Loading digital wallets through credit cards? You should be careful now. As you know, the banking system in Nepal is going through a liquidity crisis this time. Banks are being really strict in lending credits. On the other hand, they are trying to bring in a lot of deposits.

In this scenario, the Nepal Rastra Bank has been bringing many policies, directives, and rules to tighten the money supply in the market. Recently, it has restricted banks to issue Letter of Credit (LC) to import various goods ranging from mobile phones, vehicles above 220 CC, garments and ready-made clothes, etc. On top of that, it has restricted the limit of domestic remittance as well to bring the flow of money through banking channels.

In these efforts to maintain the suitable ratio of liquidity in the banks, NRB is rolling the dice of contractionary policy for credit disbursements. If you are loading a digital wallet through a credit card, you must know these new directives by NRB.

Beware while loading digital wallets through credit cards

Nepal Rastra Bank has allowed credit cardholders to load their digital wallets through credit cards but there it comes with huge limits in making payments through such loaded amounts.

If you have loaded your digital wallet like eSewa, Khalti, CellPay, IMEPay, and others through your credit card, you can only make digital payments to merchants and vendors through that loaded amount. Previously, some users used to load money through their credit cards and then transfer that amount into their bank account. This way, they were literally depositing the credit money into their bank account.

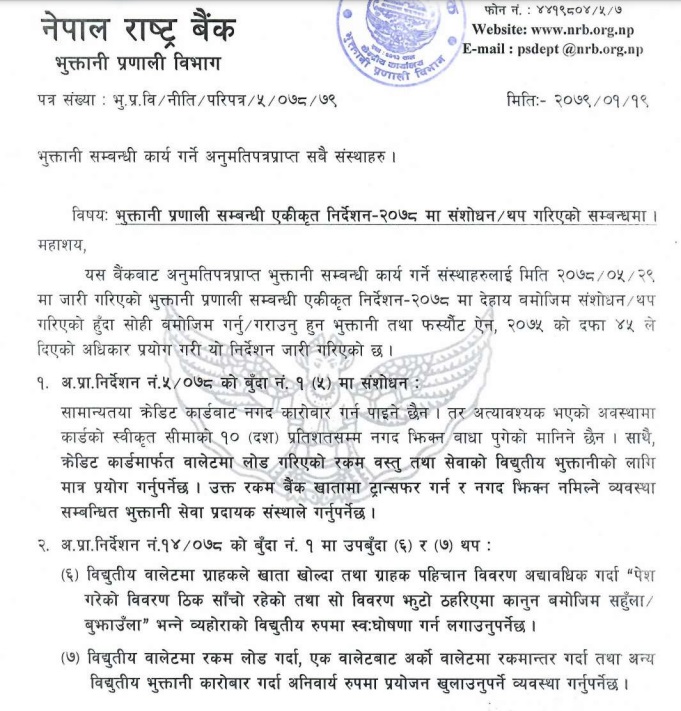

To control this, NRB’s Payment Systems Department has issued a directive today

What are the new updates in the directives? Beware while loading digital wallets through credit cards

Normally, banks allow cash withdrawal of up to 10% of the credit limit. It means if you have a credit limit of NRs. 100,000, you can withdraw up to Rs 10,000 from the ATM using your credit card. Unlike a debit card, a credit card is used for making payments directly, not for cash withdrawal.

However, as the wallets allowed load options through credit cards too, some users went misusing this feature and transferred that amount to their bank account. Hence, NRB issued this directive to tighten the usage of credit cards and limit if just for making payments at the point of sales.

According to the directives:

- After loading digital wallets through credit cards, the wallet fund should be only used for making digital payments for the purchase of goods and services

- That amount should not be used for cash withdrawal or bank transfer. And digital wallets should maintain that feature in their system

- The digital wallet users should fill up their KYC with a self-declaration stating that every document attached are authentic and if not, they are ready to get treated as per that law

- The purpose must be disclosed compulsorily when loading digital wallets, making a wallet-to-wallet transfer or making digital payments

These rules are applicable while you are using your credit card to load the wallet.

By the way, you can link your credit card directly to your MOCO wallet and make digital payments, it is different than loading digital wallets through credit cards

MOCO digital wallet is a different fintech product that allows you to link your debit credit card to this wallet and make digital payments directly. Similar to the linked bank account in connectIPS, MOCO digital wallet is the payment gateway for debit/credit cardholders. This removes the hassle to load funds into their mobile wallets as they can simply make payments through their cards.

This will facilitate more credit card holders as they can freely make digital payments through their cards without having a balance in their bank account. However, you can not make bank transfer or cash withdrawal from that.

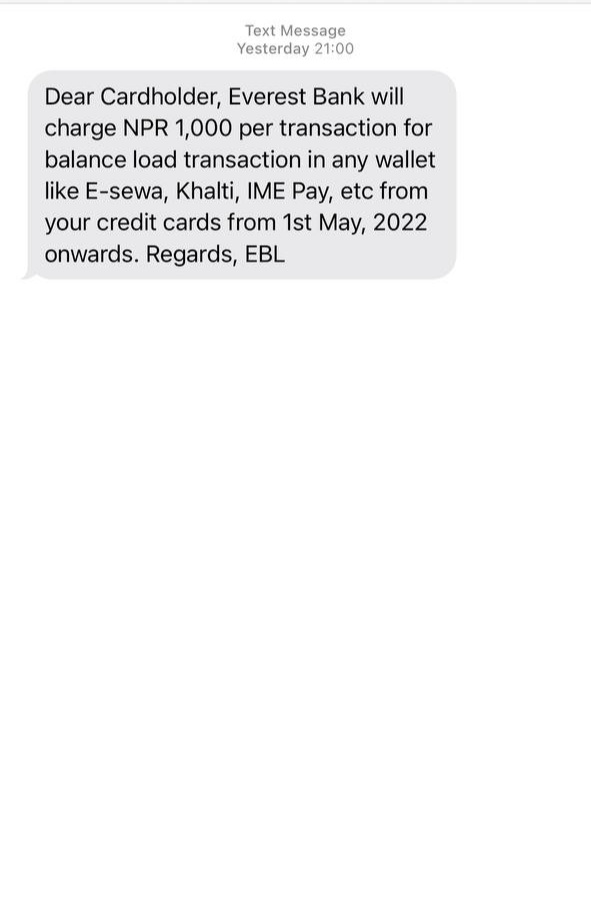

On the other hand, some banks are even charging wallet load fees when done through credit cards and this is making wallet loads through credit cards expensive

Everest Bank is charging Rs 1000 on loading a wallet through its credit card. This way, the banking system seems to be too serious in curbing the usage of credit cards and limiting their misuse. Is your bank also charging such a huge amount in loading wallets through credit cards?

If you are loading your digital wallet through a credit card, you must be aware of these rules. Since using credits must be wise, it is better to check upon the updated interest policies and credit limits too.

We have created an article on the difference between debit and credit cards. You can read that and be clear on how to use credit cards wisely.

Also read: Using Credit Cards? You Should Know How to Benefit From It