HSBC has launched a new international money app called Zing in an effort to take on fast-growing financial technology competitors like Wise (formerly TransferWise) and Revolut.

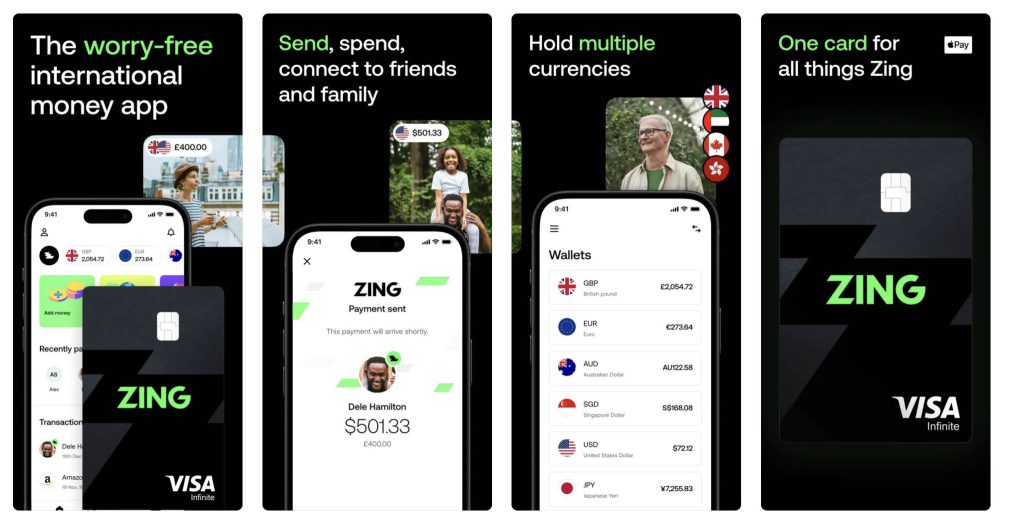

The Zing app allows UK customers to open multi-currency accounts online and convert between 10 major global currencies at lower foreign exchange fees than HSBC typically offers. It’s currently only available for UK account holders and will get wider international rollout in 2024

So how does Zing Compete with Fintechs ?

An Easier Way to Exchange and Send Funds Overseas

The Zing app allows UK account holders to open online wallets that store 10 major global currencies – GBP, USD, EUR, CAD, SGD, JPY, AUD, NZD, HKD and AED. Users can easily exchange between currencies at competitive rates and send money overseas directly from their currency wallets.

Zing undercuts HSBC’s regular exchange fees by charging just 0.6% on GBP-EUR and USD-GBP currency swaps. This narrowly trails category-leader Wise’s 0.45% rate for the same pairs. Comparatively, baseline accounts at Revolut have a 1% conversion fee on exchanges over £1000 per month.

Customers can also receive international payments into currency wallets with account details provided in selected currencies. Wise offers inbound transfers in over 48 countries, still eclipsing Zing, while Revolut only permits deposits in users’ home currencies.

Spend Worldwide With No Transaction Fees

The Zing app comes with a contactless debit card enabling fee-free spending directly from currency wallets when traveling or shopping overseas. A 1% conversion charge applies if adequate funds are unavailable in the local currency. This gives Zing an edge over Revolut cards which levy weekends fees without premium accounts. However, Wise has no conversion charges on debit card purchases using its dual currency automatic switching feature.

Zing’s Simplicity vs Rival’s Customization

The clean functionality of Zing provides a basic multi-currency account and money sending abilities largely on par with dedicated fintech firms who have captured the digital native demographic. But Wise and Revolut still offer more flexibility and options for expert global money managers.

Revolut provides cryptocurrency exposure, stock trading, and peer-to-peer payments inside its app. Wise offers a borderless multi-country account number to receive funds from anywhere on Earth. Zing does not integrate investment features or facilitate income aggregation across countries at this stage.

Zing appeals to clients who desire the reliability of a banking institution with the convenience of financial technology. HSBC hinted that more advanced capabilities may arrive soon as Zing expands outside Britain in 2023.

Can Big Banks Beat the Fintechs?

The launch of Zing by an old-guard financial member like HSBC proves that traditional institutions realize they must adapt to compete with disruptive apps in the borderless, mobile-first world.

But whether Zing and future bank challengers can halt the momentum of digital disruptors remains uncertain. Revolut and Wise have first-mover advantage, constantly evolving products, and trust with the mobile demographic. Zing tackles simple transfers but may need to match rival features while leveraging HSBC’s assets to stand out.

In the financial world’s new battle lines, the fintech offensive has dealt a harsh wakeup call to legacy banks. Zing represents the empire striking back with a refined digital weapon of its own. But this clash of the titans likely comes down to a battle for hearts, minds, and thumb taps on phone screens. So long as the fintech experience remains slick and savings obvious, customers may not switch allegiances easily.