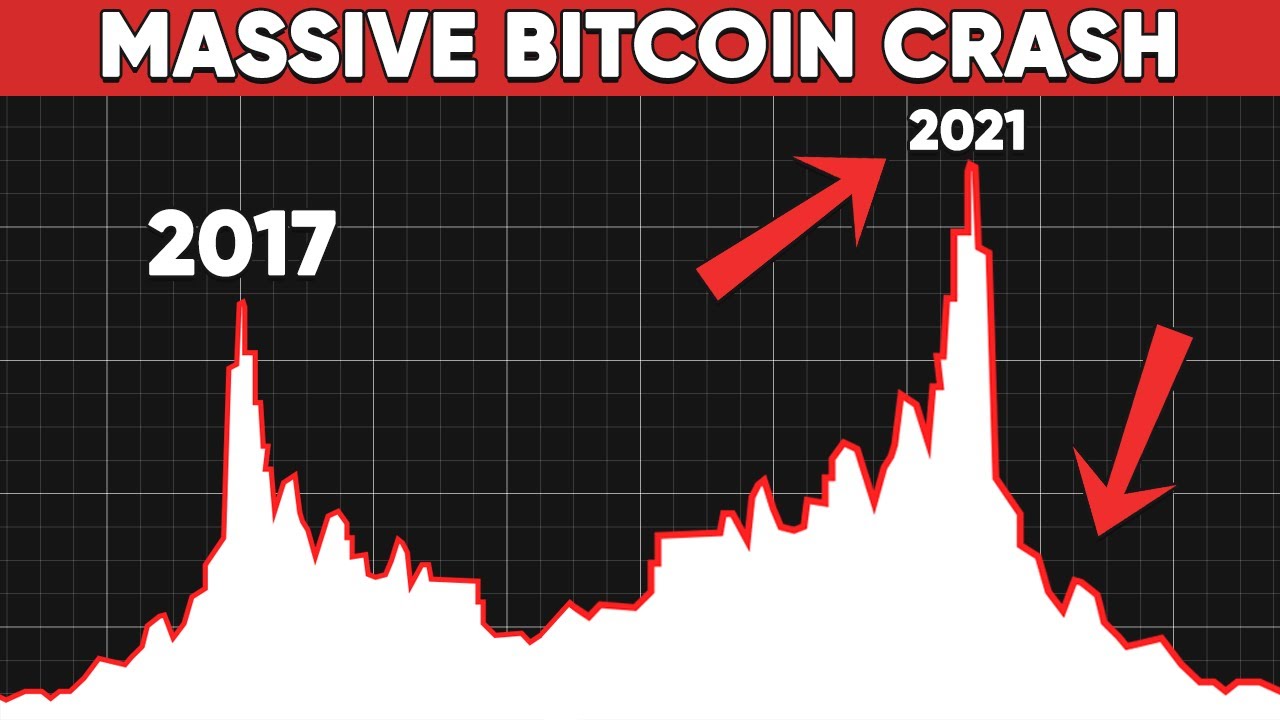

In just about 4 days, the major cryptocurrencies are losing 25 percent of their value erasing more than $1 Trillion in market value. The leading cryptocurrency Bitcoin has been facing decline after decline as it dropped below $36,000 to its lowest level since July. This is a complete bloodbath situation for some as all the cryptocurrency values are plummeting one after another following the path of Bitcoin. Many investors worry that this cryptocurrency market crash is just the beginning of prolonged winter in the crypto world.

Crypto Crash Erase More than $1 Trillion in Market Value

Since Bitcoin’s all-time highest peak in November, it has lost over 45% of its value. Bitcoin’s decline since that November high has wiped out more than $600 billion in market value, and over $1 trillion has been lost from the aggregate crypto market. Other cryptocurrencies such as ether and meme coins have also been facing pretty much the same situation, some even worse than this.

According to Bloomberg Data, Crypto-centric company stocks also dropped on Friday, with Coinbase Global Inc. at one point losing nearly 16% and falling to its lowest level since its public debut in the spring of 2021.

Despite its high volatility, the market value of these digital assets soared to nearly $3 trillion in November 2021 from $620 billion in 2017. Now the market is feeling bearish sentiments and a lot of crypto investors from around the world are starting to feel the panic. As many serious investors worry about the situation, many market watchers are saying that investors should not panic.

“The seasoned investors were expecting this correction, but the average investor wasn’t. The charts were showing bearish patterns. Most people who got into crypto last year are at a loss. They are now trapped. They can’t buy a dip because they don’t have money and don’t want to sell to incur large losses.”

Vishal Gupta, a popular crypto commentator

What Induced the Cryptocurrency Market Crash

The times are so difficult for crypto investors right now. Currently, crypto proponents are debating whether the crypto market has entered a bear phase. Similarly, many wild theories are flooding the internet to make sense of the crash. According to our research, there are three major factors that induced the cryptocurrency market crash.

The latest cryptocurrency selling mania started after Russia’s central bank called for a crackdown on cryptocurrencies. The Russian central bank on Thursday proposed banning the use and mining of cryptocurrencies on Russian territory, citing threats to financial stability, citizens’ wellbeing, and its monetary policy sovereignty. This announcement from Russia which is also one of the largest crypto adopter in the world demotivated the crypto investors and in turn, dipped the market.

Moreover, in the United States, the federal reserve is planning to withdraw stimulus from the crypto market claiming it to be riskier assets. The US federal reserve also indicated the possibility of boosting interest rates as soon as this March.

Since there is a strong correlation between tech stocks and Bitcoin, experts claim the large chunk of tech stock sell-off also impacted the decline in a cryptocurrency market crash. Other factors including slow pace macroeconomic conditions, rise in oil prices, rising inflation, and a slump in the technology market are adding to investors’ troubles.

Cryptocurrency Market Performance in last 24 hours

Bitcoin — $35,572 — (-8.46%)

Ethereum — $2447.95 — (-14.59%)

Binance Coin – $343.48 — (-17.37%)

Solana – $98.02 — (-20.55%)

Shiba Inu – .00001920 — (-25.58%)

Matic – $1.54 — (-18.23%)

Will the bearish sentiment prolong?

Like other markets, we cannot tell for sure if the market will remain in bearish sentiment or it will move up again. But, as of now, there does not seem to be any support until the $30,000 level, says Edward Moya, senior market analyst at Oanda.

Since cryptocurrencies have relatively high volatility and valuations, there is a grave necessity to adopt a comprehensive, coordinated global regulatory framework to guide national regulation and supervision and mitigate the financial stability risks.

Also Read: Multiple Submarine cable failures causing Internet Service degradation in Nepal