Do not get confused with connectIPS and other digital wallets. We went through few FAQs on the website of connectIPS and saw a question that says, “ Is connectIPS another digital wallet?”

Well, it is definitely not. So, what makes it different than all those digital wallets?

connectIPS is an e-payment system implemented by NCHL as a standardized single payment platform for online payments which includes fund transfers, bill payment and creditor/ merchant payment. All payment transactions are processed directly from/ to bank accounts of the sender and receiver irrespective of the channel – online, mobile and bank branches. The system also facilitates linking multiple bank accounts. The user needs to enroll for connectIPS, link its bank account and verify the linked account from its bank, as a one-time process.

connectIPS is an instant or faster payment system with additional channels (web, mobile, gateway) as platforms to link multiple bank accounts and to process payment transactions through one of the linked bank accounts, unlike the requirement of load/unload of funds in mobile wallets. Multiple mobile wallets are also associated with connectIPS to help them load/unload funds in their wallets.

The main difference between connectIPS and a digital wallet is that the former one is a product of Payment Service Operator (PSO) while the latter is a type of Payment Service Provider (PSP).

To get further, let’s know about PSOs and PSPs

According to the Payment System Oversight Framework- 2018 published by Nepal Rastra Bank, Payment Service Operators (PSOs) are those systems established with the objective of processing, routing/switching, operation, control and clearing of payment related activities. Clearing house, institution/mechanism operating electronic card network, institution/mechanism operating electronic payment network, etc are classified as PSOs.

Currently, there are 9 payment system operators (PSOs) in Nepal. Nepal Clearing House Limited is one of the PSOs and connectIPS is one of the retail payment systems developed by it.

Retail payment system, as defined in Retail Payment Strategy- 2019, refers to a low value payment system catering to the needs of consumers, businesses and the Government in serving their payment requirements. The retail payment systems in Nepal are mainly operated by Nepal Clearing House Limited (NCHL), which provides image-based cheque clearing solution and electronic fund transfers comprising credit transfers and direct debits, and operators in the cards payment space viz., Smart Choice Technologies P. Ltd (SCT), National Payment Network (NPN), and Nepal Electronic Payment System Ltd (NEPS).

On the other hand, Payment Service Providers (PSPs) are those service providers providing the payment services through electronic means, carrying out domestic money transfer business, utility bills payments, goods and services payment and also have direct relationship with customers. Mostly, the digital wallets and mobile banking systems fall under this category. Currently, there are 18 non-banking digital wallets licensed by NRB as a payment system provider.

NRB has licensed 51 banks and financial institutions, as Payment System Operators (PSOs) and Payment Service Providers (PSPs) to operate retail payment systems. Nine non-banking institutions have been licensed as PSOs while 18 have been licensed as PSPs.

As you are now clear about why connectIPS is not just another digital wallet, let’s know that it has an option to load funds in your digital wallets as well.

Digital Wallet Loading Options in connectIPS

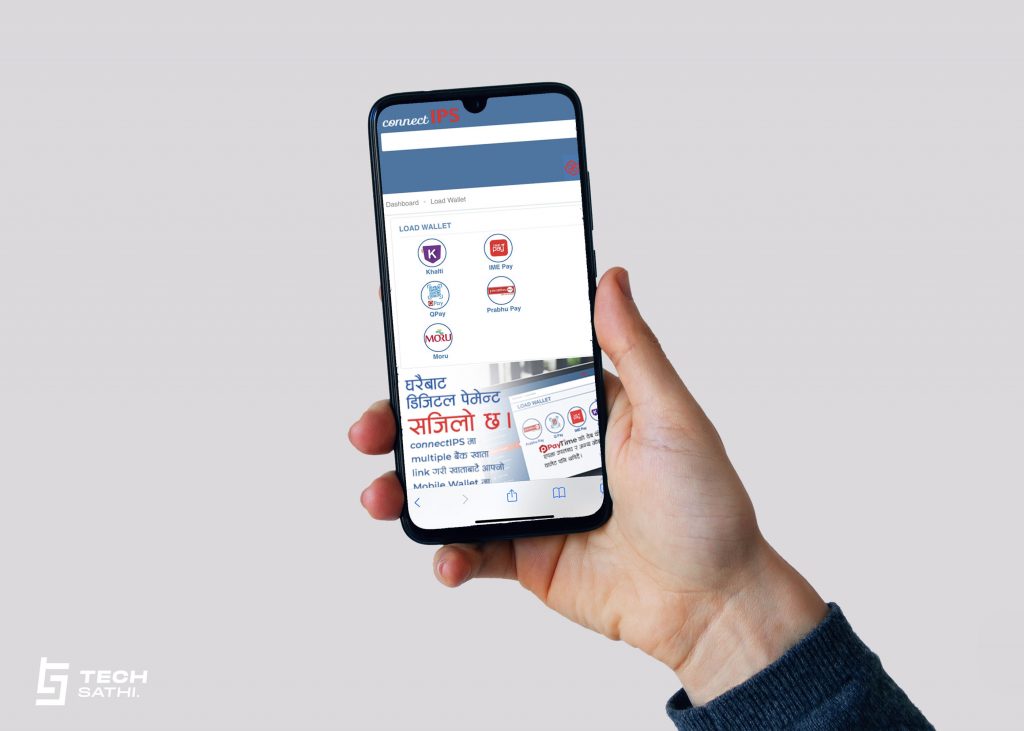

At present, connectIPS allows its users to load the amount for five digital wallets:

- Khalti

- IME Pay

- QPay

- Prabhu Pay

- Moru

How to Load your Digital Wallet Account from connectIPS?

You can load any of your digital wallet among the given five alternatives from connectIPS. To begin with this, first of all you must be a registered user of connectIPS and any of these digital wallets.

Then, you can follow these simple steps:

- Go to your web browser or mobile app of connectIPS and log in

- In the left corner of home page, click on Utilities Payment

- Then tap on Load Wallet option

- Select any digital wallet suitable for you among the given five

- Enter or select your account number, fill up the amount to be loaded in Transaction amount

- Enter your valid user ID and remarks

- Click on transfer

- Enter the 6-digit transaction password and click on Submit option

With these simple steps, you can load the amount directly from your bank account to your digital wallet account. This option allows you to load your digital wallet without logging in to your bank account since your bank account is already linked to the connectIPS.

Also, other Digital Wallets including EnetPay, Lenden, iCash, e-Dheba, PayTime, CGPay, PayWell, DPaisa offer in-app fund load via connectIPS.

Also read: Making Payments Online? Here’s the Transaction Limit on NCHL connectIPS

What do you think about this feature of connectIPS? Does this experience differ from loading your digital wallet via a mobile banking app? Dropdown your views in the comment.