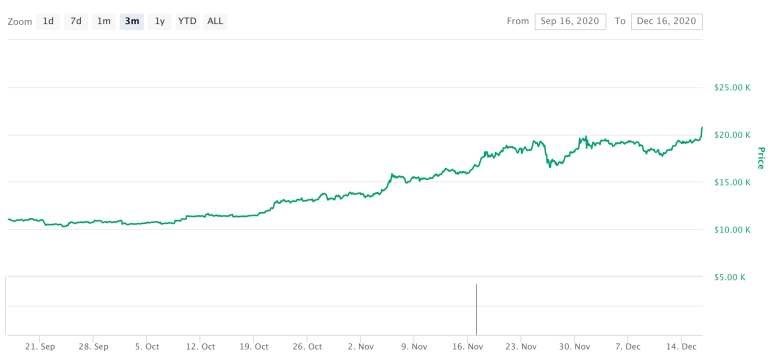

The covid-19 pandemic has crumbled the world’s economy. Everything from the stock market, tourism industry, airlines, and financial markets are negatively impacted by the pandemic. Yet the cryptocurrency is booming and especially Bitcoin, the most valued virtual currency has reached its all-time high and recently crossed the $23000 mark. Here, we’ll analyze the possible causes of rising in the value of bitcoin despite the global pandemic.

Huge institutional investment

It is basic economics that the increase in demand automatically increases the value. This year, huge multinational financial giants like PayPal, Square’s cash app, and leading business intelligence firm MicroStrategy along with other reputed financial corporations invested more than a billion US dollars in bitcoin. This worked as a driving force behind the drastic rise in the value of bitcoin.

Scarcity and finite supply

Bitcoin’s are of finite supply. Meaning that only 21 million bitcoins can be mined, circulated, and traded in the market. until now 18.5 million bitcoins have been mined which means only less than three million bitcoins are yet to be circulated. Not only this. The process to mine bitcoin becomes harder and harder as it nears the 21 million mark. This puts BTC on par with gold having almost similar characteristics in terms of supply and mining.

More Accessible to buy

These days Bitcoin has become more accessible to buy more than ever. The most widely used medium of money transfer sites like PayPal and cash app have facilitated the buying and selling of bitcoin instantly and without any hassles. Which resulted in mass buying of bitcoins resulting in the increment in its price.

Backing of top fund managers and influential bankers

Hedge fund managers and influential bankers play an essential role in the volatile world of cryptocurrencies. During earlier years top hedge fund managers and influential bankers used to backlash the bitcoin but now the time has changed. Top hedge fund managers are predicting bitcoin to be worth hundreds of thousands of dollars in just a few times and there is positivity all around the bitcoin.

Wider demand and acceptance

Over the years, the demand for bitcoin is continuously rising. The covid-19 pandemic brought the demand to the mainstream as the economy of the majority of countries negatively impacted. people became fearful of their own currency and US dollar. Gold seemed somewhat risky too and people saw the potential in bitcoin. Furthermore, bitcoin became widely accepted in many fields and adopted by various industries.

Although it isn’t the first time bitcoin spiked exponentially. in 2020 the case Is different. In late 2017 bitcoin rose but couldn’t capitalize as the main market participants were mostly private traders and speculators, who accelerated the price of bitcoin. But now the main Market participants are institutional ones, Asset management companies, banks, and other financial institutions.