As the biggest festival is on our doorsteps, so are our expenses. The trend of waiting for hours at Nepal Rastra Bank to change newly printed notes for Dashain is slowly fading out. The main reason for this is the option of digital payments. Since PSPs and PSOs are competing to provide fund transfers on minimum charges, it could reduce the usage of paper notes. With the same objective, Nepal Clearing House Limited (NCHL) has brought an amazing festive offer. During the festivals of Dashain, Tihar and Chhath, fund transfers through connectIPS are completely free. One can transfer funds from connectIPS in their mobile banking, connectIPS mobile app or load fund through connectIPS during this offer to the mobile wallets for free.

Before this, the maximum transaction fee on connectIPS was Rs 15. It used to charge Rs 15 for payments more than Rs 50,000. Now, you can do it for free during this offer.

The offer by connectIPS has already started from today (Ashwin 20) and would end on 25th of Kartik, 2078.

In addition to that, lucky 10 people would get Rs 1000 from this offer. Moreover, 3 lucky ones can win smartphone on sending money through connectIPS.

The customers can avail fund transfer service by registering in www.connectips.com or through its mobile app or through the connectIPS fund transfer option available in BFI’s mobile banking channel of more than 55 BFIs, which does not require a separate registration. Similarly, customers of more than 14 digital wallets can directly load funds from their bank account using connectIPS.

Fund transfer up to NRs. 1 lakh per transaction and 2 lakhs per day can be done from connectIPS mobile app while mobile banking allows 50 thousand to 2 lakh as per BFIs internal policies.

How to send money from connectIPS?

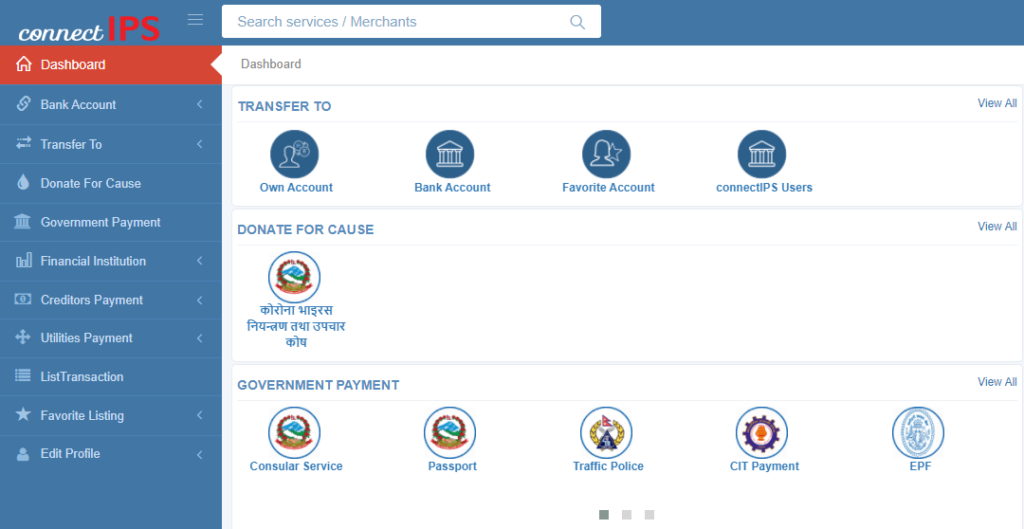

- Login to your connectIPS account

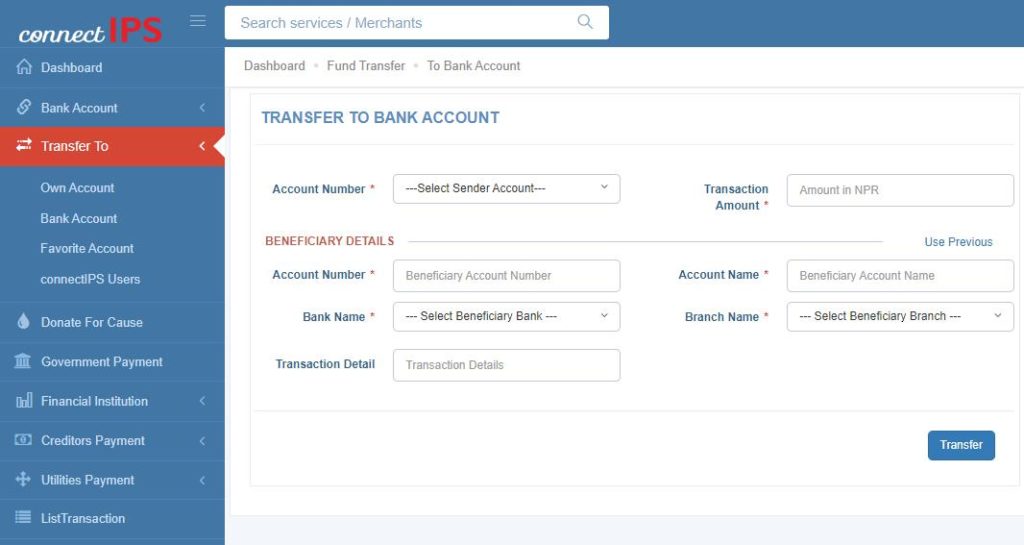

- Tap on “Transfer To” and choose any option as per the need to transfer funds

- Then, enter the details of recipient and click on “Transfer”

- You will need to enter an OTP and transaction PIN to complete the process.

- In this way, you can transfer funds using connectIPS. It is available in both mobile app and web version.

How to transfer funds using connectIPS on mobile wallets?

You can use connectIPS to send money to other bank accounts using your own mobile wallet. If you would like to send money to other bank accounts, there are three options for that:

- Recepient’s mobile number

- Recipeint’s account number

- Using connectIPS

If you want to use connectIPS (because it’s free now!!), you can follow these simple steps:

- Log in to your mobile banking app

- Tap on “send money”

- Tap on other banks

- Click on using connectIPS

- Enter the bank accounts, receiver’s name, select the bank and amount

- Tap on “submit” and it will direct you to connectIPS.

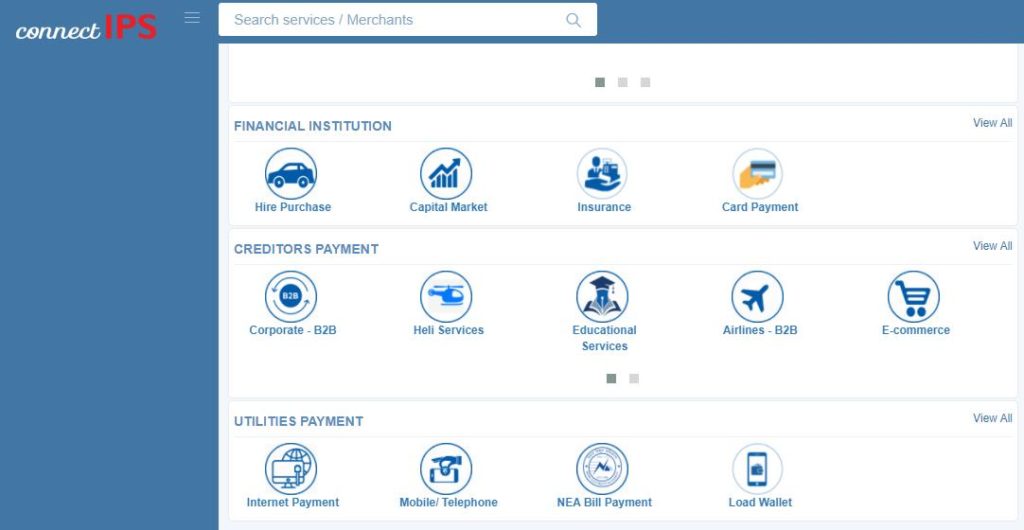

You can also load your digital wallets through connectIPS

- Go to www.connectIPS.com

- Tap on “Utilities Payments” on the left corner or scroll down on the home screen

- Then tap on load wallets option

- Click on any of the digital wallets option to load

- Select your linked bank account, wallet user ID and amount

- Tap on “Transfer“

- Then you will need to enter an OTP and transaction PIN to complete the transaction.

Also read: You can Now Pay your SCB Credit Card Bills via connectIPS in Real-Time

In these ways, you can enjoy a free fund transfer service using connectIPS until the offer lasts. On one hand, it would save you money. And on the other hand, online fund transfer is a safe and quick method since you do not need to carry cash or cheque to transfer money. Additionally, it is more effective for long-distance fund transfers since you do not need to travel that far. Moreover, NCHL has taken a commendable stand for promoting digital payments along with reducing the use of paper notes.

connectIPS is a real-time payment system operated by NCHL. It allows the users to make payments through their linked bank accounts directly. Additionally, it provides access to the member BFIs, PSPs/PSOs, and other entities to access such a system through open APIs to extend such payment services to their channels. The transactions through connectIPS are increasing day by day due to its lower transaction cost and easy payment system. Moreover, its two-layered confirmation process includes both OTP and transaction PIN to complete the payment, which makes it even safer. connectIPS has processed more than 18.9 million transactions equivalent to the settlement value of NRs 1.36 trillion during FY 77/78and during the current FY 78/79 (until Bhadra end) has already reached over 6.2 million equivalent to the settlement value of NRs. 448 billion.