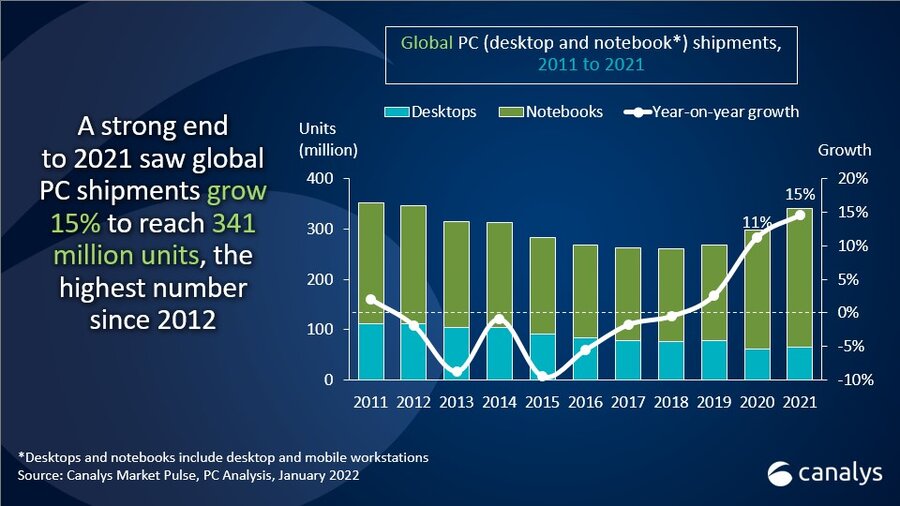

As the Covid-19 pandemic continues to force people to work, study, and play at home, the worldwide PC shipments jump 15 % globally to 341 million. This data is 27% higher than 2019’s, and the highest single-year figure since 2012. It makes PC one of the hottest selling tech items in 2021. Through the data gathered by Canalys, it is known that Lenovo once again reigns the top position in market share as the largest contributor to PC shipments.

Canalys PC Shipment Data Analysis

According to the data collected by Canalys, the PC market ended 2021 with a bang, as Q4 shipments exceeded 90 million for the second year in a row. The latest Canalys data shows that worldwide shipments of desktops, notebooks, and workstations grew 1% year on year to 92 million units over 91 million a year ago. This pulled up total shipments for full-year 2021 to 341 million units, 15% higher than last year, 27% higher than 2019, and the largest shipment total since 2012.

Furthermore, the PC industry saw high revenue gains, with the total value of Q4 shipments estimated at US$70 billion, an annual increase of 11% over Q4 2020. For the full year, revenue passed US$250 billion in 2021 against US$220 billion in 2020 which is up by 15%.

“2021 was a watershed year in the history of the PC market, with the PCs place at the center of work, learning and leisure truly cemented.”

Ishan Dutt, senior analyst at Canalys

Lenovo Reigns The First Place

Lenovo took first place in the PC market in Q4 with total shipments of 21.7 million units. It was also the biggest-shipping vendor for full-year 2021 with a 13% increase since 2020. Similarly, HP ranks second, with Q4 shipments of 18.7 million units helping it reach 74.1 million units in 2021. The third place is taken by Dell. It sees growth of 8.9% in Q4 to reach 17.2 million units and increased its market share by over 1%. In the same way, Apple and Acer occupy fourth and fifth place of the market share.

Canalys PC Market Analysis: Q4 2021

| Vendor (company) | Q4 2021 shipments | Q4 2021 market share | Q4 2020 shipments | Q4 2020 market share | Annual growth |

| Lenovo | 21,701 | 23.7% | 23,220 | 25.5% | -6.5% |

| HP | 18,645 | 20.3% | 19,225 | 21.1% | -3.0% |

| Dell | 17,195 | 18.7% | 15,794 | 17.4% | 8.9% |

| Apple | 7,810 | 8.5% | 7,163 | 7.9% | 9.0% |

| Acer | 6,582 | 7.2% | 6,166 | 6.8% | 6.7% |

| Others | 19,802 | 21.6% | 19,431 | 20.7% | 1.9% |

| Total | 91,736 | 100.0% | 90,999 | 100.0% | 0.8% |

Source: *Canalys PC Analysis (sell-in shipments), January 2022

Canalys PC Market Analysis: Full-year 2021

| Vendor (company) | 2021 shipments | 2021 market share | 2020 shipments | 2020 market share | Annual growth |

| Lenovo | 82,142 | 24.1% | 72,646 | 24.4% | 13.1% |

| HP | 74,072 | 21.7% | 67,688 | 22.7% | 9.5% |

| Dell | 59,300 | 17.4% | 50,273 | 16.9% | 18.0% |

| Apple | 28,958 | 8.5% | 22,574 | 7.6% | 28.3% |

| Acer | 24,383 | 7.1% | 20,023 | 6.7% | 21.8% |

| Others | 72,198 | 21.2% | 64,430 | 21.6% | 12.1% |

| Total | 341,053 | 100.0% | 297,614 | 100.0% | 14.6% |

Source: *Canalys PC Analysis (sell-in shipments), January 2022

Over the last few months, the demands for PC have skyrocketed in spite of the constant cloud of supply constraints. Both the younger generations and older generations are getting their hands on a PC. In developed countries, it has even become the norm to own two or more PCs by a person. This data only shows how the path is clear for the continued success of the PC industry as there is no turning back from how embedded PCs are in our day-to-day lives.

About Canalys

Canalys is an independent analyst company that guides clients on the future of the technology industry. They urge their clients to think beyond the business models of the past. One of the major services provided by Canalys is delivering smart market insights to IT, channel, and service provider professionals around the world.

Also Read: How To Prevent Your App From Being Disabled in Google Play Store