Kieslect, a global brand that believes in providing superior quality through best value from technology has arrived to Nepal. Call Mobility…

Nothing is one of those brand that does everything except disappoint their fans. Every new release from Nothing for the past…

Its no secret that Nothing Phone 2 was already available in the Nepali market for a while now. The global launch…

The company that holds the drone industry together, DJI , has come up with their new DJI power. DJI power is…

In the ever-evolving realm of audio technology, the JBL Authentics 500 and Marshall Woburn 3 emerge as frontrunners in the high-end…

JBL is one of those brands which often pop up when people are on the lookout for portable speakers which are…

As per the recent news, the result of grade…

Fintech

TECH REVIEW

Kieslect, a global brand that believes in providing superior quality through best value from technology…

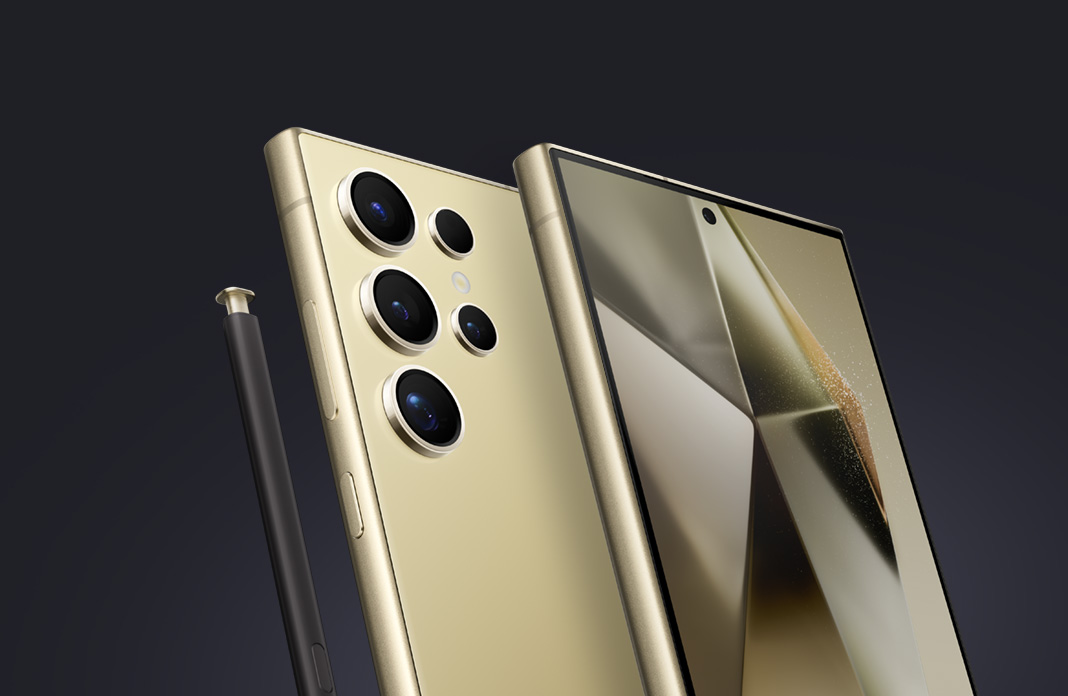

For anyone trying to get a new phone in 2024, I feel you. There are so many options at so…

Tech Stories

Starting a business is never an easy task, and doing it at the age of 17 is even more challenging.…

TLDR: Five-point highlights Nepal Telecom has launched a new ultra-fast…

Ncell, a leading mobile network operator in Nepal, has signed…

Are you looking for a new phone but don’t want…

Kieslect, a global brand that believes in providing superior quality through best value from technology…

Nothing is one of those brand that does everything except disappoint their fans. Every new…

Its no secret that Nothing Phone 2 was already available in the Nepali market for…

The company that holds the drone industry together, DJI , has come up with their…

JBL is one of those brands which often pop up when people are on the…

The K1 Pro is a premium 80% layout wireless mechanical keyboard with QMK/VIA, crafted for…

The highest battery powered automobile seller Tesla is supposedly looking for places in India with…

Subscribe to Updates

Get the latest creative news from SmartMag about art & design.