrounding ones.

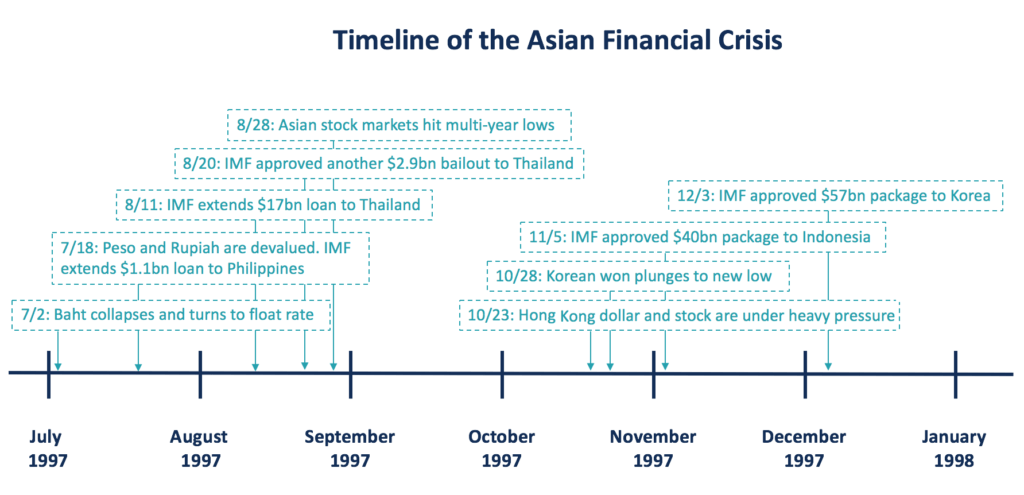

In 1997, the outbreak of the Asian Financial Crisis plagued the superpowers of East Asia regions like Thailand, South Korea, Indonesia, Hong Kong, Malaysia, Laos, and the Philippines. It started with the collapse of the currency exchange rate of the Thailand Baht in July 1997.

Since the Thai Baht was pegged with the US Dollar, the fixed exchange rates between the countries encouraged huge external borrowings. After when the US Federal Reserve under Alan Greenspan raised the US interest rates, inflation took charge and it destroyed the currency of Thailand with the rising price of Dollars, which spread across other countries and heavily damaged currency values, stock markets, and other asset prices in many East and Southeast Asian countries.

The foreign Debt-to-GDP ratio had soared to 180% in these ASEAN countries prior to the crisis, for which the IMF had to bail out external debts and send financial aid to support the countries like Thailand, South Korea, and Indonesia.

However, these economies recovered really quickly by the end of 1999. They followed a series of reforming steps to revive the drowning economy like taking grants from IMF and World Bank to stabilize the currencies, attracting capital inflow for tourism and development projects, and maintaining higher interest rates to attract foreign investors for a higher rate of return.

India too went through an economic downturn during 1991

In March 1991, India was left with just Rs 2,500 crores in its foreign reserves enough to cover the imports for just three weeks. The rising oil prices due to the Gulf War, and rising external and public debts were crippling the Indian Economy. Moreover, the rule of license permit in running a business in this closed economy was to blame the most in this economic crisis which prohibited foreign companies to invest there.

Just then, after the appointment of Dr. Manmohan Singh as the Finance Minister, the country could recover from this crisis. The measures like the devaluation of the Indian currency by 11%, making exports easier by removing quota and trade barriers, allowing FDI, and freeing the domestic market.

Not only India, Srilanka itself has overcome its economic crisis in the 1990s which resulted from the worldwide supply shock of oils and the internal ethnic conflict inside the country.

Since 1983, the conflict has become more intense. For a period during the late 1980s, a festering antigovernment insurgency within the majority Sinhalese community in the south also gained momentum, spreading turbulence throughout the country.

John R. Karlik, Mr. Michael W. Bell, M. Martin, S. Rajcoomar, and Charles Adair Sisson in their research paper” An Overview of Economic Developments in Sri Lanka”

However, the country overcame this by dismantling trade and payment restrictions, promoting exports, reforming the policies to support the agriculture and industrial sectors, reducing tax burdens for exports of products like tea, and most importantly, introducing Structural Adjustment Facility (SAFs) from IMF.

This led Srilanka to have the highest Human Development Index (HDI) for many years among the SAARC countries. In 2019, Srilanka had an HDI score of 0.782, which was even higher than that of China (0.761).

Now, the tragedy is that it has more than $35 billion of debts to the whole world, including more than $3 billion of liabilities to China only.

Read this original research paper to know more in detail.

Nepal is also in the brink of economic downfall but is it similar to that of Srilanka?

As Srilankan Economy is going through these tough times, there is an ongoing debate in Nepal over the possible repercussions like that of Srilanka.

The ongoing liquidity crisis and rising inflation in Nepal are raising concerns over a common query- Will Nepal also be doomed like Srilanka?

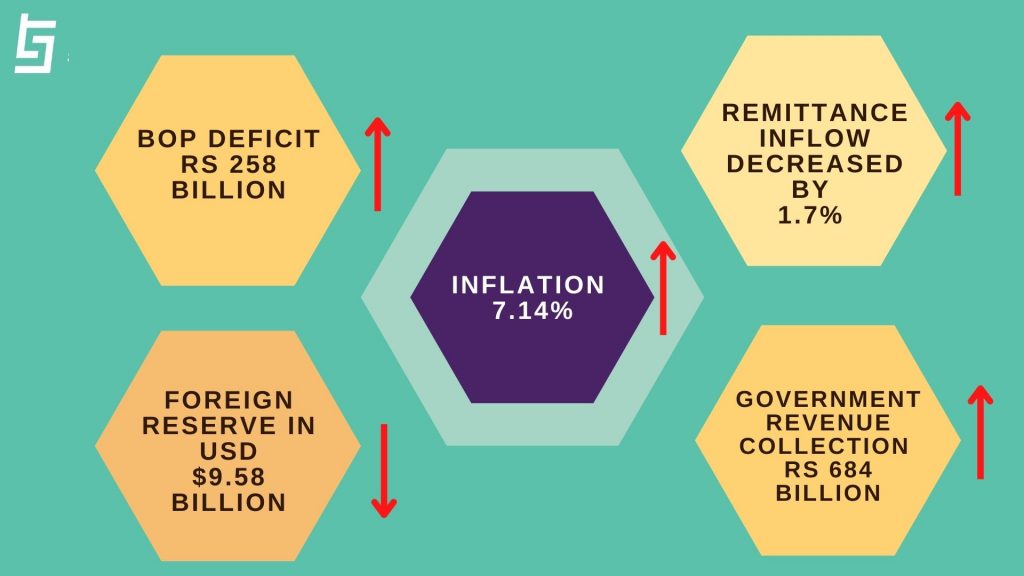

Before that, let us have a glimpse of the current economic situation of Nepal according to the monthly statistics of Falgun published by Nepal Rastra Bank.

The foreign reserve of USD 9.58 billion suggests that Nepal can cover imports up to only 6.5 months at present. If the imports keep rising with exports being stagnant, Nepal might go under a severe economic condition. Moreover, the ongoing liquidity crisis is another challenge that needs to be addressed aptly. With the government expenditure of only 36.2%, the money multiplier ha

But having said that, will it end up like Srilanka? This can not be anticipated accurately because the economic condition of Nepal has some distinct characteristics from that of Srilanka.

| Economic Condition | Nepal | Srilanka |

| GDP size | $33.98 billion (2020) | $80.71 billion |

| External Debt | $13.61 billion | $51 billion |

| Debt-to-GDP ratio | 46.67% (2021) | 104% (2021) |

| Foreign Reserves till March 2022 | $9.58 billion | $1.93 billion |

| Remittance increase between 2020-2021 | 12.6% | 16.7% |

World Bank had forecasted Nepal’s Economy to grow by 3.9% in 2021 and 5.1% in 2022. Though these milestones were not reached in the year 2021, Nepal still has a sight of hope.

Nepal’s debt sustainability score is 3.28, indicating a robust debt carrying capacity, according to a joint debt sustainability analysis (DSA) by the World Bank and the International Monetary Fund. On the other hand, Srilanka has defaulted its loans with its major creditors. The debt crisis in countries like Srilanka and Pakistan posed a high warning to vulnerable and import-led countries like Nepal.

What did Nepal do to mitigate the ongoing problem?

Since Nepal heavily relies on imports ranging from basic food items to luxury goods, the rising oil prices in the global market have largely affected the general prices and inflation has risen to 7.14% in the month of Falgun, which was only 5.97% in Magh. Having to pay for more in imports, with remittance levels dropping and near to zero income from the tourism sector after the impact of Covid-19, Nepal is also on the brink of a financial crisis. The ongoing liquidity crisis in the banking sector, decreasing foreign reserves, slowed economic activities and the ongoing capital flight through hundi, crypto, and others is hindering sound money supply in the economy.

And to mitigate this, NRB imposed restrictions on the import of luxurious items and other goods that are available in Nepal:

- Vehicles

- Gold

- Mineral Water

- Beverages and Cigarettes

- Perfumes and Cosmetics

- Shoes and Sandals

- Furniture

- Sports items

- Dairy products, vegetables, cereals, and pulses

- Plastic and plastic products, leather and leather products

- Spare parts for vehicles, machinery, electronics

NRB called all the bank CEOs and ordered not to allow Letter of Credit (LC) to the importers of these goods. Since promoting exports is a pretty long process than restricting the imports, NRB took this step as an immediate measure to prevent the ongoing crisis to some extent.

Things are expected to get worse with the suspension of the NRB Governor amidst the ongoing liquidity crisis

NRB was playing its role to mitigate the liquidity crisis by restricting imports, issuing treasury bills, limiting domestic remittance to bring it to the banking channel, restricting on crypto trading and advising some immediate measures to reduce petrol usage. However, on April 8, NRB governor Maha Prasad Adhikari was suspended from his position. The meeting of the Council of Ministers alledged Adhikari for not being able to collaborate with the government in these difficult times, and not being able to solve the ongoing economic problems in Nepal. Right now, the interim Governor is Mrs. Neelam Dhungana.

Dhungana said,

“Since the whole banking system including the microfinances is under the liquidity crisis, the economy is affected by the changing business cycle in Nepal. This situation will soon pass with the patience in all of us.”

Many politicians and economists address this step to have a deteriorating effect on the economy since NRB and the Finance Minstry both are required to go hand-in-hand for the betterment of the economy in such crises.

On the other side, Srilankan politicians including the National Council of Ministers are resigning during the crisis, surrendering that they can not overcome this problem. Let’s hope such situation would not occur in Nepal but we can atleast be alert from both policy level and market at the consumer’s and producer’s side.

Also Read: The Growing Economic Crisis in Srilanka is Scary! Is Srilanka in the Verge of Bankruptcy?

5 lessons to learn from the Srilankan Economic Crisis; Nepal still has rooms to improve

Srilankan economic crisis has awakened our senses, making us realize the fact that any economy can not sustain on imports alone. Our tourism is devastated by the lockdown imposed during Covid-19 pandemic, leading many hotels and travel industries to shut down. However, some tiny efforts are seen to promote domestic tourism.

Additionally, our dependence on imports for even basic goods is lagging us behind in the foreign reserves. Also, the rising political tensions have created a doubt on the growth of FDI in Nepal. Keeping the prevailing measures intact, can we do some more in raising the foreign reserves and strengthen our economy? Definitely yes!

- The trade corridor concept used by the Kings and diplomats in our history can be revived. If Nepal becomes a trade corridor between India and China, it can make a great impact for reducing trade deficit in the country.

- Though remittance is not the long term remedy for ecnomic development, we can promote its inflow for the short term by increasing the interest rate to some extent. The latest budget 2078/79 has provisioned to provide additional 1% interest on deposits of remittance income, which is one of the commendable efforts after about two decades of receiving remittance from abroad.

- Also, income from remittance can be curbed to be invested in productive sectors. Real estate can be a productive sector if we institutionalize it and bring under licensing provisions.

- If we can improve in developing the skills of our human capital, then we can export our talents virtually by growing the IT industry under the Fifth Industrial Revolution. For instance, Pakistan’s IT export is expected to grow from $2.1 billion to an approximate $3.5 billion this year 2022. Nepal too has the potential of exporting such services with its large pool of IT professionals and human resources.

- Last but not the least, FDI is the main driver of growth for any developing country. With the potential of hydroelectricity production from our more than 60 hydroelectricity companies (more than 40 listed in NEPSE), we can replace the use of petroleum usage by electricity in many ways even in our daily lives. Moreover ,the policies do play a major role in facilitating for the ease of doing business by foreign ivestors in Nepal.

As Nepal Investment Summit is about to be held soon, we can hope for some positive reforms that will be enacted to attract FDI in the country. With the national election approaching at our doorsteps, the money supply in the market is expected to grow which will increase consumption and is expected to pacify the ongoing liquidity crisis. Other long term measures mostly rely on reducing the usage of imported goods at most (if they have close substitutes in Nepal), and promoting local production by reviving our existing industries. In the field of IT sector, we can learn from Pakistan how it is reviving from the debt crisis with the use of technology. Another example is Bangladesh. Bangladesh expects the IT sector to add 7.28 percent to GDP growth by 2021.

Apart from these, there might be other short and long term measures to combat these crisis. If our consumption level and the exports continue to be on this trend, Nepal might be on a huge downfall. Moreover ,the government has been mostly reactive than being proactive during such crises in Nepal. And the blame game is on the DNA of our leaders.

As we are running out of time to increase our production and foreign exchange reserves, the international trade is also being affected through the ongoing Russia-Ukraine war affecting the oil prices. Amidst this situation, all we can do from the consumer side is try to reduce the usage of imported products and search for our own local substitutes. And yes, increasing foreign reserves through FDI and exports is the prime measure which requires a robust public-private-partnership.

I hope you too belive that there is a silver lining to the dark cloud on this ongoing crisis in Nepal. While there are nuances going on whether Nepal’s situation will be like Srilankan Ecnomic Crisis, Nepal still has some rooms to improve in order to prevent the economic downfall. As we are recovering from a more than 2 year long Covid-19 impact, things will take time to revive. But the type of recovery depends upon the producers, consumers and policy makers in the country.

Also read: NEPALPAY or RuPay; Where is our Concern Headed for Unified Payments?