NCHL-IPS, the interbank payment system platform under Nepal Clearing House Limited has recently updated its settlement and exchange timings.

Transaction sessions that used to take long hours before can now be processed within an hour or not more than 2 hours.

But before that, let us know in detail about NCHL-IPS.

NCHL-IPS is an interbank payment system developed by NCHL

NCHL-IPS is a whole different system that supports the transfer of funds from one account to any other account held at any member banks and financial institutions (BFIs). These all transactions are operated by the respected banks and are processed by NCHL in the backend. For that, the system NCHL-IPS comes into play.

With an objective to replace the paper-based interbank payment process with an electronic payment and clearing process using a secured payment system, NCHL-IPS has been operating in Nepal since August 2016.

It handles a large volume of repetitive payments by means of standing instructions for the payments channeled through the BFIs with proper recording, accounting, security, and transparency.

It supports account-to-account payments (Direct Credit) and collection (Direct Debit) related transactions. The underlying transaction could be for various purposes defined as products.

And those products are given a specific acronym according to their purposes like:

| S.No. | Code | Purpose Name | Purpose Description |

| 1 | CUST | Customer Transfer | General customer fund transfer |

| 2 | TREA | Treasury Payment | Transaction related to treasury operations |

| 3 | GOVT | Government Payment | Transaction related to payment from a government organizations |

| 4 | REMI | Remittance Payment | Transaction is related to payment of remittance proceeds |

| 5 | DIVI | Dividend Payment | Transaction is the payment of dividends |

| 6 | IPOR | IPO Refund Payment | Transaction is payment of IPO refunds |

| 7 | SALA | Salary Payment | Transaction is payment of Salaries |

| 8 | INSU | Insurance Payment | Transaction is a payment of insurance premiums and for disbursement by Insurance companies |

| 9 | INSM | Installment Payment | Transaction is related to a payment of an installment of loan repayment, other repetitive and recurring payments |

| 10 | CCRD | Credit Card Payment | Transaction is related to a payment of credit card account, bill, charges, etc |

| 11 | SALC | Salary Payment Corporate | Transaction is related to a payment of Salaries (charge liability on originating corporate) |

| 12 | FEEO | Fees Payment | Transaction is related to a payment of Fees. |

| 13 | SUPP | Supplier Party Payment | Transaction is related to a payment to a supplier and party |

| 14 | COLL | Collection Payment | Transaction is related to the collection of payment |

| 15 | RTPS | Real-Time Retail Payments | Transaction is related to real-time retail payments backed by a settlement guarantee fund (SGF). |

| 16 | SSBE | Social Security Payments | Transaction is payment of social security benefits by the government or other institutions |

| 17 | SSFC | SSF Collection Payments | Transaction is related to the collection of SSF payments. |

| 18 | PENS | Pension Payments | Transaction is payment of pension by the Government or other institutions |

| 19 | REMD | Domestic Remittance | Transaction is related to domestic remittance to beneficiary account |

| 20 | INVS | Investment & Securities | Transaction is for the payment of mutual funds, investment products, and shares. |

| 21 | PFDS | PF Disbursement | Transaction is related to the fund disbursement of EPF and CIT |

| 22 | PFSA | PF Savings | Transaction is related to the collection of EPF and CIT savings |

| 23 | G2GP | Government To Government Payments | Transaction is related to the government-to-government institutional transfer. |

| 24 | GREV | Government Revenue-Related Payments | Transaction is related to the collection of Government Revenue |

| 25 | COMC | Commercial Payments | Transaction is a collection of funds by commercial customers/institutions/Tech. Member. |

NCHL-IPS Updates its Settlement Timing; Offers Same Day Settlement with Multiple Sessions

NCHL-IPS supports transactions in four currencies:

- NPR

- USD

- GBP

- EUR

Since the US Dollar, the British Pound Sterling, and Euro are high in value and processed worldwide, it has allowed these three transactions to be processed from 10 Exchange units so far.

NCHL-IPS timing is divided into three-time intervals with a unique name:

- Presentment Cut-off time: This is the time when NCHL gets requests for the transfer of funds from the BFI that sends the payment to the recipient bank. it is the time period when the sending bank gives instructions to NCHL for processing payments.

- Reply Cut-off time: This is the time when NCHL verifies the recipient bank and then gives a reply on whether to proceed or cancel the transfer.

- Final Settlement time: It is the final settlement time when the bank account of the recipient receives the amount and the sent money is deducted from the sending bank.

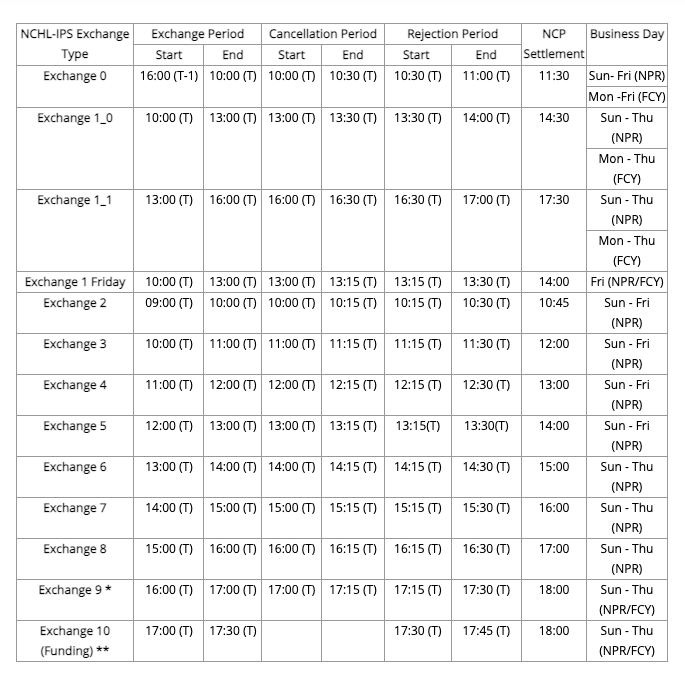

The newly updated exchange period, cancellation period, and rejection period come with a start and end as follows:

You might be baffled looking at these multiple timings. Let us make it easy for you to read this table because it might help you to Here, the starting time for the exchange period in Exchange 0 started from 4:00 PM on the previous day i.e. T-1, which will end at 10:00 on the next day. Similarly, the cancellation period started at 10:00 AM the same day and ends at 10:30 AM.

Within the cancellation period, the sending party can cancel the request sent to NCHL if any circumstances for cancellation occur. If it is past 10:30 AM, the cancellation is not valid for the same day.

Then, the rejection period starts at 10:30 AM and ends at 11:00 AM at Exchange 0. This means the receiving bank can reject the transaction during that time. If not, the transaction will proceed for settlement. After the rejection period, the transaction will be settled by 11:30 if it is not interrupted by either receiving party or the sending party during the process.

Similarly, there is a different timing for Nepalese currency (NPR) and Foreign currency (FCY). You can refer to the table above to get an idea of when to send money on which exchange such that the transaction will be completed within the required time period.

Special Considerations on the updated timing in NCHL-IPS

NCHL has stated that Exchange 9 will be disabled in the winter season starting from 16th Kartik to 15th Magh. Also, the session timings for Exchange 10 will be shifted by 1 hour earlier during the winter season. The exchanges are open from Sunday to Friday while a few exchanges- 1_0, 1_1, 7, 8, 9, and 10 will remain closed on Friday.