Cryptocurrencies are now openly legalized by the Indian Government since the Budget announced on February 1, 2022. India’s Finance Minister Nirmala Sitharaman, in the budget speech 2022 said that income from the sale of virtual assets will be taxed at a fixed rate of 30%, with no deductions allowed.

She also recommended a 1% TDS (tax deducted at source) on transactions in such asset classes beyond a specified level to bring such assets into the tax net.

She also stated that any losses incurred as a result of virtual digital assets cannot be offset against other gains.

Moreover, she also stated that if crypto assets are “given” by anyone, they would be subject to income tax. The recipient of such a gift will be subject to a 30% tax.

Cryptocurrencies transaction have exploded in popularity in India too, prompting debate about whether to outright ban them or legalize them in some form. However, this new taxation policy in India has hinted that crypto is legalized in India.

Now the investors in India can be sure that they can invest and trade in crypto currency since their income will be taxed.

Following the ratification of the Union Budget in Parliament, the tax plans will take effect on April 1.

India was in the verge to ban cryptocurrencies before

The soaring interest of people in cryptocurrencies has hit the whole world. Some countries like Hungary have openly accepted cryptocurrency. It even has the statue of Satoshi Nakamoto, the developer of the oldest cryptocurrency- Bitcoin in the capital city Budapest.

India is also experiencing a huge boom in crypto investments as the crypto investors are more than 100 million in number.

According to crypto research and intelligence business CREBACO, Indian crypto investments have already crossed $10 billion in volume this year, compared to only $923 million in April 2020.

In such case, the Reserve Bank of India was nearly about to ban the cryptocurrency in India. Since the price of cryptocurrencies like Bitcoin have fluctuated extremely, putting investors at risk, many countries are concerned about the liquidity.

Bitcoin is the oldest and the most valuable crypto currency in the world. It was created in 2009 at the end of the Financial Crisis of 2008. It is a digital currency that was intended to provide an alternative payment system that would operate free without the central regulation.

However, some countries including India are launching their won digital currencies

Among all the crypto currencies, Bitcoin is the oldest and most valuable among all. It had $0 value when it was launched in 2009. Now, it is the most valuable digital coin in the world. A single Bitcoin is priced at $37,084.9 (NRs. 4,452,064) as of writing this article. Other valuable crypto currencies in the list are Ethereum, Ripple, Litecoin, Dogecoin etc which are popular these days.

There were nearly 6000 cryptocurrencies in the world by the end of 2021. Investments in these cryptos are risky and mining of cryptocurrencies like Bitcoin require a huge power hardware.

Many countries including China have banned the mining and trading of in their country. Some have banned the crypto like Bitcoin, launching their own digital currencies from the central banks.

In regard to this, India is also launching its own digital currency “Digital Rupee” based on cryptocurrency in 2022/23. It will be a launched by RBI.

Is there any chance if Nepal will launch its own crypto currency?

Nepal Government is back to back issuing notices to punish those who are involved in trading on digital assets like crypto currency.

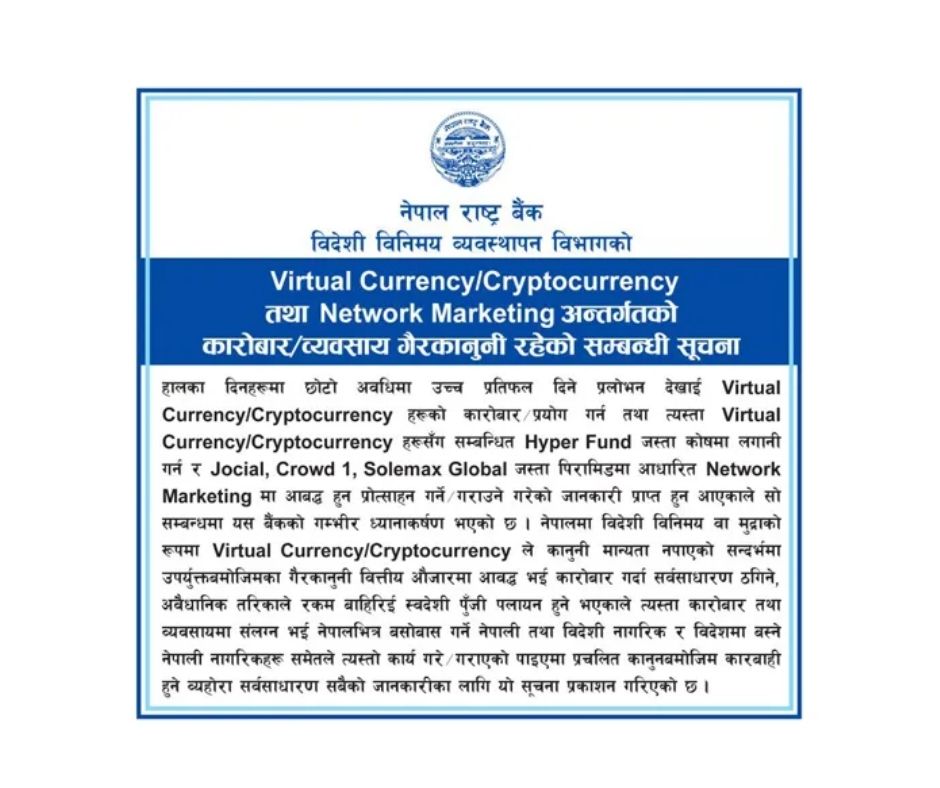

Nepal Rastra Bank has released a directive banning any investment in or transactions for cryptocurrency or hyper funds stating the increased risk of fraud and illegal outflow of domestic capital. Any Nepali or foreigner living in Nepal and Nepalis abroad found to be investing in virtual currencies is liable to prosecution.

NRB declared Bitcoin illegal in 2017 and some investors were even trapped in jail. Recently, a whole family from Kailali which was involved in trading cryptocurrencies were under Police custody. They have collected more than NRs. 37 crores from other people, promising a handsome return from that scheme. Their case has been filed under Kathmandu District Court.

Regarding these revelations on crypto investment and Hyper Funds cases, Finance Minister Janardhan Sharma has blamed these activities for the ongoing decline in remittance inflow in Nepal. Moreover, it has also largely affected the liquidity in Nepal. He has proposed to start a task force in monitoring such investments and tightening the banking system for detecting the money going outside from Nepal in the form of such investments.

India has taken a mid-way to legalize crypto, by planning to launch its own digital currency till the next year. However, some investors in India are not happy with the taxation policy in crypto incomes.

By seeing these trends, a question arises. If the countries are banning many cryptos and launching their own digital currency, won’t it collide with the common understanding of cryptocurrency? It’s because cryptocurrencies are meant to be decentralized.

What do you think? Should countries launch their own digital currency or should there be one centralized global currency where every country scan rely upon? Is it possible? Feel free to drop down your thoughts.

Also read: Cryptocurrency Market Crash: Is 2022 the start of long crypto winter?